Revenue growth seems like a commonplace metric to calculate, but many businesses don’t take a close enough look.

Revenue growth might well be the king of all SaaS metric monsters, the Godzilla of the balance sheet. And what works for the beast from the deep works for revenue growth: to master it, you must first understand it. The high-frequency emitter is optional.

Though you can calculate revenue growth with a simple growth rate formula, found below, that’s only half the battle. From there, you need to understand how the metric speaks to other aspects of your company's accounting (particularly churn) and how your company's structures and processes are (or aren't) contributing positively to it.

What is revenue growth?

Revenue growth refers to an increase in revenue over a period of time. In accounting, revenue growth is the rate of increase in total revenues divided by total revenues from the same period in the previous year.

Revenue growth can be measured as a percent increase from a starting point. For example, if the company’s revenue doubles from $1 million to $2 million, it has experienced 2% revenue growth. If this company had started with $500,000 it would have seen 5% revenue growth.

How to calculate your revenue growth rate

Revenue growth rate calculates annual growth by comparing the previous period's revenue with the current period's revenue. Each time period you're measuring should be of equal length, so compare last year to this year, or last month to this month.

The revenue growth formula

To calculate revenue growth as a percentage, you subtract the previous period’s revenue from the current period’s revenue, and then divide that number by the previous period’s revenue. So, if you earned $1 million in revenue last year and $2 million this year, then your growth is 100 percent.

(Current Period Revenue - Prior Period revenue) / Prior period revenue

This can be calculated annually, quarterly, monthly, etc. The formula calculates both positive and negative changes in revenue growth.

How revenue growth is different for subscription businesses

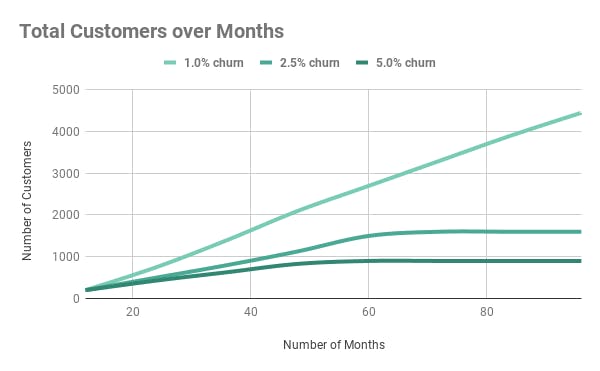

Because subscription businesses depend on winning and consolidating recurring revenue, they need to factor in churn in order to understand their revenue growth.

Often, SaaS companies prioritize revenue growth over churn because it satisfies certain superficial requirements (meeting overheads, etc.). If growth appears to be flagging, the instinct is to devote more resources and analysis to replenishing that cash flow than to anything else.

This, however, is faulty logic. Churn should always be your top KPI. If left unchecked, churn eats away at your revenue growth. Once you pass even relatively low rates of churn, adding new customers won’t be enough to see stable revenue growth. You'll continually be playing catch-up due to the customers you're losing.

Over time, a subscription company with lower revenue growth and a controlled churn rate will be more stable than one with high revenue growth and a high churn rate.

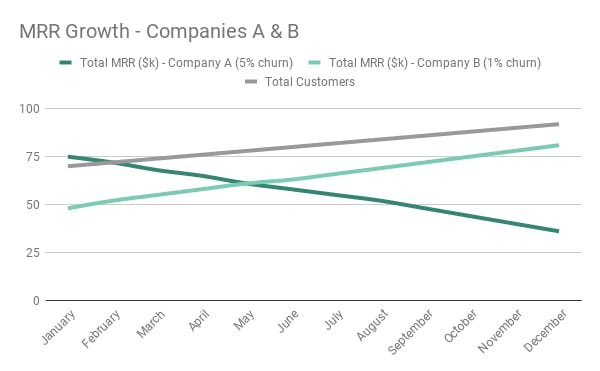

Company A has invested more directly into revenue growth than Company B, and for the sake of argument let's say both companies are getting customers at the same rate. Company A's revenue growth might be high, but its churn is so high that their MRR is going down. Company B started lower, with less month-on-month growth, but because their churn is absolutely under control, it doesn't take long for them to overtake Company A.

