Please note: This post is the fourth post in a four part series on the main pricing methodologies, highlighting the pros and cons of each. Check out the first post on cost plus pricing, second post on competitor based pricing, or third post on value based pricing.

We’re beginning every one of these posts with the same statement: “Pricing is the most important aspect of your business.” No other lever has a higher impact on improving profits. We elaborated on this assertion in a previous pricing strategy post, but realize that a 1% improvement in price optimization results in an average boost of 11.1% in profits. That’s no small change (pun intended).

Remember what we’ve been saying throughout our existence: pricing is a process that utilizes data to eliminate as much doubt as possible for key stakeholders to make a profit maximizing decision. There is no silver bullet, but with data you’ll have a nice barrel full of lead. The metaphor we’ve been using (some of you like it, some of you don’t) is a dartboard where you’re trying to hit a bullseye with the perfect price, but there’s all that extra space “distracting” your dart. Data and these methodologies eliminate that space, guiding your dart to the ideal price point.

What is a pricing strategy?

A pricing strategy is the method of pricing a business uses to determine how much to sell their goods or services for. It's one of the most commonly overlooked and undervalued revenue levers in business. Carefully selecting the right pricing strategy whether you're starting a business or growing an existing one, takes a deep understanding of your product, your market, and your customers.

The three most common pricing strategies are:

- Value based pricing - Price based on it's perceived worth

- Competitor based pricing - Price based on competitors pricing

- Cost plus pricing - Price based on cost of goods or services plus a markup

There are many other commonly used pricing strategies that can be employed to separate your company from the competition (e.g. penetration pricing, price skimming, psychological pricing, bundle pricing, economy pricing, prestige pricing, etc.), but the three strategies listed above are the bread and butter of most businesses.

Top 3 Pricing Strategies

So far, we’ve already learned about cost plus pricing, competitor based pricing, and value based pricing in depth. We learned that cost plus and competitive pricing can be useful, but they’re fairly weak overall, particularly in the SaaS or software space. We also learned that value based pricing, although it has its quirks, provides valuable data to shrink the dartboard when done correctly. To recap for those of you who don’t want to read the other posts, let’s review each methodology and give you the top level findings to utilize immediately.

1. Cost-plus pricing: The oldest and simplest (mostly) method of setting prices

Cost plus pricing is the simplest method of determining price, and embodies the basic idea behind doing business. You make something, sell it for more than you spent making it (because you’ve added value by providing the product), and buy something nice with the difference. In practice, a lot of companies calculate their cost of production, determine their desired profit margin by pulling a number out of thin air, slap the two numbers together and then stick it on a couple thousand widgets. It’s really that simple. This method involves very little market research, and also doesn't take into consideration consumer demands and competitor strategies.

Fortunately, cost-plus pricing is really simple, requires few resources and hedges against incomplete knowledge by covering the entirety of a product’s costs. Yet unfortunately, it’s horribly inefficient, because it creates a company culture of isolationism and doesn’t take a single ounce of customer perspective to determine different prices.

Overall though, cost plus pricing isn’t ideal for most businesses, unless you truly cannot spend some extra time on the most important aspect of your business, which sometimes happens when you’re bogged down by fulfilling orders or just getting off the ground. Regardless of ease, no software or SaaS company should use cost plus pricing, because the value you’re providing is traditionally much more than your costs of doing business.

2. Competitive-based pricing: Essentially, ineffective plagiarism

Competitive-based pricing is a lot like plagiarism - you decide not to do your homework, so you copy that of those who have already done some work (or that you’re assuming have done some work). Obviously the market doesn’t dole out suspensions for copying prices, but the processes of swiping an essay and competitor based pricing are pretty similar. Also called strategic pricing, this method involves looking at the prices set by other businesses in the same sector, and then adopting those numbers, plus or minus a few percent according to how your product looks that day. The dartboard gets smaller, because there’s more data here, allowing you to rely on your competitors to do the work for you (as long as you trust they actually know what’s going on in the market).

