There’s no more vital metric for a SaaS company to keep track of than churn: the rate at which customers are leaving your business and taking their subscription dollars elsewhere. Churn can be powered by a number of factors, and even small month-on-month increases in churn percentage can be ruinous to planning, so understanding what churn is and how to analyze it is paramount.

What is churn analysis?

Churn analysis is the evaluation of a company’s customer loss rate in order to reduce it. Also referred to as customer attrition rate, churn can be minimized by assessing your product and how people use it.

Customer churn comes in many forms

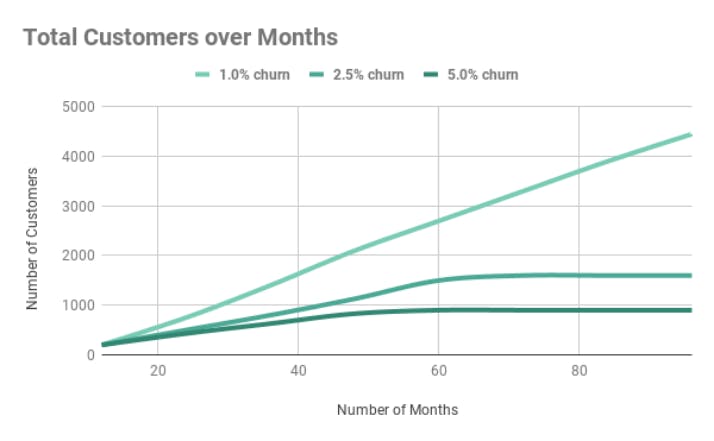

To be blunt: churn is expensive for your business. A high churn rate forces a business to compete with the stress and difficulty of bringing enough new customers in to plug the holes in the ship. Even seemingly small, single-figure increases in churn rate (%) can quickly have a major negative effect on your company’s ability to grow. What’s more, high churn rates are more likely to compound over time.

That’s why having a grasp of churn analysis is so important. Understanding the different reasons behind customer churn is a fundamental step in addressing and reducing your rate.

Canceled subscriptions

Canceled subscriptions are probably the first kind of churn you’d think of, and they can be motivated by a number of different reasons.

1. Poor customer fit

Selling your product to the wrong type of customer can result in them churning soon after signing on, immediately invalidating the cost of the resources used to win them.

2. Missing functionality

Customers may ask for new features to your product as their needs change. A sense that your company is resting on your product’s laurels and not being responsive to changing customer needs is a route to churn.

3. Failure to achieve outcome

Customers who fail to get what they want out of your product will certainly churn. This kind of churn represents a particularly poor loss of opportunity if the customer could have gotten what they needed from your product, but didn’t. Poor onboarding or a badly designed setup process is frequently the culprit.

Switch to a competitor

Certain aspects of churn analysis require you to focus on your company’s own operations. However, there’s a competitive element as well.

Keep an eye on competitors offering a similar service—how they set their price points and how they package their deals. If they’re bundling in more services for free than you are, including what you offer in a better package or at a lower price, you may find that customers are canceling their plans with you in order to churn to your competitor.

Your business is especially susceptible to this kind of churn if it is not properly attuned to the changing needs and support requirements of your customers. More dynamic competitors will be more likely to win business from your customer base.

Not renewing a subscription

Some churn is not the result of active dissatisfaction with a product or service but the result of improper maintenance of customer relationships. Oftentimes, customers who are not being engaged with sufficiently will just drift away from a product. They'll forget how it might be useful for them and not renew at the end of the subscription period.

