Securing SaaS funding is one of the most fraught and exciting parts of running a SaaS business. We run you the through the options to help you find the right pathway forward for your business.

With funding types continuing to diversify, companies have more options than ever to consider. But so many options can make the selection process much more complicated. Do you gun straight for the glamour (and pressure) of venture capital investment? What about a venture capitalist who might be sympathetic to your mission? Or what about an incubator? Going into the pursuit of funding without a plan can lead you nowhere—or, even worse, leave you saddled with a funding plan that’s bad for you and your business.

Don’t worry—everything you need to know about SaaS funding is in this article. We break down different funding options, when the time is right to be seeking investment, and what you need to really impress your investors.

When is the right time to look for SaaS funding?

The short answer to this question is: “When you’re ready.” There’s no ideal point during the growth of a SaaS where going after funding is ideal.

The downsides of taking too long to seek funding are self-evident. After a certain point — presuming, of course, that you’re not able to turn good revenue without funding—you will find that your growth begins to slow because you can’t afford the resources (e.g., more staff, legal advice, PR, etc.) required to continue scaling. There’s also the possibility that you may be superseded by a proactive competitor who has sought funding.

That said, for many SaaS startups, too much funding too soon may not be beneficial and can even be harmful. Injecting cash into a venture without a clear strategy, revenue, or proven product-market fit can lead to all sorts of problems:

- Investor expectations can become overwhelming.

- The number of potential directions for your business can result in paralysis by analysis.

- Costly product iterations may be completed without the market understanding required to justify them.

Focus on refining your technology as much as you can within your current constraints. Look for funding when you find you have a product idea that can't be iterated or developed further without extra money.

5 types of SaaS funding

“Startup funding” is not a one-size-fits-all concept. Types of SaaS funding vary according to a number of criteria, like the investment amount typically provided, the structures used for providing it, and the expectations associated with them. Therefore, being able to tell funding types apart is key to recognizing which one is best for you.

1. Venture capital

Venture capital is provided by firms or funds founded specifically to give investment to fledgling companies. As a funding type, venture capital investment is typically provided to startups that are deemed to have either a high growth potential or a strong enough track record of recent growth to suggest that investing now will result in a much larger pay-out later.

Venture capital, sometimes shortened to VC, is a household concept. It’s the glitziest and most prestigious funding source for SaaS companies. Securing VC funding is a sign that a company has considerable potential for exponential growth.

However, being endowed with a VC investment comes with a ton of expectations and pressure that are, in many ways, absent from the other, less meteoric SaaS funding types. It’s highly likely that when receiving VC investments, you’ll cede a large ownership stake to your investors and give up a certain amount of control over your business as a result. Your investors will expect significant return on investment, too—there’s much less room for failure and experimentation when you’re being backed by VC.

2. Angel investors

Angel investment is provided by a single individual as opposed to a firm or fund.

Angel investors are ideal for startups looking for their first big investment (otherwise known as the seed stage, which we’ll get to shortly). But more recently in the investment space, angels (particularly the so-called “super” angels) have begun to play a decisive part in later funding rounds, too.

This type of funding is especially effective when the company’s mission is well aligned with the angel’s own priorities and experience. It usually requires giving up less ownership/control, too, as the investor stake will often come in the form of convertible debt or ownership equity.

3. Incubators/Accelerator

Incubators and accelerators are appropriate funding choices for businesses at both ends of the scale spectrum.

Incubators are designed to aid the growth of very-early-stage (seed-stage) startups. The assistance provided will involve making a financial investment in your company, but incubators will also offer assistance in the form of training, expertise, experience, and a network of other supports during your company’s early stages. It is a founder-centric method of investment with an open-ended structure.

Accelerators, often run by private funds, are aimed at providing later-stage startups a platform to scale up. Where incubators are focused around founders over an indefinite period, accelerators are focused around “cohorts” or teams rather than individual founders (as is the case with incubators); accelerators provide fixed-term funding opportunities, usually in the form of group programs that include mentorship and training. Unlike incubators, accelerators are highly structured and often broken down into five stages: awareness, application, program, demo day, and post-demo day.

