Don't get overwhelmed trying to measure all of your SaaS metrics all the time. Just focus on the most important metric at each stage of your company's growth.

SaaS companies are handed dozens of shiny metric tools on a tray and told to measure things. It can be incredibly difficult to try to assess this collection of numbers and figure out where to begin.

You might be tempted to pick a metric to measure arbitrarily or to choose one that makes your company look good. Yet this will give you misleading results. You'll lie to yourself and risk steering your company dangerously off-path. Or you might think you need to measure everything, but feel daunted and put off measuring anything at all.

There is no one perfect metric to use all the time, and you can't measure every metric at once. Different things are going to be important at different stages of your company's growth. It's much more realistic to focus on one metric at a time to make sure that you're headed in the right direction at each of these stages.

Below we'll break down the most important metric for each stage and how they align with your objectives at those times.

The 7 most important SaaS metrics to track

Tracking metrics is important in every business, but in SaaS, tracking the right metrics could mean the difference between profit and loss. Here are the 7 most important SaaS metrics if you're in the subscription industry.

MRR (Monthly Recurring Revenue)

MRR comes in a handful of varieties such as Net New MRR and Expansion MRR. MRR is the lifeblood of a SaaS company, so it's important for SaaS companies to track monthly revenue to gauge how they're growing and how much they’re earning now.

ARR (Annual Recurring Revenue)

On a much grander scale than MRR, is ARR, the annual equivalent: MRR is the revenue you generate each month, and ARR is the revenue you generate over the course of a year. Each is important and worthwhile in your analytics because they provide varying time windows in which you can judge your performance.

MRR Churn

Churn is one of the most important metrics for SaaS companies, but MRR churn is particularly valuable. Monthly recurring revenue churn tells you the amount of MRR leaving every month through some form of churn. This is a more relevant metric for SaaS companies who depend on recurring revenue.

CAC (Customer Acquisition Cost)

CAC tells you how much you're spending on getting a customer, and whether the final cost is worth it or not! CAC plays a huge role in determining the profitability of a business: if you’re spending too much to acquire customers, then you can continuously grow your business but not your revenue.

Lifetime Value

Lifetime value, sometimes called LTV, is the dollar value a company receives from a specific customer. You can increase this metric by finding creative ways to upsell and generate more sales from each customer.

ARPU (Average Revenue Per User)

When asked at any point, you should know your ARPU. ARPU helps establish a dollar value of the average customer. APRU is sometimes interchanged with ARPA or average revenue per account.

Active Users

Active users is often considered a vanity metric, but you should always keep close track of your number of active users. This metric help you determine how engaged your customers are and the likelihood of customer churn in the future. Both Monthly Active Users (MAU) and Daily Active Users (DAU) can be helpful in this regard.

Why are SaaS metrics So important?

While we inherently know “data is important”, understanding your SaaS metrics specifically is crucial for two key reasons: 1. SaaS success is one giant formula, and 2. each data axes is crucial to optimizing short, mid, and long-term goals.

SaaS is one giant formula that’s easily optimized

The absolute beauty of SaaS as an industry is that success comes down to one giant formula that every subscription company is following. Unlike more complicated industries, SaaS success is predicated on building a great product, gating that product in some manner through a paywall, and keeping those customers that go past the paywall around for as long as possible through continued usage. That’s really it.

Sure, there are plenty of complications in putting that formula into practice, but every change or product optimization then hinges on that playbook. Will a feature increase lifetime value? Will a better value proposition lower customer acquisition cost? Determining the answers to those questions and iterating to drive those metrics in the right direction is what SaaS is all about, and what makes the subscription economy much simpler to grow in relative to other verticals. Simply put, every metric becomes a fulcrum through which you can make a decision.

Why scale metrics by stage?

You can't measure a bacteria cell with a yardstick, or a freight train with a bathroom scale. Your method of measurement has to scale along with your size in order to collect the most accurate and most helpful information.

But knowing where your company is in its stages of growth—and acting accordingly—is challenging. A company will miscalculate its true stage if it makes optimistic decisions that overestimate its size and scale in an effort to grow as fast as possible.

