Remember the old video game SkiFree? The idea was to ski down the hill as far as possible, avoiding all the trees and rocks and hitting all the jumps. But, inevitably, you’d end up being caught by the ravenous, unrelenting yeti...

Remember the old video game SkiFree? The idea was to ski down the hill as far as possible, avoiding all the trees and rocks and hitting all the jumps. But, inevitably, you’d end up being caught by the ravenous, unrelenting yeti.

Players would spend hours trying to outrun that yeti, and most attempts ended in failure. But every so often, you’d discover a strategy that got you just a little bit farther. And by putting those strategies together over time, you’d eventually end up farther and farther down the mountain.

After working with hundreds of SaaS companies, we've realized that the same advice applies for your retention rate as well.

Yes, churn is inevitable—every customer will abandon your product eventually. But just like avoiding the yeti is way more fun than restarting the game, boosting your retention is more fun—and way more valuable—than acquiring more customers. Twice as valuable, to be precise.

Keeping your customers as long as possible is the key to running a sustainable subscription business. And, just like that yeti, churn is public enemy number one. So let’s look at some concrete customer-retention strategies you can use to give your bottom line the boost it needs and keep your SaaS sustainable for the long haul.

Retention is always multifaceted, and there’s no one-size-fits-all approach to reducing churn. You’ll need a multi-pronged strategy, like the one we've outlined below.

1. Align team incentives around retention

Almost every department within every SaaS company I’ve come across measures success differently.

Sales teams like to track dollars in the bank each month. Marketers, they’re measuring qualified leads, which don't always pan out. Meanwhile, product teams are busy tracking how many features they've delivered and story points they've completed.

It’s a mess—not just because every team has different incentives, but also because none of these metrics focuses on retaining customers. “It behooves companies,” explains Tim Thyne, head of customer development at Help Scout, “to shift the focus from what employees do (‘I market,’ ‘I sell,’ ‘I support’) to what benefits they provide to the customer, which starts by tracking people’s performance differently.”

David Cancel, founder and CEO of Drift, shared a simple solution in his talk at SaaSFest 2015: design your internal metrics for every department to incentivize customer retention. This one change, he argued, could help SaaS companies dramatically improve their retention rates.

What does that look like in practice?

- For sales teams: Limit by geographical area or industry vertical the number of prospects each salesperson is responsible for, and modify commission structures so sales teams receive some percentage only after customers stick around. This keeps sales staff from running through leads too quickly.

- For marketing teams: Focus on lead quality over volume. Instead of tracking the number of marketing qualified leads (MQLs), try tracking the number of sales qualified leads (SQLs) as a success metric. Also, integrate more closely with sales by embedding business development reps on the marketing team to better qualify leads.

- For product teams: Make sure product managers have direct and open access to speak with customers. Without direct feedback, product improvements will be haphazard and, ultimately, won’t help retain customers.

2. Make onboarding your top priority

An effective customer onboarding process can make or break a customer’s decision to stick with your product. If your software isn’t intuitive and customers can't find value in it, they will quickly flee.

