On this episode, Saba Mohebpour from Spocket asks us a key question to understanding growth: How is customer acquisition cost (CAC) changing over time?

This episode was originally produced for Paddle Studios.

To answer this question, we looked at the data from just under seven hundred subscription companies. Here’s what we found.

Customer acquisition cost is the lurking variable that will make or break most businesses due to its impact on the velocity of your growth. If you uncover hotbeds of CAC that’s low and fast, then your growth can feel limitless, while icy cold CAC can spell doom for your business.

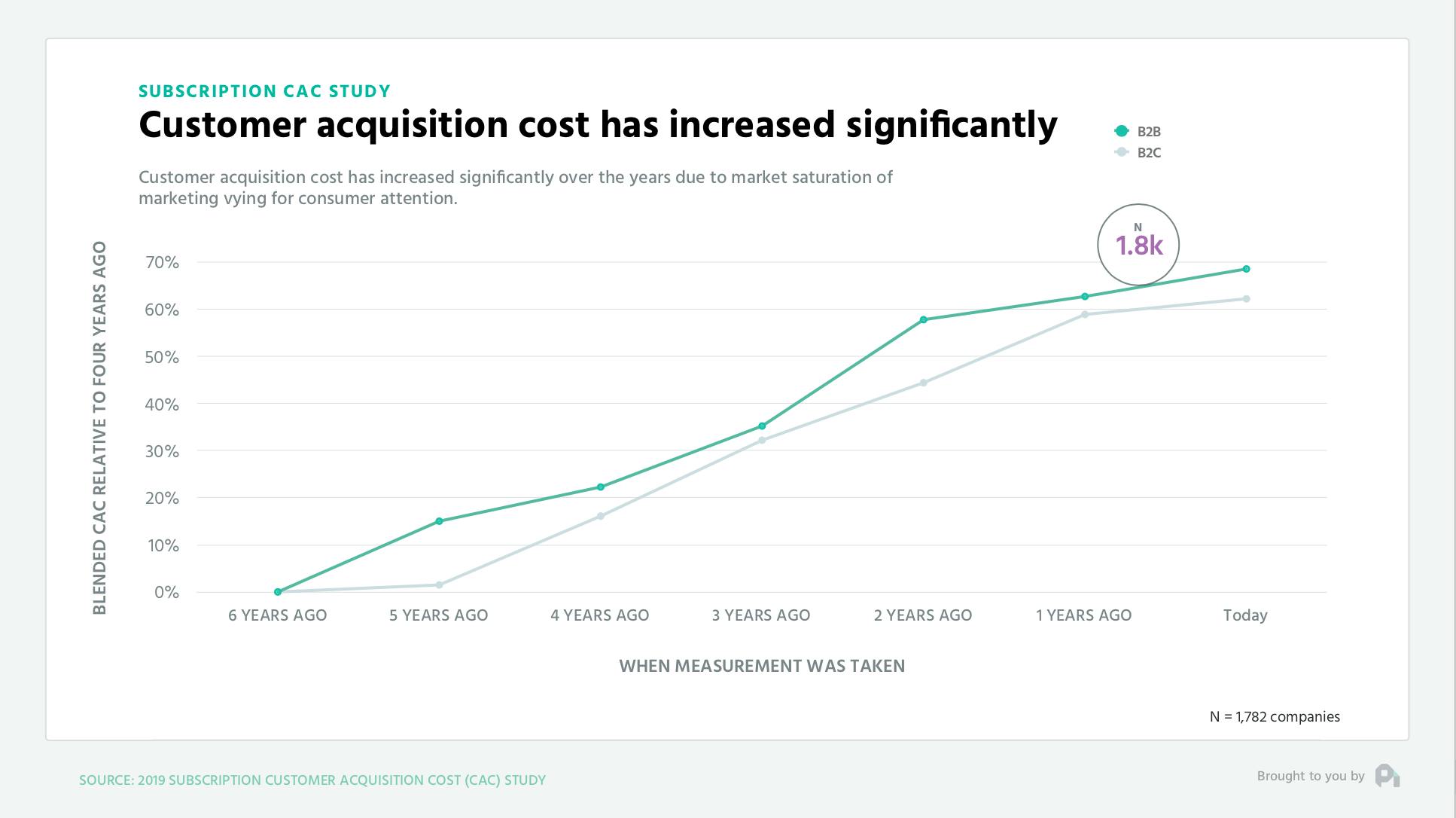

CAC is up across the board for both B2B and B2C companies due to competition and everyone and their mother having ebooks, paid ads, and most aspects of all the common marketing channels. While B2B CAC is slightly higher, both B2B and B2C are up roughly 60% compared to five years ago.

