The subscription economy has shifted the power balance in favor of the customer. Subscriptions, one of the most common software monetization strategies, are built on ongoing relationships with customers, so companies selling subscriptions need to understand how to monetize this relationship on a recurring basis.

That’s what makes subscription sales so difficult. Not only does your sales team need to bring new customers through the door, but they also need to ensure that what they’re selling matches up exactly with those customers’ expectations.

That’s why we’ve put together this subscription sales guide to help you get started. We’ll talk through the importance of audience targeting, the kinds of resources that are helpful, and the ways to differentiate between B2C and B2C sales.

Let’s dive in.

Focus sales based on your target audience

Different audiences require different targeting strategies. Determining the type of customers you want to sell subscriptions to, their needs, and their willingness to pay all starts with an understanding of your industry and your target buyer personas.

The most important distinction you can make between different customers is whether your company is selling to individual customers (B2C) or to businesses (B2B).

B2C subscription sales

Selling directly to individual consumers requires a deep understanding of what converts interested parties into paying customers. One of the best examples of this type of sales is Netflix—its pricing strategy paved the way for many modern subscription platforms.

When you sell subscriptions in the B2C market, it’s important to forge strong connections with your customers. Your relationship with them is the core driver of your success.

B2B/Enterprise subscription sales

Your relationship with businesses is functionally different from your relationship with individual consumers. When you’re selling B2B or enterprise subscriptions, showcasing value throughout the sales process is a must.

Because the contracts are typically much higher in these sales agreements, B2B subscriptions often require a much longer sales process before your customer will consider making a purchase. Your sales team will need to work harder to bring these customers in the door.

3 important resources for subscription sales

Subscription sales teams will be effective only when they have the right resources to supplement conversations with potential customers. In today’s competitive SaaS and technology markets, many people are much savvier than ever before and require concrete examples and accurate data to feel comfortable making a decision.

1. Customer knowledge

Because subscriptions are built on recurring relationships with your customers, a clear and comprehensive understanding of their needs, wants, and motivations is paramount. The sales strategy required to win over a small business owner will be drastically different from the strategy required to convince an experienced CTO of your subscription’s value.

When you’re just starting out, this information can be difficult to find. You’ll have to make assumptions based on your personas and existing customer data in your industry. As your company matures, you’ll be able to reach out and survey existing customers as well as prospects with more targeted inquiry.

The more data you have at your disposal, the more accurate your decisions will be.

3. Market data

Both B2C and B2B companies need to understand the market conditions for their industry. Is it growing quickly or slowly? Who are the incumbents? How do they sell their subscriptions? Understanding these questions can provide valuable context to shape your own company’s subscription sales strategy.

A lot of this data can be gathered during your positioning and product-market fit research. When you understand how the various different players in your market sell their subscriptions, it provides your own sales team with more context to use when speaking about the benefits of your own product.

4. Use cases

Your sales team will be more effective when they can provide concrete examples of how your product helps other businesses achieve their goals. Build out use cases based on your customer and market research to showcase how valuable your subscription is for existing customers.

Four pillars drive success when selling subscriptions

To successfully sell a subscription, you need to find a way to showcase value at every stage of the buying process. Acquiring customers is just the first step for subscription and SaaS companies. After someone purchases your product, the focus needs to shift to retaining them long term as well as upselling and cross-selling them.

Traditional sales teams live mainly on the acquisition stage in the cycle. Selling subscriptions requires a more comprehensive understanding of the entire revenue cycle and where sales can make an impact at each stage.

1. Pricing

Setting your price is one of the most important decisions you can make when selling subscriptions. When you can connect your price to the direct value your subscription provides for customers, it eases the buying decision and can keep customers longer.

B2C pricing:

- Pricing needs to be clear and easy to understand immediately. Typically these types of subscriptions are bought through self-serve purchase experiences.

- Ensure that your pricing tiers are based on a solid understanding of each customer’s willingness to pay

B2B pricing:

- Custom pricing makes more sense for B2B customers due to the specific needs of enterprise businesses. Use a “contact us” page to encourage larger companies to reach out.

- Check out Price Intelligently to determine a pricing strategy that works for specific customers.