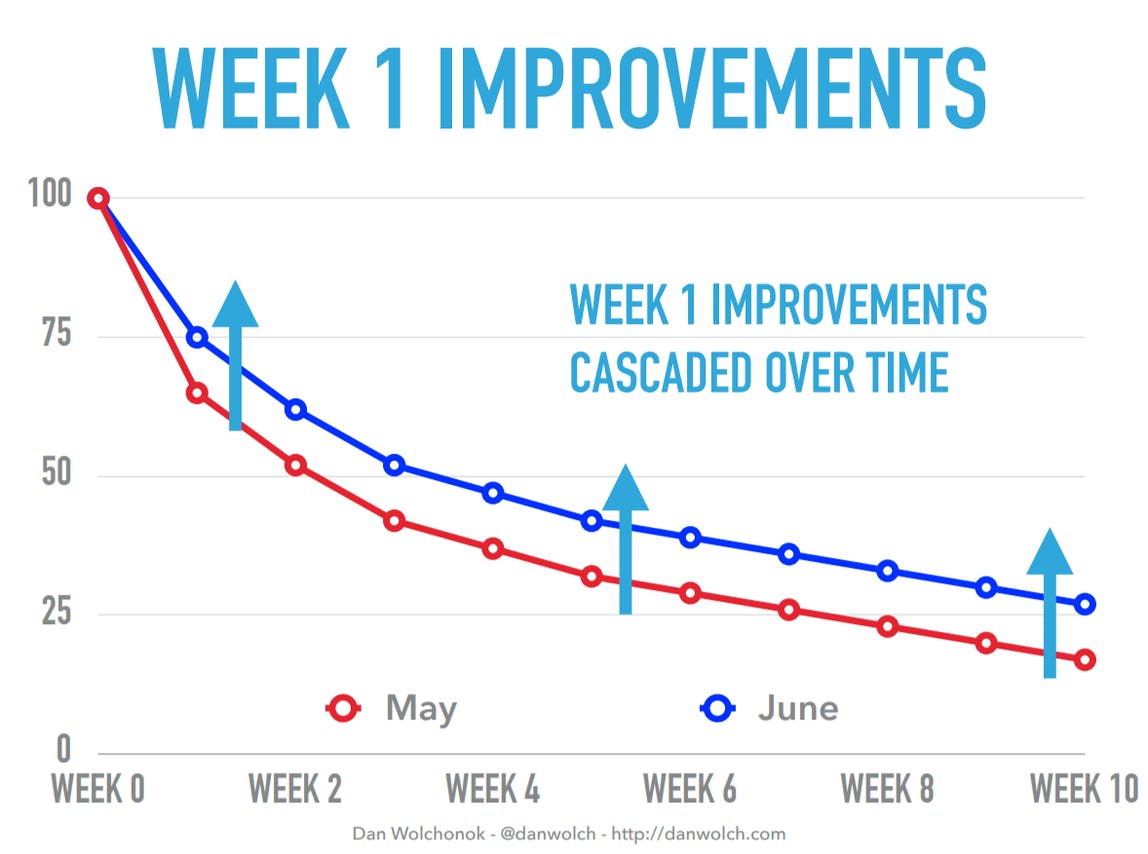

In a second talk at SaaSFest 2015, Dan Wolchonok, head of product and analytics at Reforge, spoke about the three different stages of retention:

- Week 1 retention: Can you get your users to use your product more than once?

- Mid-term retention (weeks 2-4): Can you establish any pattern of usage?

- Long-term retention (weeks 4+): How does your product become an indispensable tool?

Most companies put more effort into improving long-term retention—but it turns out that improving early retention through better onboarding cascades into the rest of your customer life cycle, creating ongoing retention gains.

Dan’s efforts to improve the onboarding experience at HubSpot’s now-defunct Sidekick product drove up first-week retention nearly 15%. What’s more interesting, though, is that those effects continued indefinitely. At week 12, those initial improvements had boosted retention from roughly 15% to over 25%—an improvement of over 60%.

So how can you improve your onboarding and see similar results in your own SaaS? Margaret Kelsey over at Appcues lists some best practices:

- Know your customers. Understand the job customers are “hiring your product” for, and frame your onboarding around achieving that success.

- Identify your aha moment, and get users there fast.

- Map out and benchmark the user journey. Design a path to guide them through key features that help them achieve their goal.

- Continue educating users even after onboarding. Provide tips, training, and education so customers get the most out of the product.

3. Engage with customers to help them succeed

According to Lincoln Murphy of Sixteen Ventures, most SaaS companies overthink customer success, even though the definition is fairly straightforward:

Customer Success is when your customers achieve their Desired Outcome through their interactions with your company.

The key emphasis here is interactions with your company, as Murphy explains: "Rather than saying 'with your product,' the focus is on all of the interactions your customer has with your company; starting at the earliest touch points of marketing and sales, moving through closing and onboarding, and continuing through their entire lifecycle with you."

Ongoing feedback and engagement with customers are key to combating customer churn. Rather than wait for something to go wrong, you should concentrate on building lasting relationships with customers throughout the entire customer lifecycle. This way, you give yourself the opportunity to reinforce the value of your product at different points and help your customers get the most out of it. Regular communication and feedback from your customers also give you the chance to spot and resolve any problems early on – before they lead to churn.

Here are some ways to foster lasting relationships with your customers:

- Consistency is key: Make sure every touchpoint with your company is positive and consistent. Every customer-facing team and communication channel should fit with your company’s brand values and tone of voice. There should also be clear processes and service level agreements that ensure that customers with the same or similar issues receive the same support.