4. Revenue-based financing & MRR Lines

More and more SaaS companies have begun leaning away from exponential early funding, in favor of more gradual growth that allows them to retain a greater degree of control over their operations. Revenue-based financing is one option.

A loan provider assesses a business’s accounts and its ability to consistently bring in revenue. Then they endow the business with a loan that is tied to the business’s overall revenue. The amount loaned and the rate of repayment will depend on the company’s monthly recurring revenue (MRR).

A loan that uses your MMR as the collateral base is much more appropriate for a SaaS business than assets (which a SaaS business is unlikely to have in numbers) or profits (which a young company is unlikely to have initially). This kind of loan is also known as an MRR line and is SaaS funding at its most direct.

There is no loss of ownership or equity whatsoever; the only condition is that, as with any other loan, you pay it back with more gradual growth. However, you are also spared the many other forms of nonfinancial investment (network assistance, operations, and financial advice, etc.) that you receive from other SaaS funding types.

The 5 rounds of SaaS funding

Now that we’ve established the types of SaaS funding available and have an idea of when to seek funding, we come to the stages of funding themselves. Because VC and angel investor funding are the types most sought by young SaaS companies, we’re going to be focusing on them.

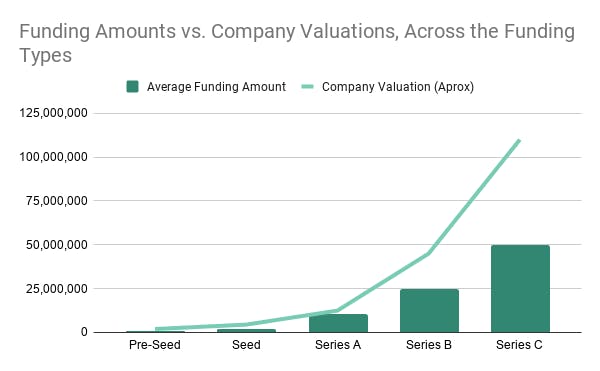

SaaS funding stages are graded according to the size of the company (according to valuation). For example, our first round (pre-seed) would be requested by the smallest kinds of startups, while the final round (Series C) is meant for the biggest of the big dogs.

1. Pre-Seed

Pre-seed funding involves a small investment (usually <$1 million) to help a company hit a preliminary target—for example, companies wanting to develop a working prototype or needing help getting it to market. After their pre-seed, companies will often boast valuations of $1 million or more.

The competitiveness of the market has made investors more discerning than ever. To be eligible for pre-seed funding, you need a solid founding team and a well-developed idea for your product.

2. Seed

Seed funding is the first big investment a company receives. The size of the initial investment varies, depending on the source of funding; it is likely to be lower from an angel investor (<$1 million) than from a VC firm (>$1 million), for instance, sometimes up to 10 times more

The purpose of the seed round is to give a company enough cash to allow it to meet product development and iteration goals, expand its team, and begin making money. Your company will have approximately doubled in valuation from the pre-seed round to be eligible for seed investment.

The maturity of the market has led to a recent phenomenon wherein companies are skipping the seed stage altogether—they can make the $5M-$10M ARR range without input from venture capitalists — and are seeking their first investment round further down the line. Which brings us to . . .

3. Series A

The extent of Series A funding varies in size (mostly around the $10 million mark), but funding amounts are rising continually.

Series A investment is made when a company has begun generating revenue and is looking to expand it. Your company will have established KPIs that are pertinent to its path for growth (MRR targets, number of subscribers onboard, etc.). The point of further funding from a Series A round is for optimizing existing processes around these KPIs and to prepare your company generally for continued scaling.

Making your business eligible for Series A funding requires considerable development to your business model; whereas prior rounds depended more on the strength of your idea, this time you need to show evidence of a business model that can sustain cash flows in the future.

4. Series B

Series B funding is market-reach funding in amounts more than twice that of Series A funding on average ($20 million +). It is predominantly meted out by venture capitalists, as all but the most super of super angels have left the game by this point.

