The subscription revenue model is hardly new. It’s been a staple of industries—publications, utilities, and, more recently, software—since it first emerged in the 17th century.

But in the past few years, subscriptions have seen a bit of a resurgence. In fact, you'd be hard-pressed to find an industry that hasn't seen at least one subscription success story: Cars. Groceries. Airlines. Fashion. Even the humble houseplant doesn’t seem immune to the subscription economy.

Why? It’s simple: the subscription revenue model benefits both customers and companies. Customers enjoy the convenience of auto-renewals and having access to a high-value offer for a low ongoing investment. Meanwhile, companies offering subscriptions can scale with confidence, with predictable revenue and deeper relationships with their customer base.

It’s no wonder more and more companies are shifting to a subscription business model. And considering that the average repeat customer spends 67% more than a new customer, it’s a bandwagon you should jump on as well.

But before you do, let’s take a look at some of the basics of the subscription revenue model and why it works across such a wide range of businesses.

What is the subscription revenue model?

The subscription revenue model generates revenue by charging customers a recurring fee that is processed at regular intervals. Subscription revenue is built on establishing long-term relationships with customers who will pay regularly for access to the product or service, also called recurring revenue.

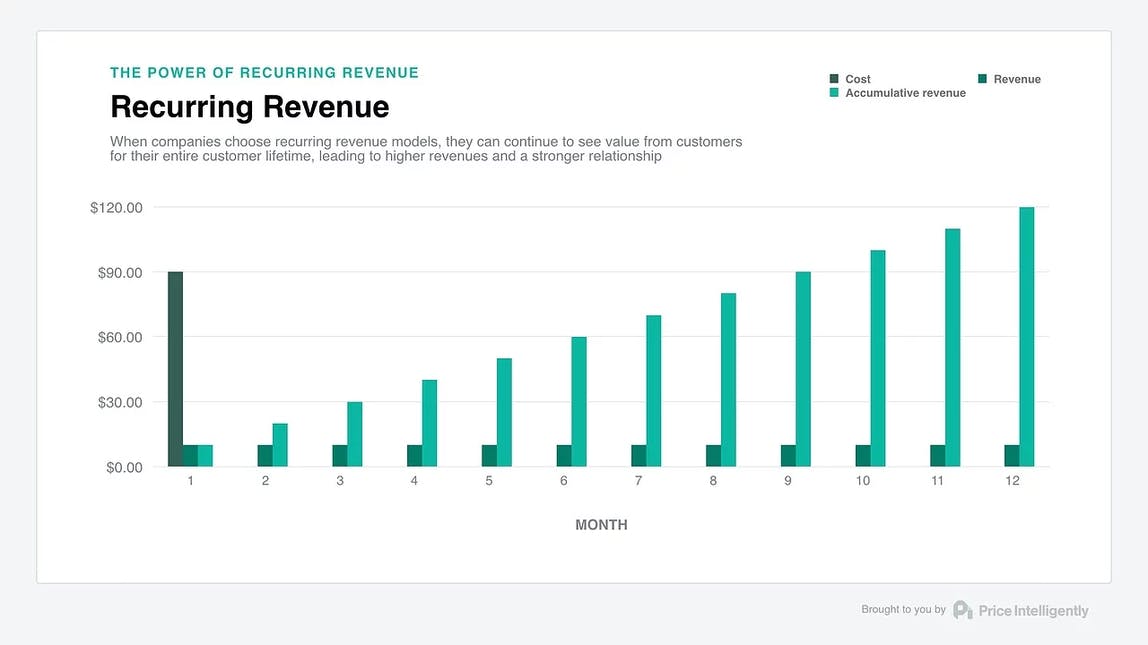

What makes subscription revenue so powerful is how growth compounds over time. Instead of remaining flat month to month, revenue accumulates with each new subscriber. As long as companies acquire new subscribers faster than they lose them, revenue grows exponentially.

Customers become more valuable the longer they use your product or service. Companies that focus on keeping their customers will save on acquisition costs, since retention is cheaper than acquisition.

What kinds of businesses use a subscription revenue model?

The consistent nature of recurring revenue is what makes the subscription revenue so popular, even with businesses you wouldn’t expect. Companies have launched subscription models for all kinds of products and services.

While almost every business could shoehorn their business model to fit the subscription business model, it’s best suited to a few different kinds of companies:

Access to content: video, music, books, membership sites

Companies that provide ongoing access to content—like video, audio, or books—are excellent candidates for subscriptions.

In the streaming-video realm, Netflix, Hulu, and HBO all provide high-quality entertainment for a low price. While your $8.99 monthly fee for Netflix might feel small, those of us who have been subscribed for 5+ years have each added over $500 to Netflix’s coffers.