- Communicate across channels: Make sure you’re communicating with customers across multiple channels. In-app notifications target customers when they're actually receiving value and don't require switching programs, catching them in the right place at the right time. Phone calls are especially important for retaining large-ACV, enterprise-level customers. And SMS messages can be used very close to a customers' contract expiration date to drive immediate attention

- Invite customers to give feedback: Customer success managers and support team members have a direct line into how their customers are using the product and what’s keeping them from reaching their goals, making them the ideal channels for collecting and managing product feedback. This feedback can help you gain a better understanding of your users’ needs and how you could improve your product and service to best meet those needs.

- Give customers a personalized experience. Companies who go the extra mile by offering a remarkable experience reap the benefits—according to customer experience adviser Esteban Kolsky, 72% of customers will share a positive experience with six or more people. Take email service provider ConvertKit, for example. By sending personalized welcome videos to each new subscriber (over 50 videos each day), the company was able to reduce its churn rate by nearly 15% in only a month.

- Keep your finger on the pulse: Use Net Promoter Score (NPS) or customer satisfaction surveys to give you a sense of how happy customers are as users of your product. Make sure you follow up with detractors and passives to close the feedback loop. And when you’re ready to get more advanced with your feedback collection, you can check out what we learned from sending over 5 million customer development surveys.

- Keep adding value: Don’t rest on your laurels. Just as your business develops, so will the needs of your customers. Keep finding ways to add value, whether that’s with additional products or new features, and give your customers even more reasons to stick with you. If you don’t your competitors sure will.

4. Reduce involuntary churn

Involuntary churn is when a customer churns without intending to. This can happen if their payment fails and it leads to subscription cancellation. In these situations, the customer didn’t fall out of love with your product, or intentionally stop paying their subscription fee – but you still risk losing them completely.

In fact, involuntary churn accounts for 20%-40% of SaaS churn. That’s an astonishing number, and bear in mind that these are customers (and revenue) lost every month that don’t actually want to stop using your product.

It can be a silent assassin for SaaS businesses. But it’s also avoidable if you take the time to understand the churn in your business and find out:

- How much of your business’ churn is involuntary

- What is causing it

From here, you can put measures in place to reduce or - even better - prevent it.

Reasons for involuntary churn

Payments fail for a number of reasons, from insufficient funds to incorrect payment details to fraud.

Firstly, different payment methods are more likely to fail than others. Payments that are taken from a direct source of funds, like a digital wallet or bank account are far less likely to fail than credit card payments. At Paddle we see payments made by credit card have twice the proportion of failed payments than those that run through PayPal.

The most common reasons for card payment failure are:

- Expired cards

- Hard declines after fraud attempts

- Soft declines after credit limit maxes

- Out-of-date billing information

- Charges not flagged as recurring

So, now we know a bit about why payments fail, we can look at how to stop them from becoming a problem. The tactics for which come down to two things:

- Preventing payments from failing: The best way to reduce involuntary churn is to optimize your payment processes so that fewer payments fail. You can do this by accepting a variety of payment methods, charging in your customers’ local currency, or using tools like card updaters to make sure you don’t get caught out by expired card details.

- Recovering failed payments: Some payments will fail so you should implement dunning and retry strategies to help you recover that revenue and most importantly, keep that customer subscribed. In fact, Paddle data shows that businesses with a payment retry strategy in place experience up to 10% less revenue churn.

For more on how to reduce involuntary churn, check out our guide.

5. Deliver exceptional customer support

Customer expectations are higher than ever, and poor service costs businesses massive profits. A 2018 report from NewVoiceMedia estimated that poor customer service costs U.S. companies $75 billion in lost business.

Of course, when one customer submits a lot of tickets, it could be a sign that they’re engaging closely with your product. But if those tickets take a long time to close—or worse, many of them end up unresolved—that’s a strong sign the customer’s at a high risk of churning.

The best ways to combat churn with exceptional customer service? Be proactive. Look for patterns that might indicate customers are having trouble—recurring support tickets for the same problem, or customers having lots of tickets that remain unresolved. For every ticket, see if there’s an opportunity to proactively monitor for that kind of problem in the future, and either prevent it from happening in the first place or address it more quickly.

Offer different support channels. Customers should be able to access support in a variety of ways, depending on the nature of the query. For smaller issues, it makes sense to create support content and guides that help people self-serve. This content needs to be easy to navigate – you could use a chatbot to help surface it more efficiently. This frees up your team to handle more serious or complex queries by other channels like email, phone, or live chat.