This can backfire: A report released by the Startup Genome found that 70% of startups fail because they try to size-up too quickly. If you act like your company is bigger than it is and fail to measure metrics that are most relevant to your growth stage, your company will flounder and go belly up.

Similarly, if you get too caught up in trying to measure everything, you'll gather a lot of data that doesn't help you at all. Startup advisor and investor Andrew Chen pointed out that you can end up tracking easy-to-measure metrics that don't mean anything. With misleading information and no useful data to guide your decisions, you're doubly doomed.

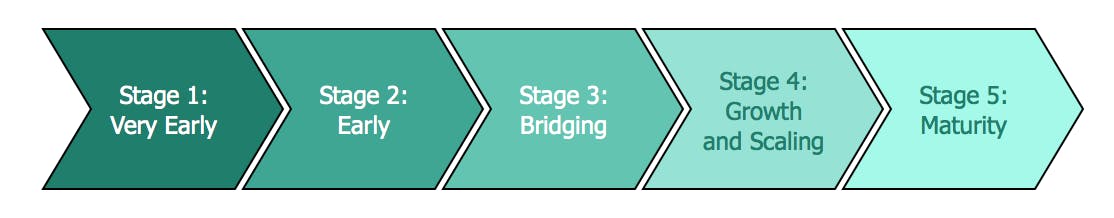

First establish you'll need to be honest about where you are in your growth. We've broken growth down into five concrete stages to provide a conceptual framework for your company's development:

As your company progresses through the stages, you'll identify different objectives and priorities.

Usually, the most important SaaS metrics to pay attention along the way will be:

- First conversions

- LTV:CAC

- MRR

- Customer retention

- Recognized revenue

Use these as a guide and use the key metric at each stage to make practical, smart assessments of your progress.

Stage 1: Very Early

It's essential that you see first conversions on your very early idea or you're wasting your time and money creating something that no one wants. Your initial vision won't survive if you don't see interest or don't understand who is interested. That's why it's vital at this stage to measure how many conversions you see and to take note of who these first users are.

Jason Lemkin emphasizes the importance of measuring unaffiliated first conversions. These are people who found you on their own and simply like the idea of your solution to their problem. Lemkin preaches that 10 conversions is a harbinger of SaaS success. This is so important because you'll gain validation that your problem/solution fit is a viable business idea. You'll know you've reached the point where you can build off of your initial ideas.

Learning about these very first interested users will help you learn who might be experiencing this problem and interested in a solution. That's why failing to measure demographics and lead channels of these first conversions is a waste of an opportunity to learn about your potential market. Without this early information you could veer off in a completely wrong direction. At this early stage, misdirection is fatal.

How this aligns with your objectives

You'll know you're at this stage when you're working to define the problem and propose a solution. You may be focusing on a specific pain point within a more general problem that you observe.

Now you want to develop your mission and your vision for the solution—and see that people actually want it.

When you measure your first conversions, you'll want to look at:

- Demographic information of these first interested users (such as age, occupation, industry, location, et cetera)

- How these early users are finding out about your solution to their problem

You can use this early information to start sketching ideas of buyer personas. Starting to learn about your users early on will help you properly monetize later on and will allow you to create the best product to meet their needs.

Stage 2: Early

You need to master your unit economics—the ratio of revenue and spend per customer—or you won't know if you can sustain a profitable business.

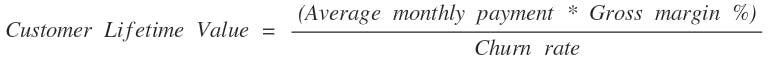

The first component of your SaaS unit economics is your customer Lifetime Value. The LTV is the total revenue value of a customer over their lifespan with your company. This tells you the long-term value of those conversions that you're seeing today—which is why it's so important if you want to set your company up for future success.

The second component you'll need to establish with your unit economics is your company's Customer Acquisition Cost. These are expenses that are necessary for bringing in new customers. It's essential to account for these costs when you're evaluating your long-term business model because you want to make sure that these inevitable costs are going to be paid back—along with a sustainable profit.