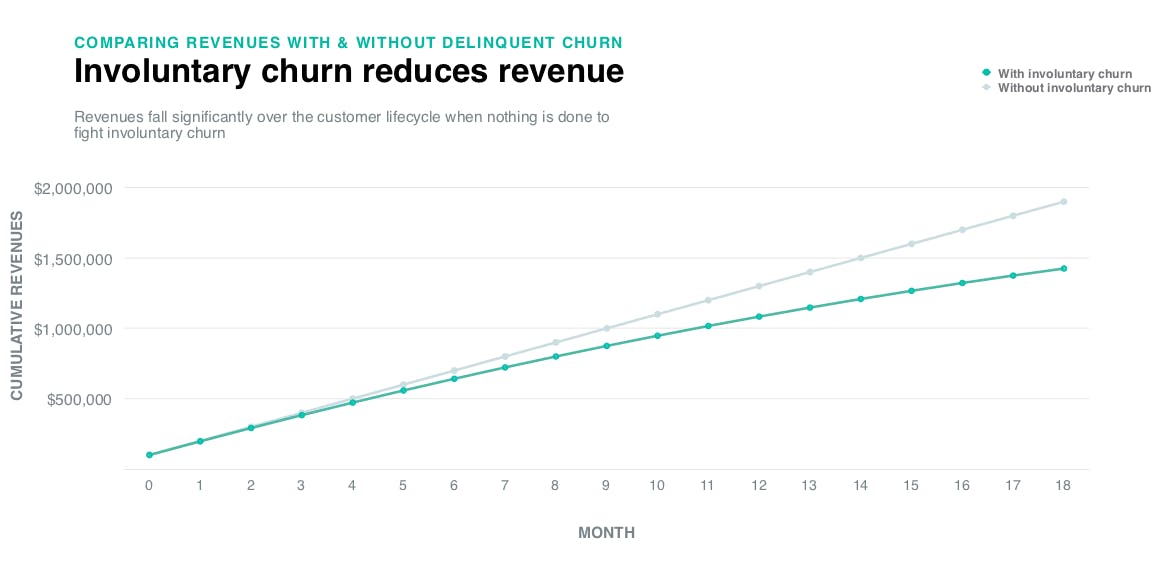

A lack of engagement also leads to an increased likelihood of delinquent churn, in which customers are lost due to payment problems related to delinquent credit cards on file. This may be a passive form of churn, but it can account for up to 40% of a SaaS company’s overall churn. What’s more, customers lost to this form of churn are rarely regained.

Closure of account

Even if your customer is leaving your business, delighted with the service you’ve provided and with their needs fulfilled, it’s still a form of churn.

You may have done your job well, but a customer lost in this way is still a lost opportunity and an expense to be dealt with. You’re losing the MRR you draw from them, and you’ll be incurring expense to replace them. Moreover, a customer leaving after they got what they want suggests that, while you’re doing well at providing your basic service, your product doesn’t have much repeat-use value.

You can mitigate against this kind of churn by expanding your product range or increasing the repeat-use value of your products.

Why you should analyze your churn frequently and accurately

Churn is a hugely influential statistic across a SaaS business. It’s the metric by which businesses, young and old, live or die. Letting your churn rate creep higher can lead to a number of related problems.

Churn leads to higher CAC & reduced revenue

Customer acquisition cost (CAC) is the total cost of sales and marketing required to acquire a customer.

Regardless of the strength of your marketing strategy and the effectiveness of your approach to nurturing leads, every customer costs money to obtain. In fact, acquiring new customers is considerably more expensive than maintaining and upgrading existing customer relationships. The more customers you churn, the more money you must spend to recoup the loss of business by finding new ones.

CAC eats away at essential revenue and fundamentally works against financial growth — the lower you can keep it, the better, and you keep CAC low by actively fighting against churn.

Analyzing churn helps you reduce it

Although you can attempt to outrun your churn by focusing on bringing in new customers, you can only actively reduce your churn by focusing on the areas where you’re losing customers. A company that is churning customers owing to a poor pricing strategy will need a different improvement strategy than one that is churning customers due to a dysfunctional customer support program.

To figure out where your churn is coming from, look to the data.

Analyzing churn data

Key performance indicators (KPIs) and goals

As with any form of analysis, successfully analyzing your churn requires you to keep track of the right data. Setting the right KPI-oriented goals can help you get a closer look at what is causing your churn.

A few KPIs helpful for churn analysis can include:

Customer engagement and usage

The surest signal of impending customer churn is a consistently declining rate of usage, which will suggest different things depending on how long your customer had used your service before their usage rate declined.

Support tickets

If your support team is receiving markedly fewer tickets than normal, that may mean that you’re doing everything perfectly. It’s more likely, however, that it’s a sign of customers’ lack of engagement, that they no longer feel it’s worth the time to seek support to fix their problems with your service.

Competitor pricing points

Monitor competitors’ pricing, as well as the deals they’re offering, as it’s important to anticipate the likelihood of customers churning to those competitors. Your pricing strategy should be a subject of continual re-evaluation to ensure that you stay competitive.

Likelihood to upgrade

Because high churn can be difficult to reduce, and even small increases in monthly churn are highly damaging, it’s a good idea to maintain a KPI that will allow you to hit back against churn preemptively. Securing customer relationships with upsells is one way to do this. Are certain types of customers more likely to upgrade their subscriptions than others? Is there a particular point in your product lifecycle where upselling is effective? Target these areas and take the time to nurture and improve those relationships. That way, even if you’re battling churn elsewhere, you are still securing the value of your other existing subscriptions.

Customer behavioral patterns

It's unlikely that your company will just be serving one type of customer. Different customers have different needs, and these different needs translate to different behavioral patterns. This is where cohort analysis comes in. Here's how ProfitWell Retain tracks customer cohorts over time:

Separating your customers into cohorts based on when they sign up and their product usage behavior can be hugely helpful in analyzing, anticipating, and preventing churn. Note similarities in customer behavior, like:

- Which customers are more likely to disengage after a given period of time

- Which features of your product are the most highly or underutilized

- Which customers are at a higher risk of delinquent churn

- Which portion of customers are using your support services

From there, address strategies to re-engage with customers who are no longer getting value out of your product. Use email marketing or direct outreach to customers who have begun to drift away. Deliver alerts to customers whose subscriptions are about to end or whose payment methods are out of date.