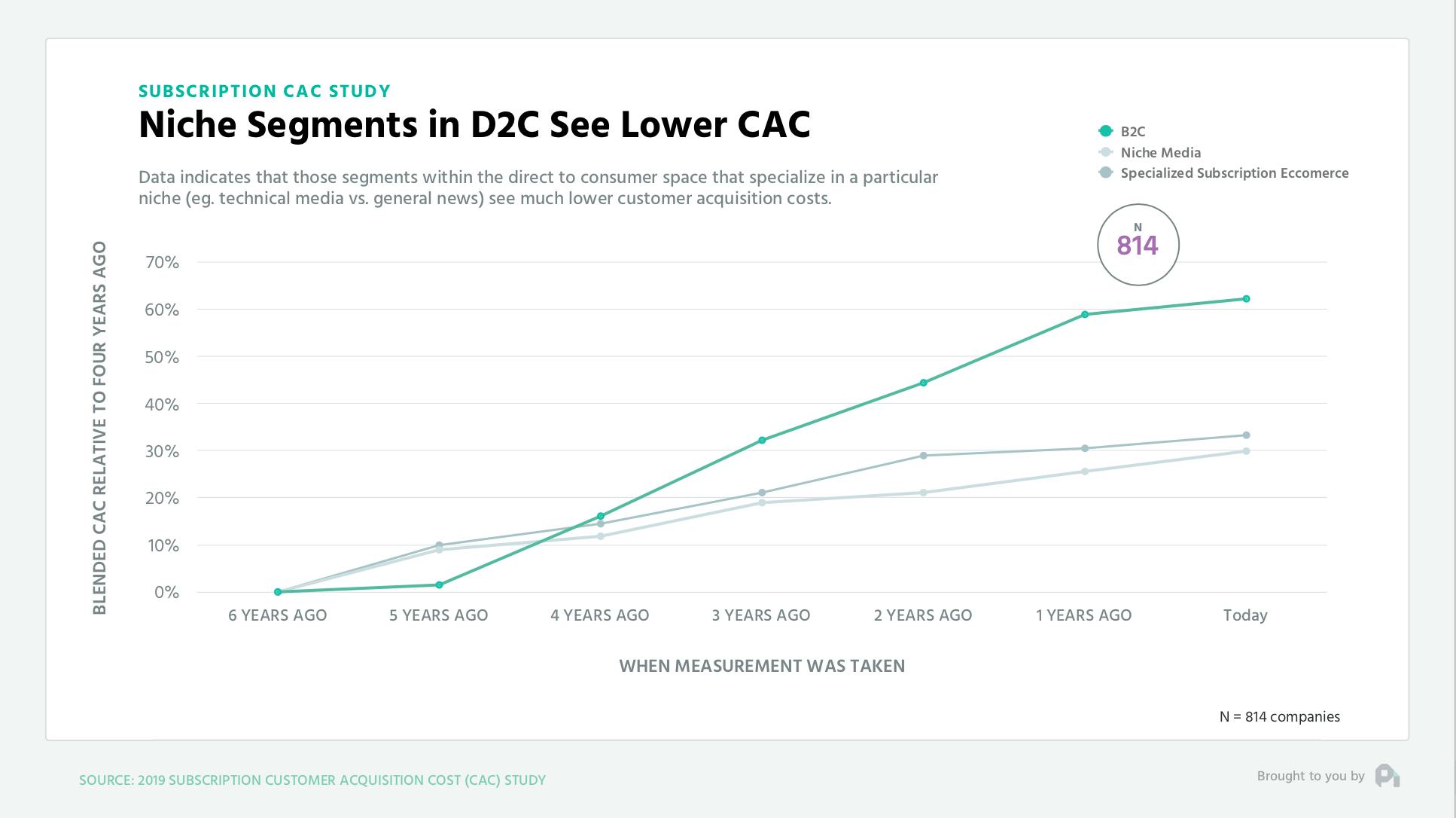

Aggregate numbers only tell part of the story though, because when we break out different industries we start to see that some folks hold up better than others.

For instance, more niche B2C companies, like technical media and specialized subscription ecommerce companies are seeing CAC only up 25 to 30% compared to 5 years ago. This is likely due to pinpoint targeting that you can do with a specific audience, as well as the fact that most of these companies are entering nascent markets as wider industries niche down.