Competitive-based pricing remains a simple, low risk way of quickly gauging prices that accounts for market share and other factors, and in some cases it can be fairly accurate. Yet, it leads to enormously large missed opportunities, because companies employing the strategy end up not assessing their true value and get caught in a race to the bottom through industry group think.

To summarize though, certain businesses need to use competitor-based pricing extensively, because consumers price compare with switching costs from buying a product at store X or store Y remaining exceptionally low. Yet, for most businesses, especially in the software or SaaS space, competitor data should not be the central tenet of your pricing strategy, because there are too many other variables to consider when you’re not comparing congruent products.

3. Value-based pricing: It's all about the customer (and the benjamins)

A value based pricing strategy works to determine the true willingness to pay of a target customer for a particular product by utilizing customer data. Most common pricing strategies and methodologies forget about the customer, instead focusing on internal reasons and/or competitive metrics to justify prices. Yet, customers don’t care how much something cost you to make or your competitors, they care how much value they’re receiving at a particular price. By maintaining this customer focus, value based pricing provides real data, helps you develop higher quality products, and even improves customer loyalty. Simply put, you have the greatest amount of data to make an informed decision about your profit maximizing price. Thus, shrinking down the dartboard.

Of course, value based pricing isn’t perfect. The process requires time and resources, along with consistent dedication, not just a “set it and forget it” mentality, especially because the willingness to pay differs for different customer personas, regions, and even offers. A 100% accurate prediction is impossible, but we can get pretty darn close.

To summarize, almost everyone in the software and SaaS space will benefit from value based pricing. Even individuals in retail, media, etc. can benefit from the methodology. It takes dedication, but when done right, provides enormous benefits in terms of more profit, better and more competitive products, and customer oriented marketing and development.

Pricing is the Untapped Growth Lever

When companies think growth, they think customer acquisition. Yet, pricing is the crucial part of your business that has the highest impact on growth.