Customer segmentation

To get an even firmer handle on the behavior of your customers, split them into separate groups based on their industry, how long they've been using your product or service, and patterns in their usage to see who’s more at risk of churn and how to engage with them.

- Observe how customers in different industries use your product and which customers are more churn-susceptible.

- Observe how the churn risk changes depending on how long your customers have been using your product.

- Observe how users in differing pricing tiers operate with respect to churn — are customers in lower tiers getting enough features to stop them from losing engagement? Are customers in higher tiers being charged too much and churning to better-value competitors?

Touchpoint behavior

Customers who become frustrated with your service, with no support to turn to, are likely to churn. Establish points of contact for support so that your customers can get all the value they’ve paid for from your product, and you can gain valuable information on how your product can be improved.

- Pre-empt early frustration by having a well-tested and analyzed onboarding process that settles the customer into the account. A taxing process that requires a lot of additional downloads or purchases or external data sets to work is one that is likely to result in churn before your customers have even gotten started.

- Having a well-written FAQ or help page on your website can be great for simple product use queries, but embrace the use of a committed, responsive customer service department for complex issues. Remember, customer service departments are excellent ways not only to solve issues but also to improve customer relationships and raise customer lifetime value (LTV).

Everything you need to analyze your churn

If your company is looking for a solution that will allow you to get a better grip on your churn analysis, you should select one that takes a holistic approach to the various types of potential churn.

Predict your churn

A useful solution will be able to predict the most likely causes of churn and flag any customers at risk. For example, how much of your churn is coming from simple credit card delinquencies, or how much of it is coming from that poorly strategized onboarding process.

Analyze your pricing tiers

Pricing is fundamental; incorrectly setting price points and packaging products in the wrong tiers can lead even a company with a great product to underperform and a higher-than-necessary churn rate.

Appropriate pricing tiers are fundamental for conversions as well as minimal churn. Ensure that your tiers are focused on buyer personas, not your own perceptions of your features.

Get metrics like ARPU, MRR, and ARR

Understanding churn is fundamental because of the effect churn can have on your other key metrics. Choose a solution like ProfitWell’s Churn Reduction Software for your customer retention analysis: this software shows you exactly how the pieces all fit together to build user retention, reduce churn, and maintain engagement.

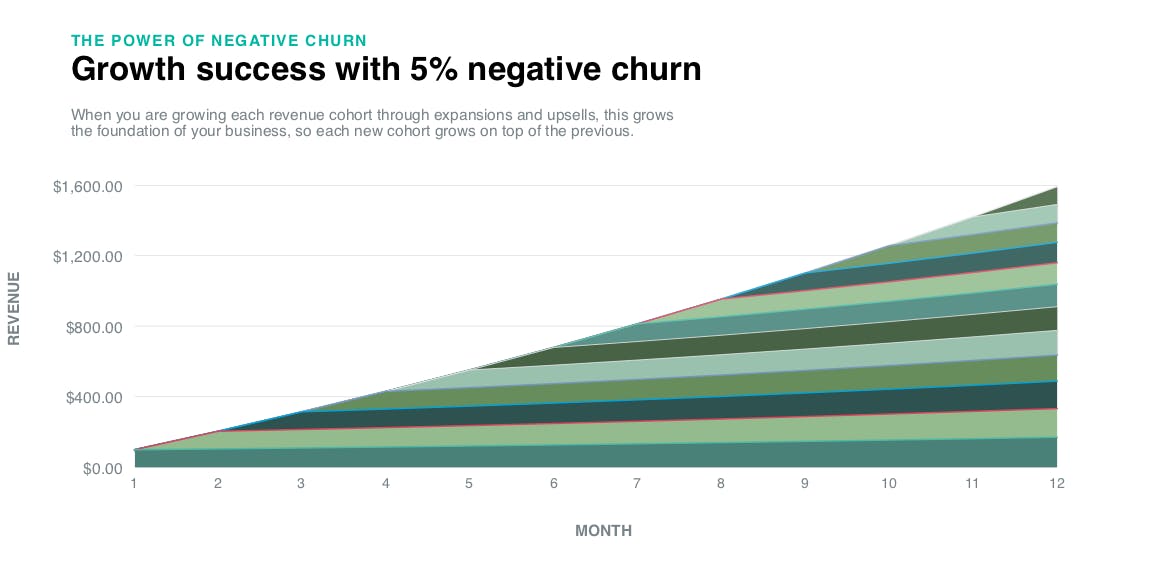

There is, in fact, one good kind of churn, and that’s “negative churn.” Negative churn is when your expansion revenue from all existing customers outweighs the revenue lost from existing customers over the same period. Negative churn means that every month, high yields will be coming in consistently from your customer base because it’s a hugely powerful growth driver.

The only way to get your churn into those negative levels is with a strong, well-thought-out approach to churn analysis. Understanding the directions that churn risk comes from, and that each one represents an opportunity to improve your company and strengthen your customer relationships, is the first step.