The feeling of cash in hand after a successful sales period is as exciting as it is potentially ruinous for your company. Don't forget the difference between cash in hand and real revenue.

Just because you possess revenue does not mean it has yet been “earned.” This discrepancy is particularly common to SaaS subscription companies, who receive payment from customers in advance of the delivery of a service. When a good or service is not fulfilled at the point of purchase, the money you've received for it is not real revenue, but “deferred revenue.”

And understanding deferred revenue will pay dividends for your business — not now, but (as is the case with most dividends) later.

What is deferred revenue?

Deferred revenue is payment received for products or services delivered after, not at, the point of purchase. Due to the lag between the purchase and its delivery, deferred revenue is also called unearned revenue.

Why is deferred revenue considered a liability?

Until delivery, it is possible that the service may not be delivered, or that the customer will cancel their order, in which case the money must be returned. Because you have been paid for a good or service that you haven't yet delivered, deferred revenue is a liability. And it's why you will find it listed with other current liabilities on your balance sheet.

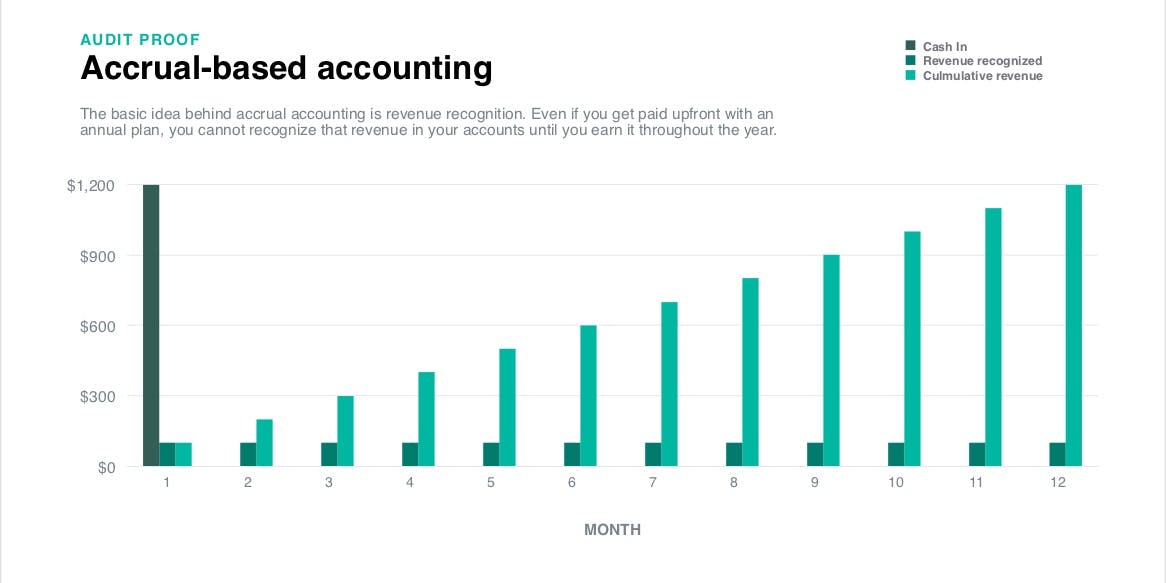

To minimize confusion, many SaaS companies use the accrual method for their revenue account. Accrual accounting recognizes revenue only when a transaction is completed, not when payment is received. Revenue recognition only comes about when your company has earned that revenue.

Here's a model graph for keeping account of your revenue: the "cash-in" metric functions as your total deferred revenue. The same amount is recognized every month, and by the end of the year, your cumulative revenue should match that initial cash-in figure.

Example of deferred revenue with a SaaS subscription company

Let's say your company provides anti-malware software via subscription to a growing customer base. Here's how you should go about revenue recognition:

- You offer a one-year plan that breaks down into monthly payments of $12.99.

- Your customer makes an advance payment for their first year upon subscription. This revenue is deferred until they have received a full year's use of your service.

- At the end of every month, you recognize 1/12 of this deferred income, since you have fulfilled your promise to deliver that proportion of your service.

How deferred revenue causes problems for subscription companies

1. Cancellations

Do not ever presume that money in your deferred revenue account can be used for re-investment or paying for overheads; if a customer cancels their subscription, you'll need to return a sum equivalent to the unfulfilled time on their subscription (i.e., nine months' fee, if that's how long they had left on their subscription).