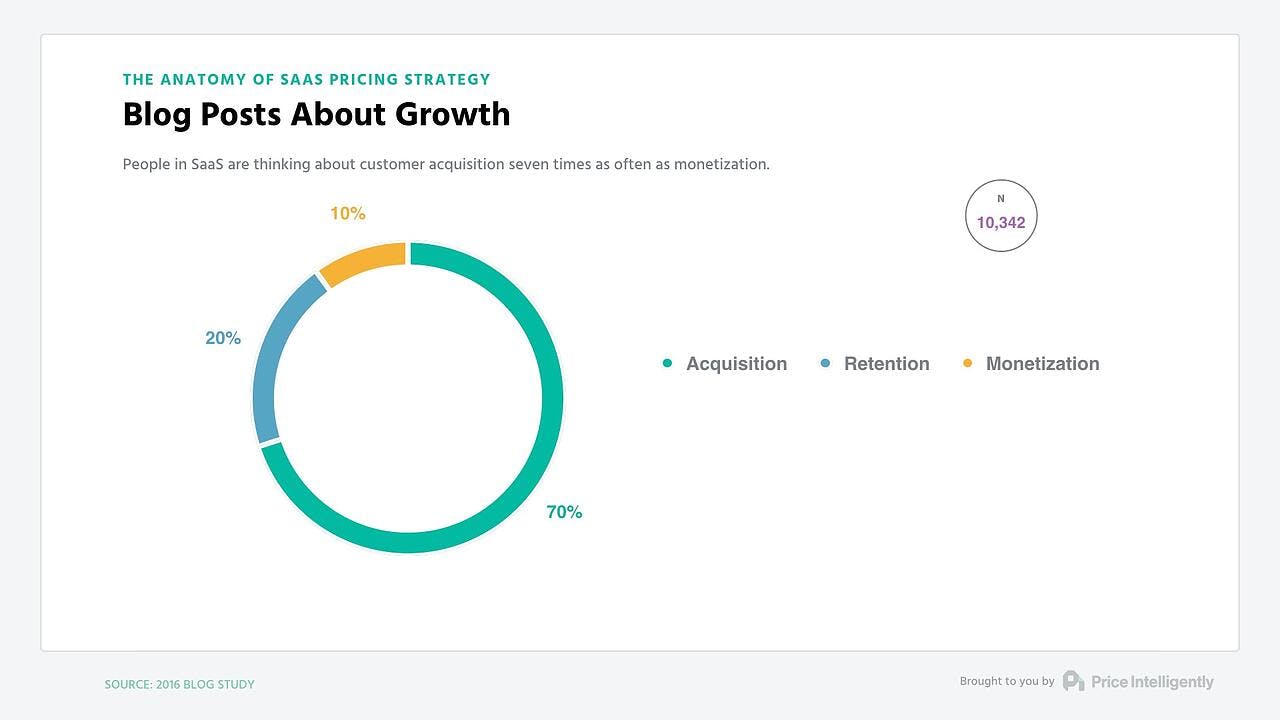

We studied 10,342 blog posts across hundreds of SaaS companies and found that pricing is the most-often overlooked way to drive growth. People in SaaS are writing and thinking about customer acquisition seven times as often as monetization.

Growth is more revenue, not more customers.How you monetize those customers is vital. Yet, out of every 10 blog posts on growth, 7 are focused on acquisition, 2 are centered around retention, and only 1 is about pricing.