Consider Series B funding when your monetization strategy has proved to be strong, and all the fundamental KPIs are promising. Your investors will now look to give you a cash injection that will help you grow to meet levels of demand in your market and to reach new market segments.

Metrics (as we’ll shortly see) are vital at all stages of SaaS funding but play an even greater role at the Series B stage. It requires proof that your company is able to compete at a much higher level, and expectations will be that, with a Series B investment, you can begin to expand aggressively.

5. Series C

If you’ve gotten to Series C, congratulations, you’ve made it. Funding amounts hover around $50 million on average but do vary considerably, and, by this point, banks and hedge funds will be looking to rival venture capitalists to provide you with investment.

Having gotten this far, your company will likely be worth around $100 million, a degree of establishment that lowers the risk of investing in your business’ continued growth. A Series C investment is generally intended to aid launch into new markets or to aid in the acquisition of other companies.

4 metrics investors check to assess SaaS companies

Now that we’ve covered what you’ll be looking for in investors, we need to talk about what investors will be looking for in your company. Investors have more freedom than ever to be discerning about who they back, and you’ll only stand a chance with the right stable of metrics and by meeting benchmarks in all of them.

1. Low churn rate

Your churn rate comprises the number of customers who leave your service over a given time frame. It’s vital that you keep it low: retaining customers means retaining their MRR and saves you money on customer acquisition.

For subscription-based SaaS businesses, a consistently low churn rate indicates long-term viability and scalability, two of the attributes most prized by investors.

Your churn rate should be kept at a rate of 1% or lower. Any higher and not only will you cease to be an attractive prospect for investors, but you’ll also find it impossible to maintain your growth trajectory.

There’s no magic solution for reducing churn and boosting retention. Churn often has many different sources and causes (which also vary by industry), and reducing churn requires a multifaceted approach. ProfitWell tracks millions of data points to identify the causes of churn and employs powerful algorithmic tools to improve recovery rates and decrease churn.

2. MRR growth

Your MRR tells an investor a great deal about your company. It indicates viral growth potential and demonstrates the care you put (or don’t put) into the maintenance of customer relationships, and its margins prove the product-market fit of your product.

The benchmark you should shoot for when talking about MRR growth depends on where you are in your growth phase:

- If your total MRR from all customers is less than $100k, then a growth rate of between 9% and14% can be considered very optimal.

- If your total MRR is $500k or higher, the benchmark for an optimum MRR growth rate falls to between 4% and 9%.

- If you’re bringing in upwards of $1 million, average MRR growth tends to sit at 1% or lower.

3. ARPU

Average revenue per user (ARPU), as the name suggests, indicates how much the whole of your customer base is bringing in to you on average, and, as a SaaS business, this metric is worth its weight in gold. It has a vital interaction with CAC by setting benchmarks for how much you can afford to spend on acquiring new users.

While ARPU is great for setting benchmarks, the benchmark for ARPU itself sits at around $0.04 per user per month.

4. CAC

Having a grasp on your customer acquisition costs (CAC) is vital for later rounds (Series A and onward). By this point, you need to hold proof that your revenue model is successful and that you have a sales team capable of meeting quota.

A CAC payback of two years or less demonstrates your ability to offset CAC with happy customers willing to provide you with subscription revenue over the long term, and also shows that you’re efficient when choosing means by which to target new customers.

The more you know . . .

The funding ecosystem is complex. When you’re seeking investment, from whom and to what end are as important as the amount of funding you’re looking to win. The variety of options available for funding-hungry SaaS companies to choose from can be a real blessing, but only if you have a secure understanding of what different choices are available and how your business’s current state of progress relates to them.

Bear the various possibilities in mind, and find the option most suited to your business idea. Don’t be too easily seduced by the highest offer on the table, but don’t aim too low either. Whether you get $10 million off your first seed round or find that a couple of years in the incubator is the best choice for you, the race is long and, ultimately, only with yourself.