2. Contract length

The length of a contract defines how often subscription payments recur. Whether it’s monthly, quarterly, or yearly, different customers need different contract lengths based on their needs. Just keep in mind that an annual package can drastically cut down your churn rates.

B2C contract length

- These customers tend to take less time to make a decision on their purchase. That can lead to increased churn if you’re not optimizing contract length to their needs.

- Offering a freemium tier up front can potentially increase contract length down the line.

B2B contract length

- Because B2B customers can be more difficult to acquire, guide them toward a longer contract period.

- Your sales team should be focused on reinforcing the long-term value that your product provides.

3. Marketing efforts

A great marketing campaign can drive relevant and interest prospects to reach out to your sales team. That can drive down customer acquisition costs (CAC) over time while also boosting brand awareness. Your marketing content should always focus on how your product can solve problems for potential customers.

B2C marketing efforts

- Marketing campaigns for B2C subscription companies should focus on driving trial and demo conversions, which is more powerful in low-touch sales situations.

- Combine your marketing efforts with advertising to target more qualified prospects directly.

B2B marketing efforts

- Marketing efforts for B2B companies should work toward qualified leads for your sales team. As prospects move through the marketing funnel you should be encouraging them toward a direct conversation with your sales team.

- For enterprise targeting, consider event marketing and sponsorship as well.

4. Salespeople

Your sales team must be trained to sell the ongoing value your product provides. Potential customers who reach out need assurance that their problems can be solved effectively by making a purchase. Your churn rate will increase over time if your team overpromises or misrepresents your product.

B2C salespeople

- B2C sales teams should focus on helping customers feel comfortable with the product.

- It’s important for salespeople to understand that subscriptions are based on monetizing ongoing relationships as opposed to making single sales.

B2B salespeople

- With the longer B2B sales pipeline, subscription companies that target businesses should build a network of potential customers over time.

- Because custom pricing is more likely to occur in these situations, you should empower salespeople to make these decisions on their own.

Understanding how to leverage these four pillars of the subscription sales process can help your team thrive. Together, they provide the backbone of an informed and value-driven sales team, which will result in better relationships with your customers.

Upselling and cross-selling for expansion revenue

Because your subscriptions are based on ongoing relationships with your customers, upselling and cross-selling are some of the best tactics you have for increasing your expansion revenue. By monetizing the relationships with your existing customer base, you’re able to obtain more revenue, increase lifetime value (LTV), and optimize your LTV:CAC ratio.

Upselling

Upselling is the process of gaining more revenue from individual customers by adding additional features to their contracts. Whether it’s moving up a pricing tier based on feature differentiation or adding upgrades to an existing package, this is a great strategy for both B2C and B2B subscription companies.

That said, building these upgrades into existing customer relationships isn’t always easy. Not only must you deliver on the ongoing value of your product, but you’ll also need to convince existing customers that paying more for additional functionality is worth the additional cash.