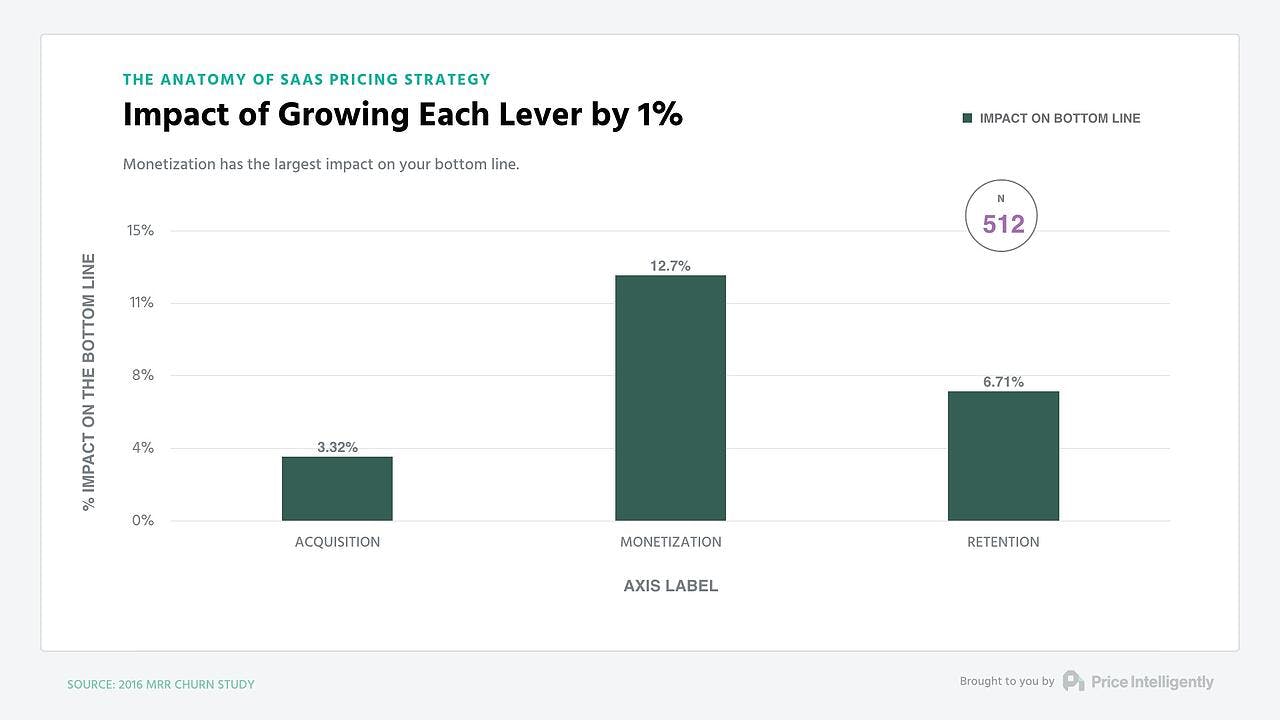

Ironically, the frequency with which people write about each growth lever is inversely related to its effectiveness in driving growth. People write about acquisition, retention, and monetization in that order, but monetization has the biggest impact on the bottom line, followed by retention and then acquisition.

In our study of 512 SaaS companies, we found that software monetization had the largest impact by far on your bottom line. This could mean targeting better customer channels, or raising prices to better fit value.Data shows that pricing is 4x as efficient in improving revenue as acquisition, 2x as efficient as improving retention. By concentrating on pricing, and looking for all possible improvements, you have the chance to use this most effective lever to maximize your profits.

Pricing’s Impact on Efficiency

When you don’t optimize your pricing, you’re throwing off the math that powers the fundamental economics of your business. On the other hand, pricing is such a great growth opportunity because optimizing pricing makes a company incredibly more efficient.

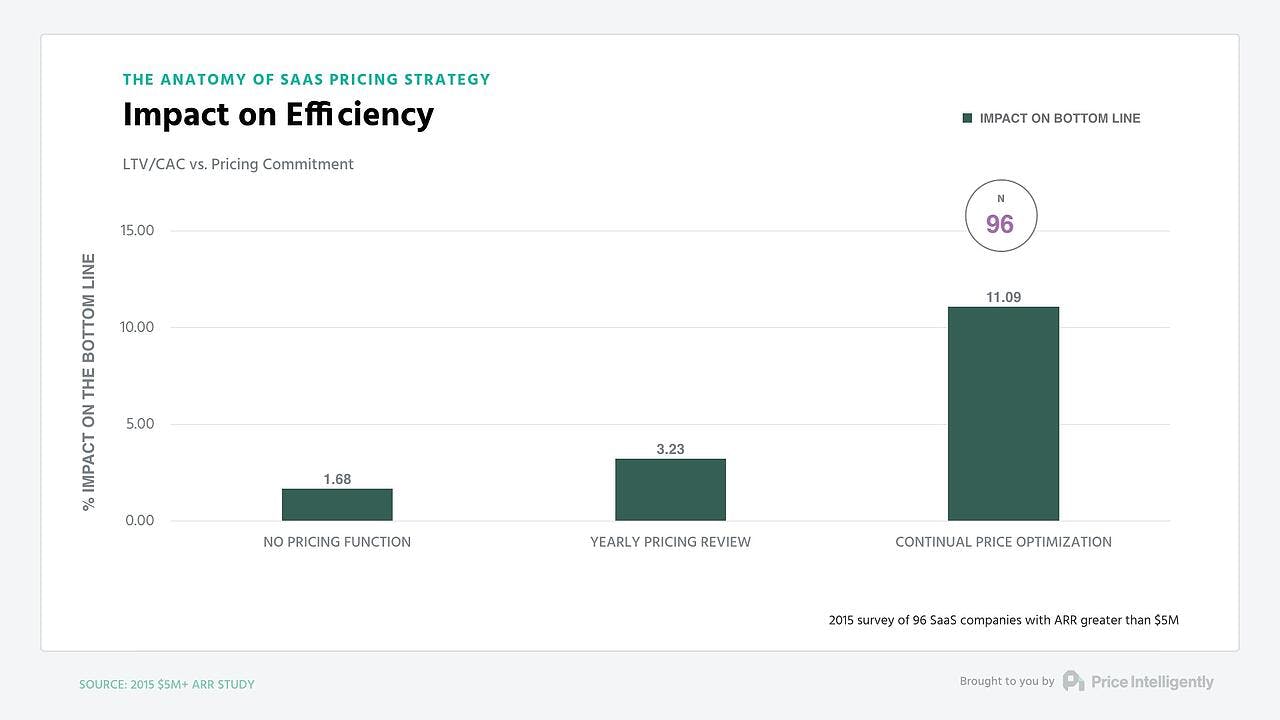

In our survey of 96 SaaS companies with annual recurring revenue (ARR) greater than $5 million, the companies that adjust their prices continually exhibited extremely robust unit economics.