Building trust with customers through great support is crucial, especially when unplanned outages inevitably occur. After experiencing an outage earlier this year, Cloudflare managed the situation well, quickly publishing a blog post addressing the outage:

Their post explained in great detail what went wrong, what they’d already done to fix it, and how they were being proactive about preventing it in the future, no doubt helping to retain many customers who might otherwise have churned.

Stellar support brings side benefits for your business as well—besides providing more personalized support, strong customer relationships give you more opportunities you’ll create for upsells and cross-sells. Ian Landsman gives an example of using customer support as an upsell opportunity over on HelpSpot’s blog:

"Customer B is frustrated, and a bit overwhelmed. He thought he was paying for something already, and it turns out that’s not what he bought. What B needs is on a higher cost tier — but now is not the time to have a salesy and promotional tone.

B didn’t call you wanting to pay more. In fact, he doesn’t feel what he’s paying for right now is valuable. Consider what you can offer him to make him feel heard, and make him feel accommodated.

Hi B, we’re sorry to hear about your concerns. We do offer that feature on our Premium level plan, which also includes… We understand you weren’t expecting to upgrade today. Would you like to try our premium features free for 30 days? We wouldn’t expect any commitment to that plan at this time.”

6. Optimize your pricing to promote retention

Optimizing your pricing to balance value with profit can have a huge effect on your company’s success, from sales and marketing to retention and profitability. Even though most companies only ever spend a handful of hours on their pricing strategy, your pricing gives you a number of levers you can pull to improve retention.

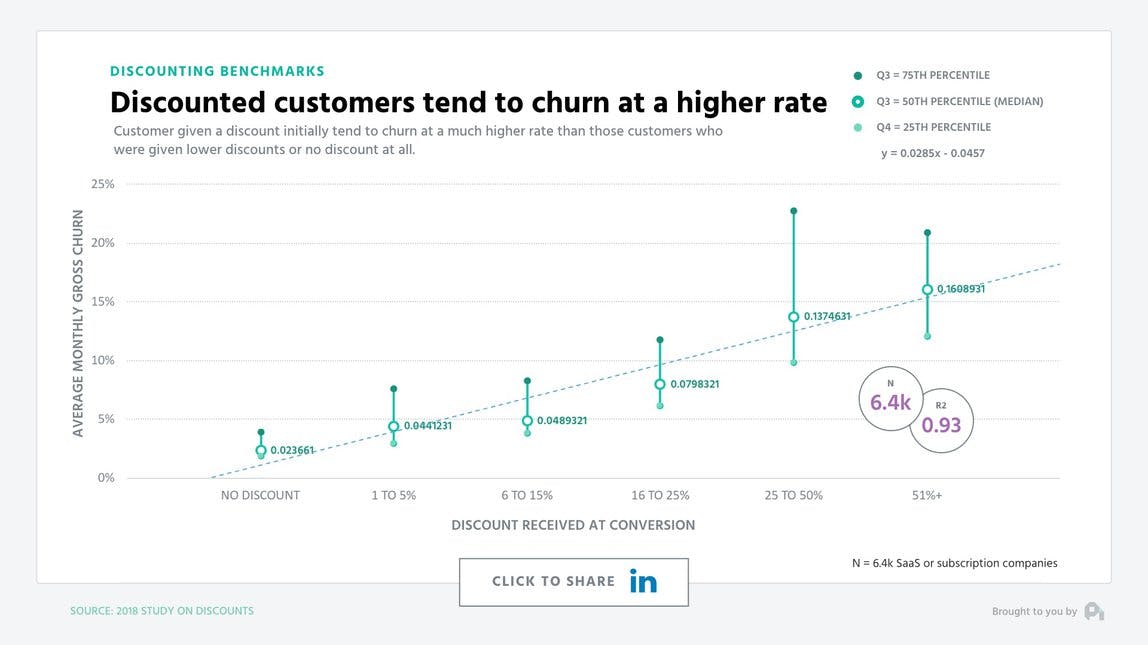

First, don’t give discounts. Offering a hefty discount on your base prices might juice your numbers up front, but the benefits are short-lived. Discounting can reduce your SaaS lifetime value by over 30%, and discounted customers have just over double the churn rate of those who pay full price.