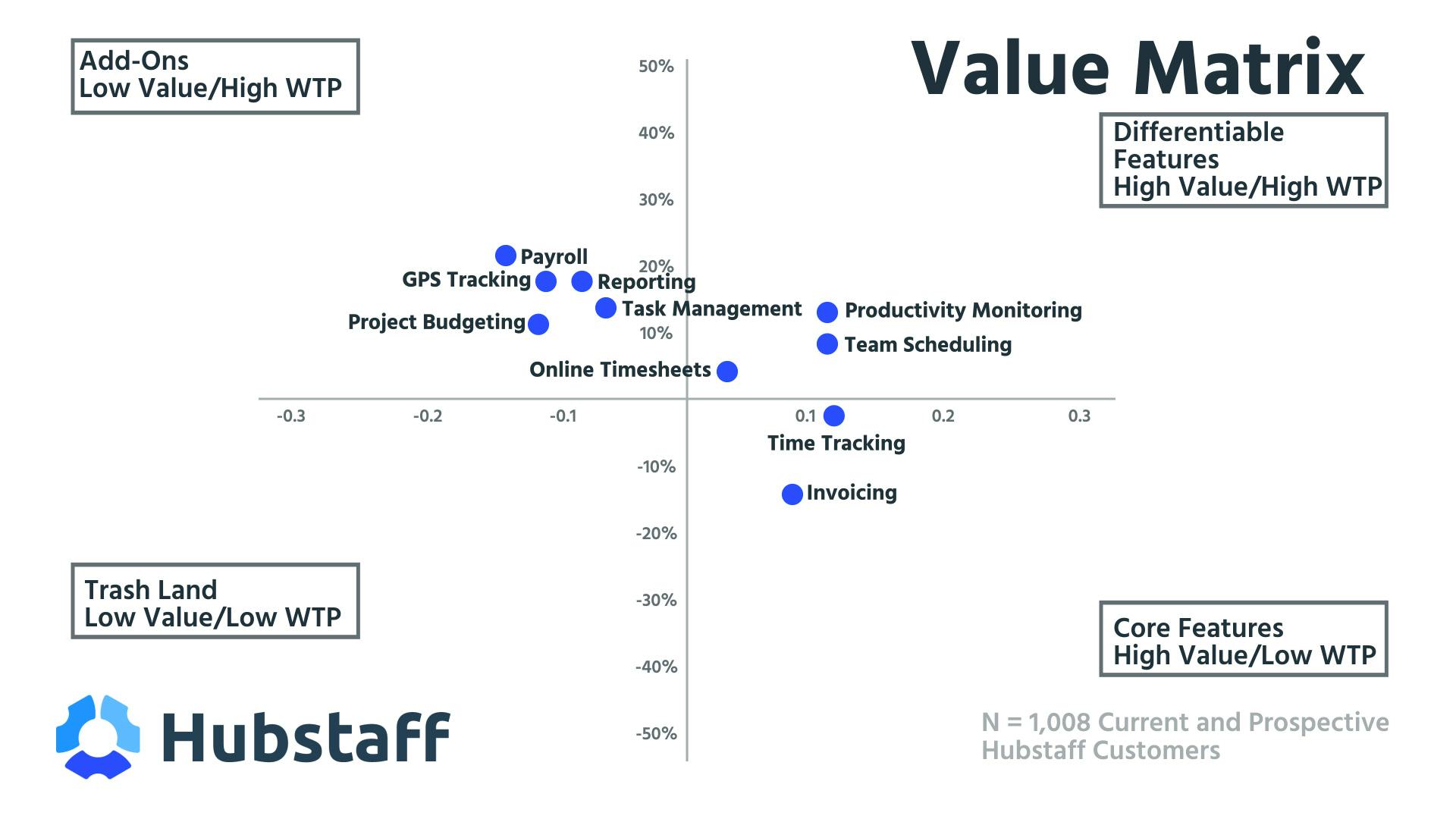

A great way to identify these add-ons is through a value matrix, like this example from our Pricing Page Teardown of time-tracking and productivity tool Hubstaff.

Relative preference for specific features based on willingness to pay

Anything that lands in the top right quadrant of this matrix has potential as an upsell. That means that, while there is a higher-than-average willingness to pay for those features, not many customers actually need/want them.

Upselling is different from cross-selling opportunities, which are based more on the addition of complementary products.

Cross-selling

Cross-selling is the process of selling an additional product or service to existing customers. It’s a great strategy to use when you have a suite of products to offer, each focusing on a different aspect of your market. Take Paddle, for example; we have four core products:

- The Paddle platform: complete payments infrastructure for SaaS

- ProfitWell Metrics: our freemium SaaS analytics platform

- Retain: our automated churn-reduction software

- Price Intelligently: our subscription pricing optimization software and consulting

Each of these products solves a specific problem for our customers. When companies start out, they might be looking for a payments and tax solution (Paddle platform) or just a business analytics tool (ProfitWell Metrics). But as their company grows and they start to get more serious with their retention efforts, a churn-reduction tool (Retain) becomes more appealing.

We can cross-sell existing customers for our freemium product with Retain or Price Intelligently, based on the needs of their company as they grow.

This is a great way to monetize the relationship with a number of different buyer personas over time and gain compounding value from our existing product suite.

Selling subscriptions is all about monetizing relationships

When you understand what drives customers to seek out, sign up, and stick with your product, it makes selling subscriptions much easier. Subscription sales teams need to understand that they’re not just getting new customers through the door; the most successful SaaS companies are built on strong, recurring customer relationships that grow over time.