In order to understand whether your unit economics add up to a profitable business model, you need to look at the ratio between two numbers: lifetime value per customer (LTV) and customer acquisition costs (CAC). The ratio between these two has to be greater 1—otherwise, you’re losing money on each and every new customer.

Companies that don’t think about their unit economics tend to hover in the danger zone, just above break even:

Companies who at least had a yearly review had a solid foundation for growth. But companies that made price optimization a continual focus realized far more lifetime value from their customers than it cost to acquire them.

A lower ratio means it takes longer to achieve growth. As Customer acquisition cost (CAC)spending is upfront while Lifetime Value (LTV) gets paid over time in SaaS, the weaker your LTV/CAC ratio, the longer it takes for each customer to pay back their costs. Looking at the payback period of each of these options, you can easily see the difference a continually optimized pricing strategy has on the growth of a company:

How to choose a pricing strategy

Choosing a pricing strategy is an incredibly important part of any business’s journey. Just as any important decision in business, a pricing strategy needs to be backed up by solid customer information, metrics, and more.

Step One: Quantify Your Buyer Personas

Surprise - every process in the history of SaaS should start with this step, because quantifying your buyer personas has a cascading impact on your product, marketing strategies, financial planning, etc. To be clear though, we're not talking about a pretty powerpoint deck with cute names like "Startup Steve" and "Enterprise Eddy" (although these aspects definitely do round out the personification of your personas). Rather, we're referring to deeply defined and well researched personas that answer questions like the following:

- What is the price each buyer is willing to pay?

- What is the estimated Lifetime Value (LTV) of that customer?

- What is the estimated Customer acquisition cost (CAC) of that customer?

- What are the top three marketing channels you’re finding this buyer in currently?

- Who does this buyer report to? Who reports to them?

- Which three features do they care about most? The least?

- Which value proposition do they care about most? The least?

- Who else needs to approve a purchase (if anyone)?

This will definitely take some time and work, but everyone should be on the same page with who you're targeting, as well as how that user thinks, breathes, and lives. We've found that SaaS companies that have personas down to this detail are typically growing at a much quicker clip than those that don't, because everything stems from these buyers.

When you're just starting out though, you may not have time to do the work to answer all of these questions, and that's completely ok. Yet, make sure you have some sort of central repository that is cataloging and updating this information on a continual basis as new information comes in (surveys, interviews, etc.).

Main Takeaway: Build out your buyer personas to make sure you're attacking the right customer(s) in the proper markets. Everything in your pricing strategy and wider company strategies will stem from these personas. Here's a step by step guide to quantifying your buyer personas, as well as an article on how to properly use your SaaS buyer personas.

_________________________________________________________________

_________________________________________________________________

Step Two: Finding The Right Features For Each Persona

Your buyer personas are your pricing strategy's foundation; now we need to build the structure on top of them. The first thing to think about is which features should be aligned to which persona. Our ultimate goal is to have a plan or entry point for each buyer persona, and then a place for them to grow via upgrades.

Determining which features align with which persona is actually incredibly easy. Sure, you'll have some tough choices to make when your prospects tell you a particular feature you slaved over isn't as valuable to them (happens all the time). Yet, the process simply requires you collecting data via surveys from your target customers.