The problem? Discounts don’t create loyalty; instead, loyalty needs to be earned through providing an excellent product and service that customers can't get anywhere else. And the best way to do that is to raise your prices.

Charging more automatically increases the perceived value of your product, boosting the chances your customers will remain loyal to your company. Raising prices also lets you allocate more resources to customer success, giving customers a better experience and further increasing the likelihood of them sticking around for the long term.

7. Create a seamless billing experience

Your billing experience needs to support your business goals and meet the needs of your customers.

For the business this means:

- Facilitating recurring payments and billing

- Supporting your pricing strategy and billing model

- Aiding retention with dunning and payment retries

For your customers it means:

- Flexibility in terms of how and when they make each payment

- The control to manage subscriptions themselves (for example to move between packages, purchase add-ons, pause or cancel their subscription with you)

- Robust support systems for subscription and billing queries.

Creating a winning subscription experience that ticks these boxes starts with a deep understanding of how your customers want to pay for and interact with your product.

- Are buyers looking to purchase your product long-term or does usage fluctuate (for example with seasonality or around project based work)?

- Would they prefer to pay monthly, or annually? What will they be expecting this process to look like and do they prefer to pay?

- How likely is it that customers will want to make changes to their subscriptions?

- What sort of customer support will customers be expecting to manage all of the above? Can they largely self-serve, or will you need to build out your support team?

Once you understand what your customers want from your subscription experience, you can start to think about how you can use subscription management to prevent churn and increase retention.

Here’s what some of those tactics might look like:

- Pauses over cancellations: 44 percent of consumers who are likely to cancel would instead pause their subscriptions if the option was available. Giving customers this option also gives you the best chance of persuading them to reactivate their accounts and avoid them churning for good. Examples where this would be a useful tactic include: briefly stopping your subscription to a research tool at the end of a project before you need it for something else or pausing your HelloFresh subscription and gym membership while you go on holiday.

- Make it easy to cancel: No business ever wants its hard-earned customers to stop using its product but trapping them into a subscription isn’t the answer. Making it easy for customers to cancel takes any friction out of that last touchpoint with you and gives you more chance of winning them back later down the line.

- Put the customer in control: Let your customers control how they use their subscription. Make it easy for them to purchase add-ons, upgrade or downgrade their subscription package.

Here’s our Subscription Senior Product Manager, Rebecca with more on using subscription management to reduce churn and increase retention.

Case study: Kaleido

Founded in 2017, Kaleido is now a global SaaS company with customers in over 180 countries. In 2021, it was acquired by the graphic design platform, Canva.

Along its rapid growth journey, Kaleido implemented new features and optimized processes that helped increase retention and reduce involuntary churn by 38%. Here’s what they did:

- Flexible subscriptions: Kaleido customers can pause or delay their subscription payments up to two times per year. This functionality was added to Kaleido’s retention flows, using Paddle’s Subscription API.

- Willingness to pay: Kaleido conducted willingness to pay surveys to help inform its pricing strategy. This helps increase retention by making sure customers are getting a service they expect for the amount they have paid.

- Localization: Kaleido’s products are sold in over 20 local currencies. This helps to reduce involuntary churn, by reducing the number of payments that fail.

8. Know your metrics and choose the right tools

You can’t improve what you aren’t measuring. Without a clear idea of where your retention rate stands right now and how you’re progressing toward your churn reduction goals, you might end up making poor decisions that could kill your progress and stifle your growth.

Tools and metrics can’t fix your churn problem, but they can take care of a lot of heavy lifting for you:

- Tools like Delighted and Zendesk make it easy to measure customer satisfaction.

- ProfitWell Metrics takes the grunt work out of measuring revenue and retention.

- Intercom and Wootric let you keep in touch with customers and collect qualitative feedback.

- ProfitWell Retain and Customer.io give you two different approaches for eliminating involuntary churn.

While tools like these make it easy to start tracking metrics, you also need to know how to pull insights out of the raw data.

First, make sure you’re calculating both user retention and MRR retention. User churn is helpful in understanding how well your positioning, customer success, and pricing are working for your business, but MRR retention lets you know whether your company is truly sustainable.

Say you have 100 customers, and 7 of them churn within the same month—that would be a 93% user retention rate. If those customers are all on your highest plan, though, that could end up being a much higher percentage of your revenue. If you only look at the user churn rate, you might assume you’re doing great—while meanwhile, you’re leaking revenue at a prodigious rate.

