Learn about the SaaS metrics that drove Front's $10M series A In this guest post from Mathilde Collin, CEO and Co-Founder.

When you fundraise for a seed round, your investors want to see your vision and capability. However, in Series A fundraising they want to see proof. You still need to tell a compelling story, but you also need to have the numbers to back it up.

When we fundraised a $10M Series A for Front, we were very careful about what metrics we used to tell our story. These were the metrics that spelled out our early customer validation and our sustainable strategy for growth.

"When we fundraised a $10M Series A, we were very careful about which metrics we used to tell our story."

We had to prove that Front could take over team email

We designed Front to be a collaborative inbox that would make team email more collaborative, more integrated, more transparent, and smarter. We saw too many problems with team email, and we designed Front to be the solution. We saw the potential for it to completely take over the space of traditional email for entire teams and entire companies.

To raise a Series A, we had to show we had the means to bring our product to a bigger market. This large market is already entrenched in a traditional workflow. To back up our claims that we would disrupt and take over the market, we'd have to have numbers that showed early customer validation and a good growth machine.

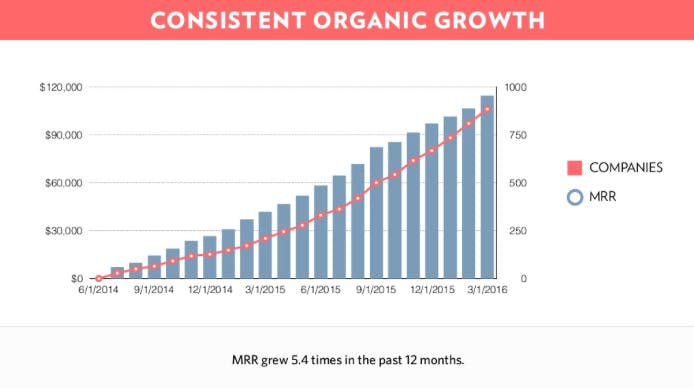

But at Front, we didn't have the viral month-over-month growth that could have indicated a quick and widespread market domination. Our MRR growth numbers were good, but they weren't exponential.

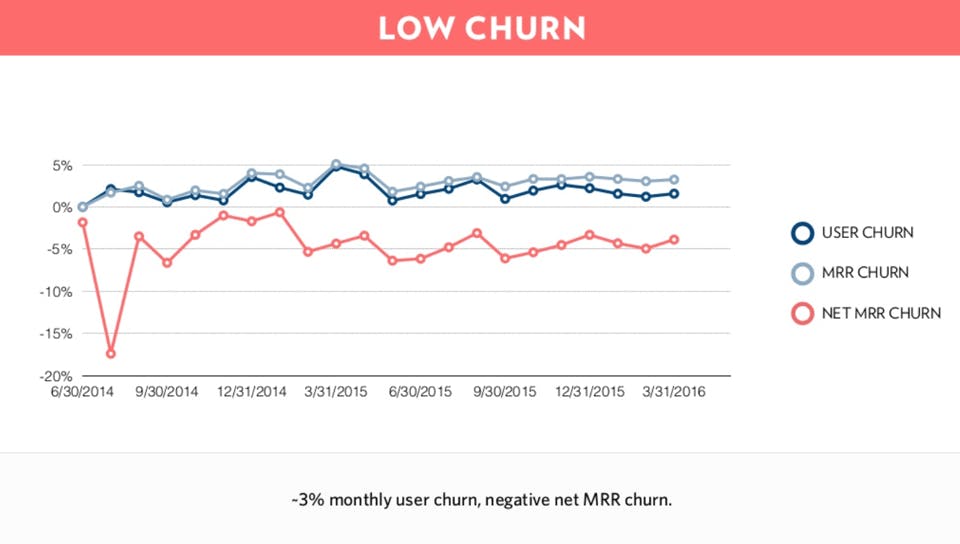

Exceptionally low churn is another good indicator of growth, but we didn't have that either. Front had a pretty standard monthly user churn of around 3%. It's not unusual for startups to face churn problems early on, but we still couldn't call our user churn an indicator of great growth potential.

We had to take a different approach. Even though we didn't have viral growth or crazy-low user churn, we had numbers that indicated that our product was engaging and could actually take over team email.