Yes, surveys. These wonderful marketing tools get such a bad rap, because we're mostly horrible at them. We make them too long and ask the wrong questions. For instance, you should never, ever...and I mean ever....ask anyone feature questions that don't force them to make a decision or tradeoffs. This is because, respondents have no incentive to give you good data, and instead will give you results like the following, where you can't tell if Feature 1 is truly better than Feature 4.

Instead, you need to be asking questions like the following that forces the respondent to make a decision between a set of features. This is absolutely crucial, because you end up getting results like the next image where you can not only tell which features are more important than the others, but you can also tell the magnitude. The math may seem pretty complex, but it's pretty simple and you can find a bit more about how to run this type of analysis futher in our article on relative preference analysis.

Main Takeaway: Force respondents to make decision when asking them about features. You'll then be able to align those features to each persona, which will force your pricing tiers to begin to emerge. Remember that it's ok to adjust your buyer persona assumptions after these types of exercises. In fact, that's encouraged!

Step Three: Determining the best value metric and bundling

Once you've aligned your features (or found that you don't have any differentiable features), then you need to start thinking about a proper value metric. A value metric is essentially what you charge for (per user, per visit, etc.), and it's quite literally one of the most, if not the most important aspect of your pricing strategy.

Value metrics are so important, because they are the main driver of expansionary MRR, which is more MRR you receive from your existing user base. This leads to the almighty, holy grail of SaaS known as net-negative churn, meaning when you put a dollar into your SaaS machine you actually end up getting much more out.

We've written extensively on value metrics, but a great value metric can be summarized by these three points:

The big key is picking a metric that grows as the underlying company grows. The usual knee-jerk reaction is per users. While it certainly works in some instances, generally there are better alternatives.

Lets take an imaginary SaaS platform that lists classifieds for boats. A simple metric is for them to charge per each boat listing. The idea being, small companies sell fewer boats and as the company grows they sell more, simple, right? Yet, think about someone selling multimillion dollar yachts vs someone selling small recreational fishing boats. Odds are fewer yachts are going to be sold, but they drive in a much higher revenue and profit.

So does the value metric of per listing equally apply to both business or is one getting away with a steal and the other getting hammered with extra fees? A fairer metric may be based on the asking price of the boat in each classified. This way, fees charged are more inline with the value each seller gets from the listing.

Another way to attack this problem is going back to your feature analysis to see which feature is valued most highly over all personas at all growth stages. This might be a hidden gem worth throttling to match pace with company growth. Be careful though, as you want to make sure you're not throttling an aspect of a product that's crucial for retention.

Main Takeaway: Make sure you take your value metric seriously, because it may be what makes or breaks your SaaS monetization. Make sure to check out this article on why per user SaaS pricing kills growth and this one that goes much more in depth on value metrics.

Step Four: Actually pricing your product

Funny how we've gone through three pretty big steps and barely mentioned anything about the actual number on the page you'll be asking for from your prospect. This is because pricing encompasses so much more than the actual number. Yet, it's definitely an important part.

Surprisingly though, determining the number you'll charge is pretty easy. You simply need to collect some data, similar to the type of data you collected in the feature value analysis. Price sensitivity data is actually much easier to collect though, because we simply take advantage of how people think about value.

Human beings don't think about value as a single point. Instead, value is a spectrum where it's difficult for you to give someone a point blank answer when asked, "how much is this worth to you?" Yet, it's easy for you to know that your laptop has a higher price than your water bottle, which both have a much lower price than a house.

You can harness this phenomena by simply changing the way you ask about pricing to the following four questions:

At what point is [your product] so high-price that you'd never consider purchasing it?

At what point is [your product] getting expensive, but you'd still consider purchasing it?

At what point is [your product] a really great deal?

At what point is [your product] so low-price that you'd question the quality of it?

Using these questions (or any variation of them) gets you much clearer guidelines into how your personas are thinking about price, and when done at scale get you price elasticity ouput like the following:

Main Takeaway: Don't be afraid to chat with your customers or future customers about pricing, just make sure you're asking them correctly. Check out more on measuring price sensitivity here.