It’s also helpful to break down customer retention by cohort. A cohort is simply a group of users who share the same sign-up date. Breaking down your customer base by cohort can help you understand when customers are at the highest risk of churn. Here’s an example of a cohort graph:

Rows indicate the timeline and the number of customers you acquired in each period, and the columns indicate the amount of time that’s elapsed since that cohort signed up.

Understanding when users are most likely to churn can help answer questions around what they’re struggling with. For example, if you send out a one-month educational onboarding sequence via email and notice that churn is highest after the first month, it might mean you need more product education to help combat that increase in churn.

Common pitfalls and how to avoid them

Retaining more customers means capturing more recurring revenue, which is great! But extra revenue and larger transaction volumes actually mean more than just more money in the pot at the end of the year.

It means more (and different types) of data to manage. It can also mean that your business is more likely to breach sales tax thresholds, with customers from different regions, with different financial regulations.

All of which is easier to manage if you plan ahead. So, here are some things to think about.

Sales tax and financial compliance

Firstly, how will this extra cash and additional transaction volume impact your sales tax liabilities with jurisdictions around the world?

Sales tax on software is dependent on where your customers are based, not just where your business has a physical presence - so it’s important to understand the regulations everywhere you operate before your business surpasses any threshold for sales tax.

Once you know where you’re liable, you’ll need to register with the sales tax authority in each jurisdiction, before filing and remitting sales tax payments accordingly.

Check out our Sales Tax Index for more on the different regulations around the world.

If you have customers from different markets, you also need to consider the local financial compliance regulations. Examples include PSD2 in Europe or 3DSecure -the requirements for which can even change by region.

Here’s our Senior Payments Product Manager, Quinisha Anderson with more.

Reporting and analytics: The metrics that matter

There are a number of SaaS metrics that will help you measure the success of your retention strategy.

Choosing the right metrics will depend on how you’re trying to improve retention. You see, some businesses might be trying to address a churn problem, where others are focused on adding value to increase retention and customer lifetime value. Yes, there’s crossover but understanding what you’re trying to achieve is key. Your overall business’ goals, your company stage, the industry you’re in and the customers you serve should also help inform which metrics will be the most useful.

Here’s some to consider:

- Retention rate: The percentage of customers you keep over a given time.

- Renewal rate: The number of customers who renew their subscriptions.

- Churn rate: The percentage of customers who stop doing business with you over a period of time. Or the amount of Monthly Recurring Revenue (MRR) that is lost because of churn or downgrades.

- Customer lifetime value (CLV): How much revenue a customer will bring during their relationship with your company.

- Average Revenue Per User (ARPU): The revenue generated by each user over a given period of time.

- Net Revenue Retention (NRR): The amount of recurring revenue from current customers you retained over a given period of time.

Once you know which metrics to track, you need to make sure that your revenue infrastructure is set up to give you that information. For this, your user and revenue data need to be connected - which means integrating all of the potential sources.

Some businesses build this in-house through their own reporting systems, others use the reporting functionality in their payments and billing tools, while others employ another tool, specifically designed for reporting and analytics.

Putting it into practice

To reduce churn and increase retention effectively, your infrastructure needs to strike the balance between flexible subscriber experience and efficient business processes that help you take action before it’s too late.

For this, you’ll need a number of systems working seamlessly together, including:

- Payments processors

- Subscription billing and management logic

- Sales tax compliance

- Reporting functionality

- Customer support systems

This is your revenue infrastructure. And broadly speaking, there are three main ways to build one for your business:

- Build the system in-house: Using internal resources to build subscription billing logic that works alongside your payment gateway. Dedicating headcount to maintain these systems and manage compliance.

- Piecemeal revenue stack: Integrating a number of different specialist tools together to create a stack that works for your business type.

- An all-in-one platform: Either using a merchant of record (MoR) or revenue platform that acts as a reseller and manages all aspects of this system under one roof.

To help you understand what exactly is required to build a robust revenue infrastructure, we’ve put together this guide - complete with checklist.

Get the guide. (No email required)

This guide is part of a three-part series on SaaS revenue infrastructure. Check out Part 1 to master customer acquisition or Part 3 to find out how you can build and implement a successful expansion strategy.