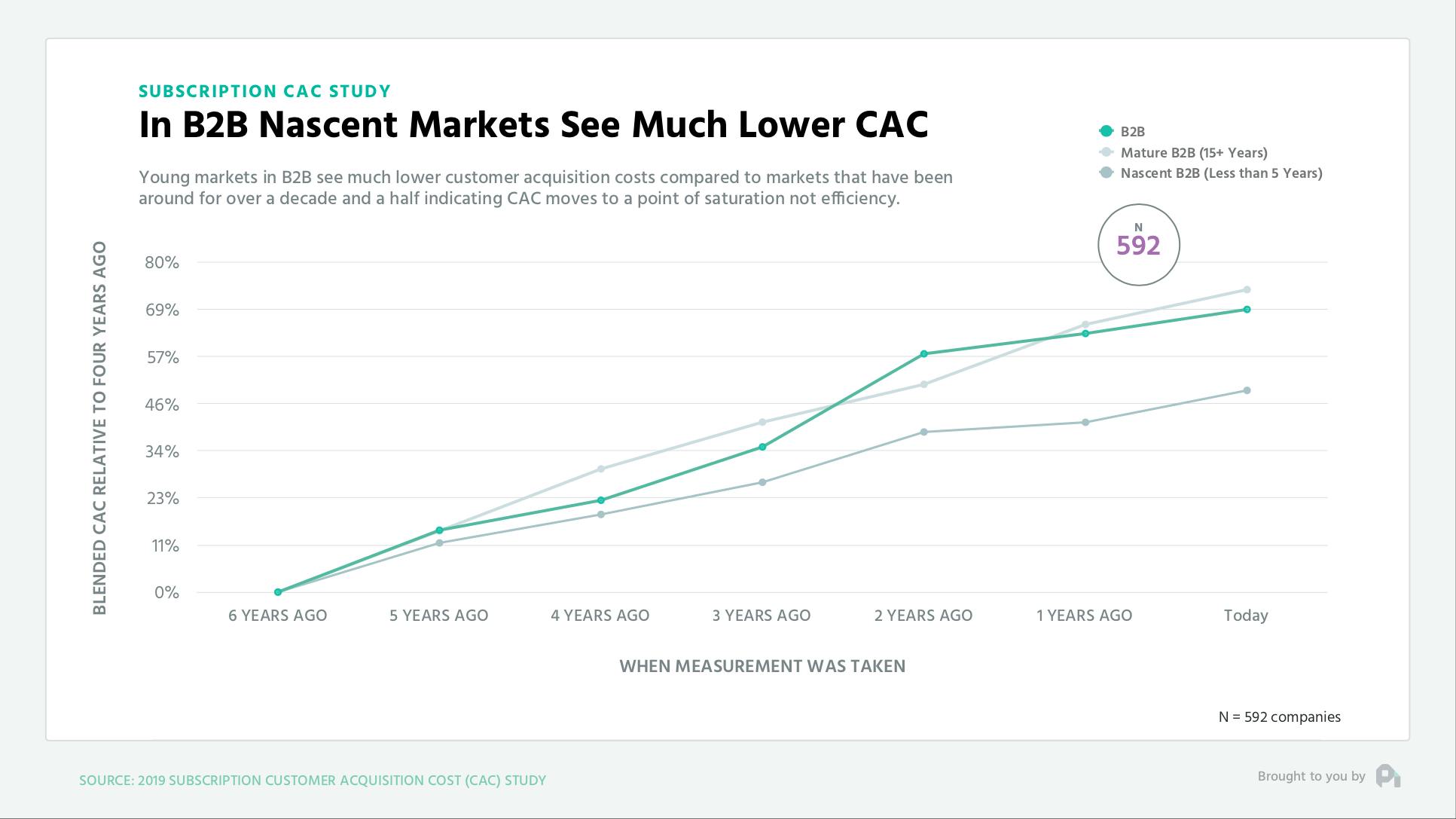

In B2B, there’s a similar trend where the CAC difference is more predicated on the freshness of the industry.

Industry stalwarts have seen their CAC up 70 to 75% whereas new markets are seeing increases closer to 50% over the past five years. This feels pretty intuitive given CPCs and content will not be as saturated.