Music and books are also frequently sold by subscription. For music, there’s a good chance you're already subscribed to Spotify, Apple Music, or Tidal—perhaps even all three. Amazon offers a subscription service for ebooks, and Audible offers unlimited access to audiobooks, as long as you remain a subscriber.

Access to services: SaaS, utilities, insurance, leasing

Service businesses are also primed for subscriptions.

Many software companies (us included!) now offer their software on a subscription basis (SaaS) instead of as a one-time purchase. With more traditional one-time software sales, it’s much more difficult for developers to make changes and improvements to their products, relying on clunky update systems to deliver those improvements to the end customer. Offering remotely hosted software packages on a subscription basis makes it much easier for software companies to improve their product over time. Customers don’t need to worry about how they’ll host the software or how they’ll keep it up to date.

Leasing an apartment, a home, car or a machine is another example of a service-based subscription business that are offered by companies like Excedr. Think about paying your rent; landlords deal with retention, churn, and other aspects of a subscription business every day.

Another example you might not consider when thinking about subscriptions? Insurance. Companies like Geico and Progressive charge customers monthly (or sometimes yearly) for home, auto, boat, and renters insurance, and customers are free to switch providers at any time.

Access to products: personal care, food, pet care

Finally, many products are now available on a monthly basis. Subscription products tend to be split into two categories: convenience and curation.

Any product that frequently needs replenishing is a good candidate for convenience subscriptions, from shaving (Dollar Shave Club) and groceries (Blue Apron) to pet food (Chewy) and even coffee (Trade).

Curated subscription boxes are generally based on a theme or target market. These subscription services deliver a curated selection of products on a monthly or quarterly basis—for example, Stitch Fix delivers a monthly box of hand-selected fashion items, while Art Crate delivers a similar service for home-decor products.

How subscription revenue differs from regular revenue

No matter if you’re selling insurance or fashion, subscription businesses are a different breed to more traditional companies offering one-off purchases. Instead of customers, you have committed subscribers who pay regularly for ongoing access to products and services. And instead of offering one-time purchases that capture all of the value up front, you need to retain subscribers as long as possible in order to turn a profit.

Difference #1: Recurring payments

Unlike one-time purchases, subscription payments happen on a scheduled basis—most often each week, month, quarter, or year. Compared with one-off purchases, each recurring payment is smaller—this makes subscriptions more affordable for consumers, but it means companies need to keep customers around longer to capture more revenue.

While many subscription companies offer subscribers the flexibility of month-to-month subscriptions, others sell their services on a contractual basis. Your cell phone plan is a great example of this—you might pay on a monthly basis, but you’re locked into an annual (or longer) contract with the subscription provider. As month-to-month subscriptions are better understood and customers demand more flexibility, though, the contract model is becoming less popular.

Difference #2: More emphasis on customer retention

Most traditional businesses don't need to retain customers for long stretches of time—the majority of buyers come in, buy a product maybe once or twice, then move on.

Since subscription companies rely on recurring revenue, though, they need to ensure customers are happy and are continuing to get value from the product or service over the long term. Companies often have to keep customers for months or even years before they finally see a positive return on their investment to acquire each new customer.

It’s easy for customers to sign up for subscriptions—but it’s just as easy for them to cancel. This means subscription businesses must stay focused on retention. The key to building sustainable subscription revenue is to keep churn low and hold on to customers for as long as possible.