Once you know your LTV and your CAC, you can determine how the two metrics compare. The ratio of LTV:CAC should be at least 3:1 for your company to be profitable. If you don't have this, you don't have a viable business model.

David Skok believes that an unexpectedly high CAC and a failure to overcome those expenses with customers' LTV is one of the largest causes of startup failure. Your company absolutely cannot survive if your LTV and CAC are off balance. You'll lose cash quickly and crash just as you're trying to fully launch.

How this aligns with your objectives

You'll know you're at this stage when you're not just looking for people interested in your idea anymore. Now you're looking for customers who will pay for the Minimum Viable Product you create. This is important because product-market fit is one of the most important factors for SaaS growth.

This stage will probably involve multiple test iterations of your MVP as you figure out how to turn your proposed value into a product that customers will pay for. It is very important to start thinking about your pricing strategy at this stage so you can lay a good foundation to consistently optimize your monetization throughout the lifetime of your business.

It's important to keep LTV:CAC in mind when developing your pricing strategy, because maximizing LTV through pricing will help your LTV:CAC ratio remain high.

This is how to calculate LTV:

This is how to calculate CAC:

This ratio will continue to be valuable through all stages and will take on added significance when you have more customers with longer lifetimes. But you should not wait until these later stages to start measuring LTV:CAC because it will be too late to take action. Be proactive and start thinking about these metrics at the Early Stage.

Stage 3: Bridging

Your Monthly Recurring Revenue propels your SaaS business from month to month. You need to understand your MRR to understand how sustainable your business is over time.

If your MRR is where you want it to be and/or growing, you can have confidence in your monetization and retention strategies. Both of these components of your business are pillars of strength and must be solidified before you can think about growth. You can't try to scale if you're losing money through improper pricing or if you're trying to fill a leaky bucket.

The total revenue you accrue each month balances—and hopefully outweighs—your spending over time. You have to have a good handle on this source of incoming cash if you want to survive, and an even better grasp if you're trying to build something profitable. You can't look to scale in the future if you don't have a business that is successful in the present.

How this aligns with your objectives

You'll know you're at this stage when you have some processes in place but know you can make them better. You're getting ready to drive growth, although you're not there yet. First you want to make sure your business model is rock solid.

At the Bridge stage, you want to define and optimize all of your processes. This means solidifying a repeatable sales strategy, nailing down your most effective lead channels, and removing any pain points from your conversion funnel.

It's all about learning everything you can about what your business is doing in the current moment and perfecting each step of your acquisition and retention processes.

This is how to calculate MRR:

You can start measuring MRR as soon as you have a viable product and paying customers. However, this metric is especially important at this stage of your company's development because you'll be able to benchmark your revenue goals and make sure your results are repeatable.

Stage 4: Grow and Scale

Measuring retention will let you know if you've created a must-have product that your customers don't want to give up. It isn't enough to simply acquire new customers—you need your existing customers to stay and ideally to purchase bigger plans.

Morgan Brown, the former head of growth at Qualaroo, GrowthHackers, and other accelerating startups, noted, “Retention rate is your best measure of a product/market fit. The higher your retention rate the more it's a must-have product.”

Note: retention rate varies by industry, so to set the proper benchmarks, you'll have to look at competitors in your industry to get the proper SaaS metrics benchmarks for you. The flip side of retention is churn, or the rate at which customers stop using your product. You should aim for a net negative churn, which happens when the MRR gained from expansion is greater than the MRR lost from churn.

Besides the obvious financial blow of losing customers, high customer churn is deadly because it becomes increasingly difficult to replace churned customers as you grow. Customer churn rates compound over time, and as you capture more of the market your pool of potential new customers shrinks.

If you can't reduce churn or replace customers at the rate you're losing them your growth will slow to a crawl or stop altogether. It's much more efficient to try to keep them in the first place, because retaining customers is only 1/7th of the cost of acquiring new customers. You can't rely on replacing lost customers—retention needs to be your priority.

