Being a seller of record or hiring a merchant of record (MoR) are two routes businesses can take when it comes to handling how they sell products or services. The latter is an all-in-one solution to help you scale faster and give you more time to focus on growing.

Explore our MoR Series

Seller of Record vs Merchant of Record: What’s the Difference?

A seller of record (SoR) usually owns the product and is the entity that directly sells the product or service to the customer. This means they are liable for calculating and filing taxes and compliance, the payment process, customer service, fighting fraud - all whilst they are trying to improve their products and grow.

They might get a third party to handle payment processing, like Stripe or Paypal, but that still leaves the seller of record to handle the rest. Many direct-to-consumer e-commerce companies are the seller of record for their business.

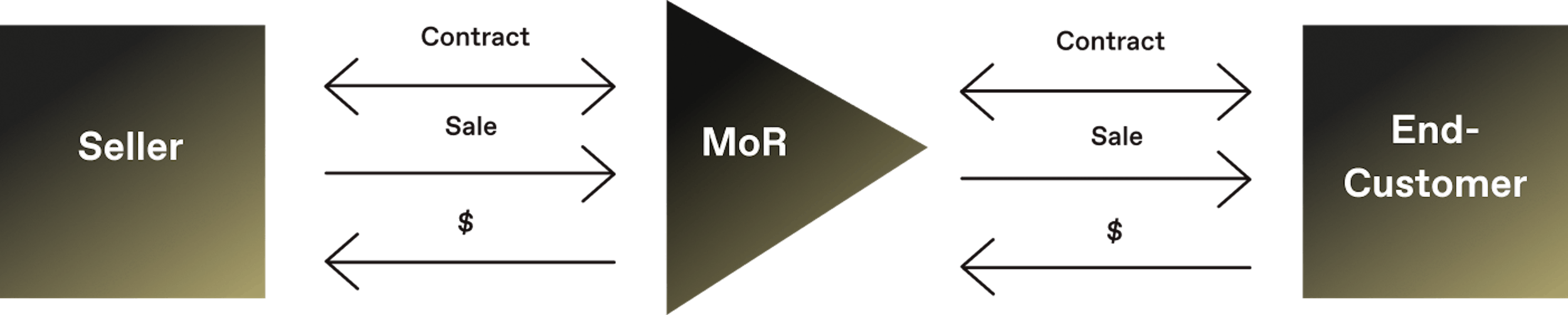

On the other hand, high-growth businesses off-load their payment management to a merchant of record. A MoR such as Paddle takes on the role of a seller of record, with extra benefits that companies don’t need to sort out themselves, such as filing the correct amount of tax. The MoR handles transactions, manages the checkout, deals with chargebacks, calculates tax and remits it. You get many different solutions all in one platform (like Paddle), rather than managing and paying for separate platforms like a payment processor or tax compliance software.

When comparing a merchant of record vs seller of record, your MoR takes on the role of the SoR, leaving you with more time to focus on building a winning product. Going for a MoR is key for the operational efficiency and scalability of your business.

Seller of Record vs Merchant of Record: Key Features

How are the two different from each other? Compare both models below:

SoR

- The seller of record either requires someone in-house to calculate and file taxes in the relevant jurisdiction, or pay for additional tax software

- Someone in-house also needs to manage customer service, and anything to do with refunds, fraud and chargebacks

- High level of admin involved

- Best for: physical goods and e-commerce

MoR

- MoRs become the reseller of a product or service

- They are fully tax compliant - taxes are calculated and remitted on the seller's behalf, covering regional and global sales tax, as well as VAT

- Customers (both sellers and end users) can leverage customer support from a merchant of record for transactions, freeing up more of the seller's time

- Opting for a MoR like Paddle means there's a lower level of admin involved for sellers. You can get set up easily thanks to our API-first approach

- Best for: SaaS, digital products, apps sold on the web, online games

Bottom line: MoRs are your ticket to growth

Businesses with a seller of record approach have to shoulder a lot of responsibilities. Many app and software founders struggle to scale as a result of all these moving parts they look after.

Paddle’s global merchant of record handles all the heavy lifting, so you can focus on growth.