The 5 steps of the subscription revenue cycle

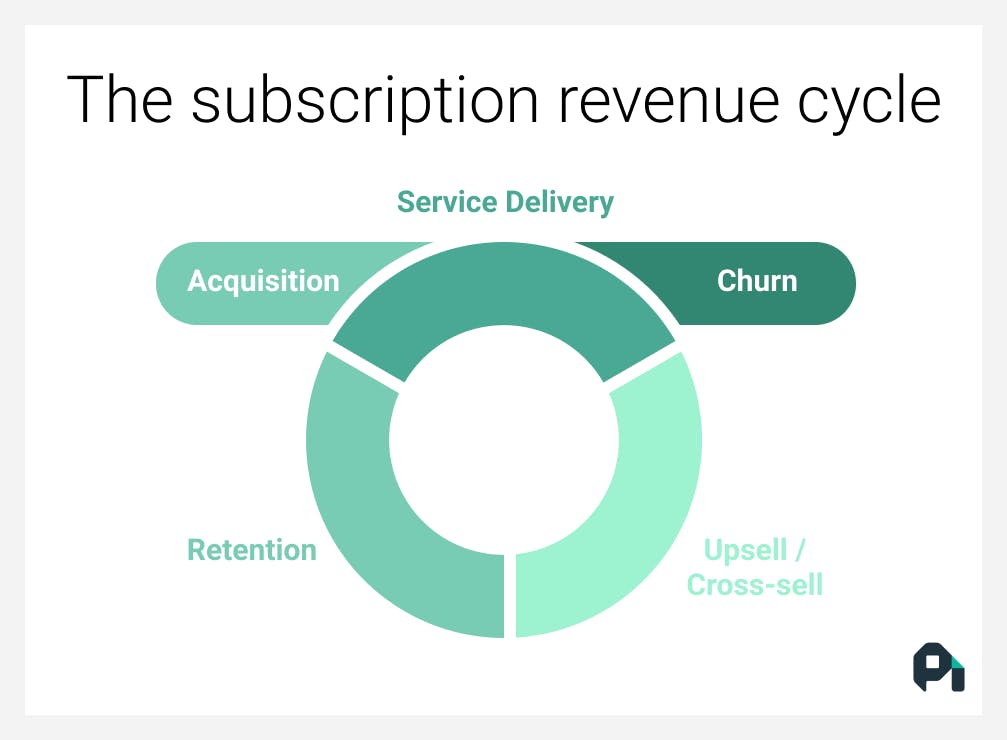

From the moment a new customer subscribes, every subscription company begins the same five-step revenue cycle:

- Acquire customers.

- Deliver consistent, high-quality service.

- Look for opportunities to upsell or cross-sell.

- Work to retain users and reduce churn.

- Rinse and repeat.

These five steps are the basis of a sustainable subscription revenue model and are repeated indefinitely for every subscriber. Let’s take a look at what’s involved for each step in more detail.

Step 1: Acquire customers

The first step for every subscription company, of course, is to acquire customers.

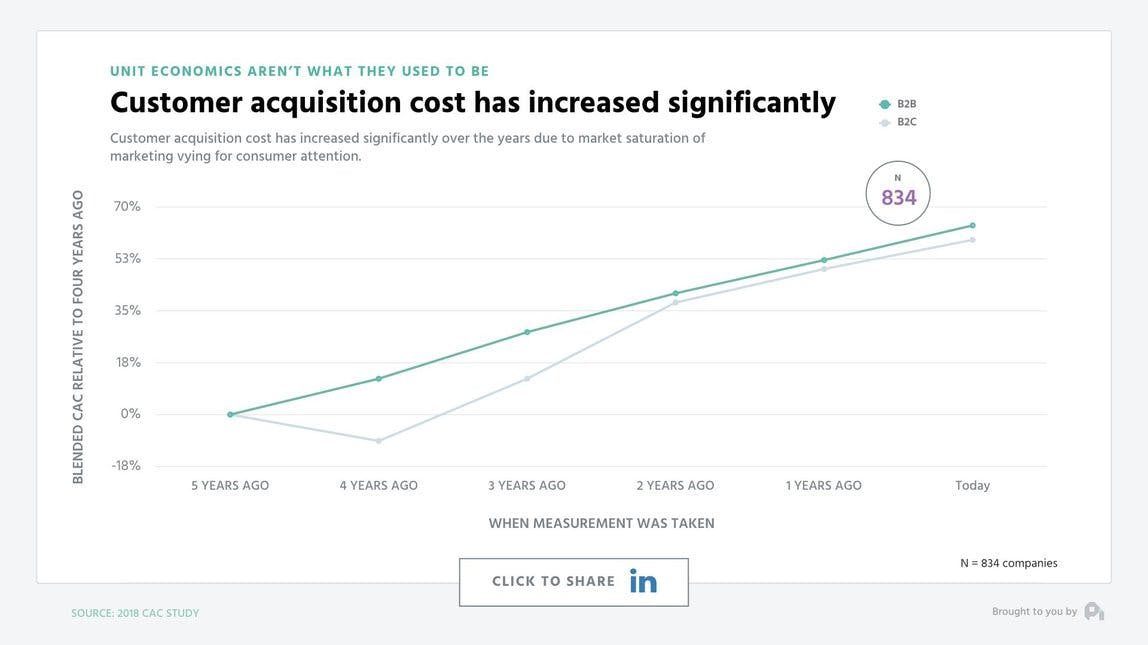

Subscription companies generally rely on the same methods as traditional companies to attract new customers, like inbound marketing, paid advertising, and search. However, since it often takes months or even years to capture enough revenue to cover those customer acquisition costs, subscription companies need to be particularly vigilant when spending on acquisition.

One software monetization strategy employed by software companies in particular is to offer a freemium model, where customers can use a free, sometimes feature-limited version of a product indefinitely. It widens the top of your funnel considerably and gives you more time to nurture new customer relationships. SaaS companies in particular lean on the freemium model as a tool for acquiring new customers.

Acquiring new customers is perpetually becoming more expensive for every subscription company—SaaS customer acquisition costs have risen nearly 50% in the past five years.

One option for improving retention and lowering acquisition costs is to offer a freemium option—companies that offer a freemium plan can lower customer acquisition costs by nearly 15%. By allowing customers to experience the value you provide through a freemium plan, you’ll have a much greater chance of upgrading them to a paid plan in the future.