How this aligns with your objectives

You'll know you're here when you've done all the work to solidify and perfect your business model in the Bridge stage. Now you're ready to scale up. As the company expands, you'll want to maintain the focus and efficiency you've developed in the previous stage. Your company's growth should be a natural expansion of the monetization and retention strategies that you've nailed.

At this stage you're looking to grow your team, which means making good hiring decisions as you scale to continue building good company culture.

This stage is also about growing your revenue, which most people associate with acquisition. There's a fixation on collecting new customers in SaaS—7 out of 10 blog posts on growth are written about acquisition. But this is actually the least effective growth lever for revenue growth when compared to monetization and retention.

This is how to calculate retention rate:

When you effectively retain customers, you can then up-sell them to fuel your growth. Upgrading customers along your current value metric deepens and lengthens your existing customer relationships, which is important for branding and referrals.

Stage 5: Maturity

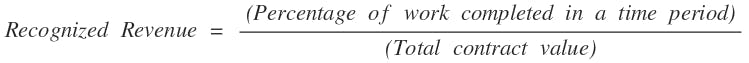

Recognized revenue is the reality check that your finances need as your company matures. Now that you're taking on more customers and bigger, higher-paying customers, the new cash in the bank will make you want to celebrate. Accounting for recognized revenue will help you avoid false victories and misguided decisions.

Your recognized revenue is the payment from your customers that corresponds with services that have actually been delivered. If a customer pays you upfront for an annual subscription, you can only count portions of their payment as recognized revenue as you deliver your service week by week, month by month, et cetera.

As you acquire larger and more complex accounts in the Mature stage of your company's development, it is especially important to establish a policy for measuring recognizing revenue. Otherwise you risk counting your deferred revenue as money you've earned, when you should really consider it a liability until you've delivered on the promised service.

Mixing up recognized revenue and deferred revenue is a deadly cocktail that will lead to bad business decisions. Operating under the assumption that you have more money that you really do will have widespread grim consequences for your company, your employees, and your customers. You could undo years of hard work by failing to keep these metrics straight.

How this aligns with your objectives

You'll know you're here when you've successfully built the machine that builds your product. But you're far from cooling your heels. Even as your company gets older, you'll want to follow the advice of Andy Grove and stay paranoid.

Now you want to make sure your successful processes are repeatable. You might consider making playbooks for your processes. If they're both repeatable and scalable, you might look for outside interest or consider expanding internationally.

The bottom line is that although you may be checking off goals and passing benchmarks, you need to kindle the fire of ambition to avoid complacency. That means being honest about your incoming revenue and staying hungry to improve those numbers and to continue providing top service to your customer base.

This is how to calculate recognized revenue:

But beware: calculating recognized revenue by hand can get extremely complicated and confusing. There are many places for human error, so it's helpful to automate the process to make sure your data is correct.

Defer to data; Know your metrics

In the age of measure anything, sometimes you need to remember that you shouldn’t measure everything. Curation in your metrics and having a formal data driven SaaS metric process is crucial to SaaS success (and customer success as well). We’ll keep bringing you the SaaS noise, but here are some other good articles to check out:

Rolling SaaS metrics deceive you. Here’s why

You shouldn’t be looking at your SaaS metrics on a rolling basis, because the process hides your actual progress and problems.

Everyone in SaaS is using buyer personas incorrectly

Similar to your SaaS metrics, your buyer personas are the fulcrum through which you create good product and align your company around common customers.

Data shows that discounting lowers LTV by over 30%

Discounting strategies may appear to boost MRR quickly, but have disastrous impacts on the backend of your MRR through lower LTV.

Now that you have the tools...

It's time for you to square up your SaaS metrics. At each stage of growth you'll find that you have to apply additional metrics in order to measure everything you need to understand your company's journey. But focusing on one metric at each stage will help set a North Star vision for your efforts to align goals across your entire team.

Growing your company in stages means placing value on your process and your vision. Take it one step—and one metric—at a time.