What to analyze when looking at revenue growth

Analyzing revenue growth doesn't just mean thinking of new ways to bring money in through every existing and potential channel possible. Diligently examine your company's financial statements: observe which internal processes or aspects of your product are responsible for top-line revenue growth, which aspects are causing decreases in revenue, and how your long-term outlook is shaping up.

Then you can start scheming about new revenue drivers.

Which channels are responsible for revenue growth?

There are a number of different roads you can go down with revenue drivers - tailor your approach based on what you have to offer.

- Email Marketing: Building revenue is in many ways like building an audience for your product, and email marketing is one of the surest ways to do so. Inboxes are notoriously crowded places, but there are ways of making your emails stand out.

- Content Marketing: Content marketing requires a lot of commitment - to publishing regularly and at a high quality over time - but it’s an excellent way of getting your service out to a much bigger and more committed buying audience. It’s another excellent way of growing your email list, too.

- Freemium Offerings: Offering the basic version of your product for free is an excellent way of raising awareness of its value and gaining early traction.

- Giveaways: No, don't give away the whole thing. It’s true, however, that giveaways, like referral and loyalty bonuses, can be great ways of both consolidating current subscribers and bringing in new ones.

Each of these channels can have real positive effects on your income statement, but you have to strategize. Each of them requires time and investment - they’re only worth it if you have the time and means to do them well.

What is causing decreases in revenue?

Any revenue growth strategies you do implement will only be successful if you can figure out what exactly is undermining your revenue growth in the first place.

- Churn: As we mentioned above, churn is the mortal enemy of healthy revenue growth. Understanding and reducing churn are fundamental to maintaining a healthy level of revenue growth.

- UX: Is your product performing at the right level? Are you updating regularly? Are your updates well-targeted/well-tested?

- Packaging: Are features of your product with lower WTP (willingness to pay) in your premium pricing tiers? If so, you might be losing out on potential revenue growth by offering for a price what you should be offering for free.

- Pricing: Is your pricing generally correct? Are your tiers well-thought-out and well-explained on your pricing page?

- Onboarding: Are you striking the right balance with your onboarding? Or are customers leaving your service before they've even used it?The root causes behind decreases in revenue will reveal themselves the more closely and carefully you’re able to examine your product and processes. Not even the best-executed selling techniques can succeed if your revenue losses are out of control.

Are you hitting long-term goals with your current rate?

If you're not on track to meet long-term revenue growth goals with your current setup, don't despair: there are plenty of ways of driving revenue growth rates.

Start with the users you already have. Increase your Average Revenue Per User (ARPU) by encouraging more usage, exploring value-based pricing, and being more aggressive with upselling to your customer base, who’ve already shown their desire for your product.

You might’ve noticed just how seriously we take pricing pages here at ProfitWell. By A/B testing your pricing page or trying different guarantees, you can improve sign-up rates. Aligning pricing with customer success, for instance, can be exceptionally good at increasing revenue

Your website speaks for your product and is key to driving revenue. So take a look at your onsite selling techniques. Using product pages instead of dropdown menus and incorporating responsive design may seem unrelated but are excellent in driving conversions. Customer UX starts even before the point of purchase!

And in terms of targeting that dastardly churn before it gets you, you can even consider using a predictive solution to better target churn-prone customers. You should never look at churn as anything less than a major source of revenue - after all, nothing leeches away at your revenue like the cost of acquiring new customers.

There are lots of ways to go about driving revenue growth - and it's easy to let the imagination run wild.

Before you take the reins off, however, ensure you have a good idea of what in your company already works. Once you’ve established those core competencies, craft ideas for new revenue drivers to complement them. In addition to nailing your expansion revenue, revenue growth is about making the best of what you already have as much it is about the next big idea.

Revenue Growth FAQs

Why is revenue growth important?

Revenue growth is a metric that indicates the success of a business. By calculating the revenue growth rate, a company gains insight into increase or decrease in sales volume, as well as business expansion trends.

What is a good revenue growth rate?

Although a company's revenue growth rate depends on multiple factors, any business with a revenue growth rate of 10% or more is considered good. However, a 2 or 3% growth rate is also regarded as healthy in some cases

What is revenue growth management?

Revenue growth management refers to the analysis of user behavior at a microeconomic level to optimize prices and products to boost revenue growth.