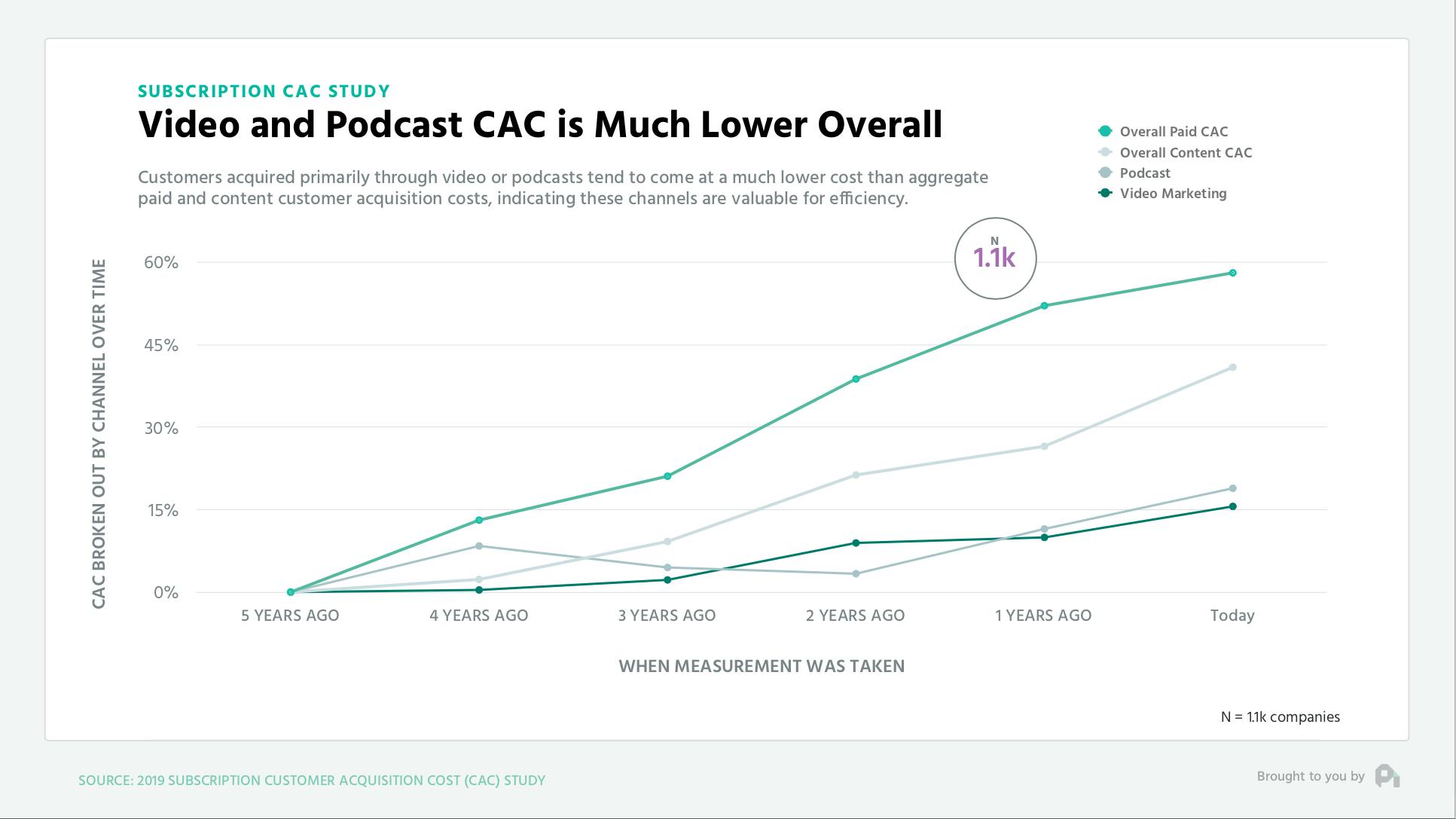

Tangentially, CAC is also pretty fascinating when broken down by channel. We split out paid and content CAC, as well as some specific sub-channels like podcasting and video marketing.

You’ll notice that the channels where assets are harder to produce (podcasts, video marketing, etc.) have much lower CAC than their “easier” counterparts (paid search, display ads, etc.).

So what should you do with this information?

Well, you’re probably not going to change your industry, so if you’re in a low CAC industry, you should spend as much as you can early on before the channels for your industry start to dry up. Regardless of your industry, you should seriously consider moving into the content game, particularly because these assets have a long shelf life and given the density of the markets, you’re going to have to jump into content eventually.

Well, that's all for this season of the ProfitWell Report. If you found value here or on any other week of the report, we appreciate any and all shares on Twitter and LinkedIn. That’s how we measure if we should keeping doing this or not. Until next time.