2. Faulty financial predictions

Companies often factor deferred revenue, along with real revenue, into their measures of future revenue growth. However, this can lead to an “illusion of growth:" a deferred revenue balance that sits far higher than an actual revenue balance.

This can mislead investors into believing growth is faster than is really the case. And the longer your invoice period, the higher the risk of overstating your growth potential.

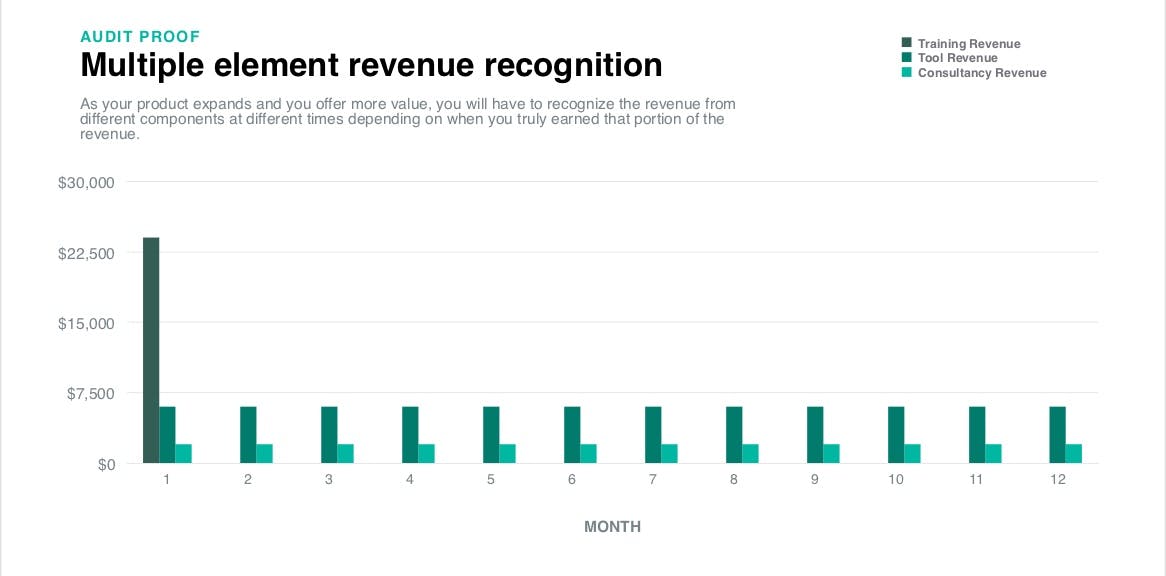

3. Multiple deliverables

If your company provides an instant-access service (online educational courses, for instance) using a subscription model, you will then have to contend with “multiple deliverables.” This means that some of what you are providing is considered fulfilled at purchase, but other aspects will be provided later. So, your revenue is part-earned and part-deferred.

These can lead to accounting issues for your company: the separate stages of delivery, whether you're delivering goods or a service, must be tracked carefully.

Bad practice with accounts can be the difference between life and death for SaaS companies. Proofing against human error and building up your understanding of the SaaS financial model is paramount.

We can see a model of multiple element revenue recognition here, where revenue from the various deliverables are tracked separately.

How to make your deferred revenue accounting audit-proof

There are ways to reduce the likelihood of errors around deferred revenue hamstringing your subscription business. Most rely on smarter approaches to revenue recognition and reporting. We've said it before: finance and accounting team members are the unsung heroes of the subscription and SaaS world. Help them keep your company out of trouble with these solutions.

Reduce human errors with deferred revenue.

Revenue recognition can often mean managing thousands of lines in a spreadsheet, as well as ensuring that your method of recognition maintains compliance with standards.

Human error — an inevitable possibility in this model — can be minimized with ProfitWell's AI-oriented solution to revenue recognition.

Get financial reports on deferred, recognized, and recurring revenue.

Our ProfitWell solution is also able to automate reports on the differing types of revenue, allowing you to keep tabs on exactly which revenue is recognized, and which is yet to come.

Deferred revenue accounting is an exercise in resisting temptation - not to use a current spike in subscriptions to smooth over that recent slump in recognized revenue, not to invest as-yet unearned cash into that key new initiative you know your company needs.

Care and patience with deferred revenue, recognizing and redeeming it, leads to a balanced picture of your company's status and its prospects for growth.