Front's MRR retention and expansion showed customer validation

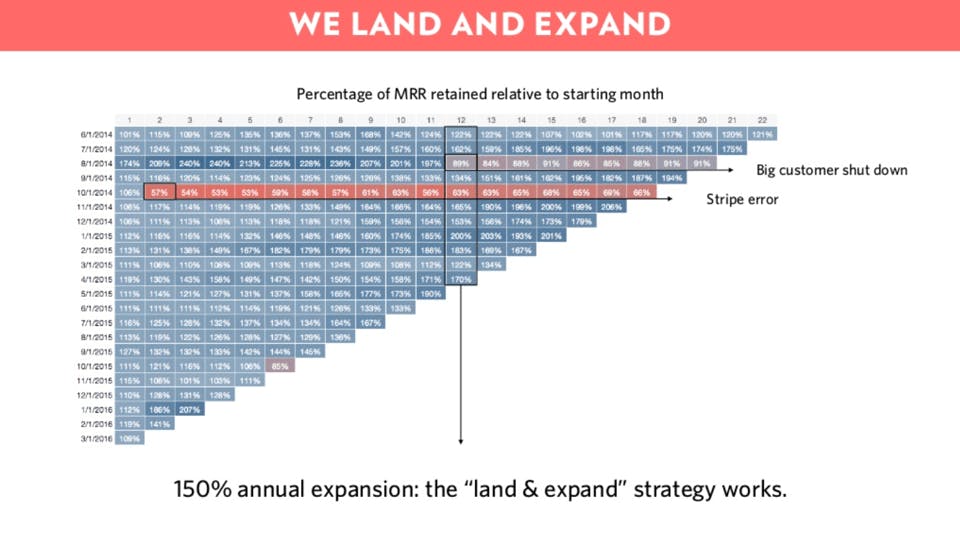

The story of how Front could scale and take over the market was in our MRR retention and expansion numbers. Front customers are paying 50% more net of churn after one year than they were when they first signed up. This is from cross-sells (selling another product to an existing customer) and up-sells (upgrading an existing customer's plan).

To an investor, achieving 150% annual revenue expansion means that customers were increasingly engaged with Front. It demonstrates customer validation and good product-market fit. Numbers like these show that Front has the potential to become essential to teams' workflows.

We measured a cohort's MRR retention over time as a percentage of the cohort's initial MRR. If we had retained all of the MRR from a cohort of acquired customers over time, the cohort had 100% MRR retention. If we had a net loss of MRR from churned customers, the MRR retention was below 100% for that cohort.

By cross-selling and up-selling customers, we pushed the MRR retained for each cohort of acquired customers (grouped by sign-up date) to greater than 100% net of churn.

Each row shows MRR retention over time (in months along the top axis) by cohort (segmented by sign-up date along the side axis). Percentages over 100% indicate that customers in that cohort have upgraded or expanded their plans.

To an investor, the most important thing about these numbers is their consistency over time and across cohorts. Achieving over 100% MRR retention with a cohort of customers wasn't a one-time occurrence or a fluke. It was a pattern that we knew how to drive. And it reflected that our customers were seeing more and more value in Front.

Net negative churn fuels Front's growth

This across-the-board MRR expansion was greater than the MRR we were losing from our 3% monthly user churn. We had achieved net negative churn—our MRR from our existing customer base was expanding over time in spite of churn. From an investor's perspective, by achieving growth independent of acquisition, we had tapped into a reliable and scalable growth machine.

Investors saw that our net negative churn was a powerful growth factor because it made customers accounts into, as VC Tom Tunguz puts it, “high-yield savings accounts.” We could count on growing our revenue each month from our existing customer base without having to do work to add another customer. Low input, high output.

It made that 3% churn irrelevant in the big picture because any lost MRR was immediately being replaced and exceeded consistently, month after month, by existing customers.

The driving force of net negative churn provided the right context for our “steady-but-not-viral” MRR growth. Our growth was coming from deepening our current market. We weren't relying on wringing new customers out of acquisition channels that would only dry up over time. This meant that market saturation was not a limiting factor in scaling.

Achieving substantial growth without pouring money into paid acquisition indicated potential to an investor. It demonstrated that we could have higher, faster growth when we do start funding acquisition channels.

Our net negative churn proved that Front had the potential to expand deeper into our current market and wider across the untapped market. To an investor, this amounts to a real shot at a widespread team email takeover.

Our land-and-expand metrics supported our high-level expansion story

MRR expansion communicated that our product was sticky and necessary. This created a strong case for product-market fit and the apparent need Front is filling for improved team email. Our net negative churn through expansion and retention demonstrated to investors that we had a scalable growth machine. It showed that Front has a fighting chance to take over the team email market.

Venture capitalist Mamoon Hamid of Social Capital says that he looks to fund Series A projects that have “early customer validation indicating strong product-market fit and best-in-class product.” Mamoon saw that in our metrics and in how they connected to our story.

Find your story and connect it to the metrics support it. What data makes you excited that your product is going to find success as it grows and changes your market? These are the numbers that will communicate the same story to investors.

Mathilde Collin is the co-founder and CEO of Front, a shared inbox designed for teams. She works with Front to reinvent how work gets done: making email more collaborative, more integrated, more transparent, and smarter. Mathilde believes in making the workplace happier and more productive. She’s also an avid LEGO builder.