Step 2: Deliver consistent, high-quality service

At this point, your sales and marketing teams have successfully done their job, and you've got a solid base of subscribers. Now you need to deliver an experience that meets your customers' needs and continues to provide value over time.

The hang-up most subscription companies run into here is not spending enough time understanding what their customers’ needs really are. The data backs this up: executives indicate that 7 out of 10 of their organizations are speaking to fewer than 10 prospects or customers in a nonsales research capacity per month. Note that this doesn’t get better with a company’s size.

The only way to solve this? Talk to subscribers constantly to understand their needs. Track your metrics to find holes in your service where customers are getting stuck and are most likely to churn (ProfitWell’s subscription analytics can help with this). Create detailed buyer personas, and break them down by budget, most valued features, willingness to pay, and customer acquisition costs; you need a solid understanding of your target customer before you can create a product that best meets their needs.

Step 3: Look for opportunities to upsell or cross-sell

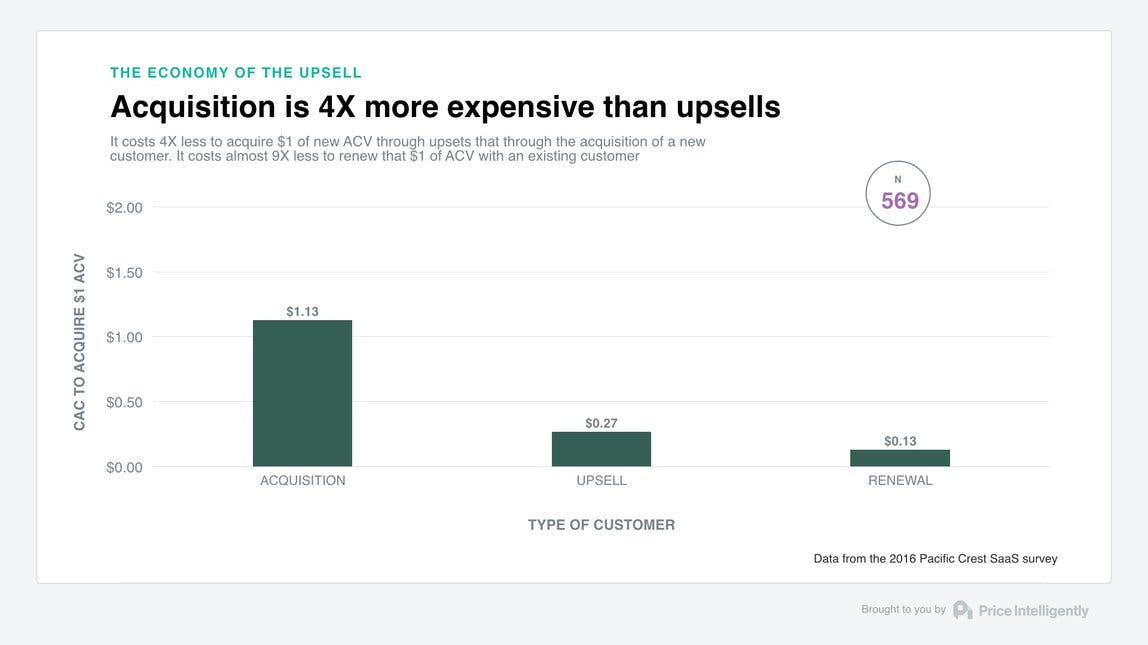

Acquiring new customers isn’t the only way for subscription companies to expand. In fact, it’s easier to generate more revenue with existing subscribers through expansion revenue—any revenue that is generated in excess from a customer's initial purchasing price or contract.

A 2016 Pacific Crest Survey from David Skok and Matrix Partners shows that the median cost to acquire a dollar of ACV for new customers is $1.13, while the median cost to acquire a dollar of ACV is $0.27 for up-sells and $0.20 for plan expansions.

There are two main ways for subscription companies to create expansion revenue:

- Upselling by upgrading customers to a larger plan as their need for your product grows.

- Cross-selling customers additional features and services to augment the service they already have.

To upsell existing subscribers, consider aligning your pricing with your customers’ value metric. Create a pricing scale that increases what you charge as customers increase their usage of your solution. The video hosting service Wistia, for example, aligns their pricing with the number of videos they host for customers. This pricing gives you a clear path to expand revenue with customers who use more of your product.

You can also offer supplementary cross-sells or add-ons related to your main offering. By providing extra value, you’re able to monetize existing customers who you already know are reliable and loyal to your brand. Twilio does this with their SMS messaging service, offering cross-sells like custom phone numbers in addition to their primary service.

Step 4: Work to retain users and reduce churn

Most subscription companies put all their efforts into acquiring new customers, when often it isn’t the most effective way to grow. Retaining customers is even more important for growing your subscription revenue.

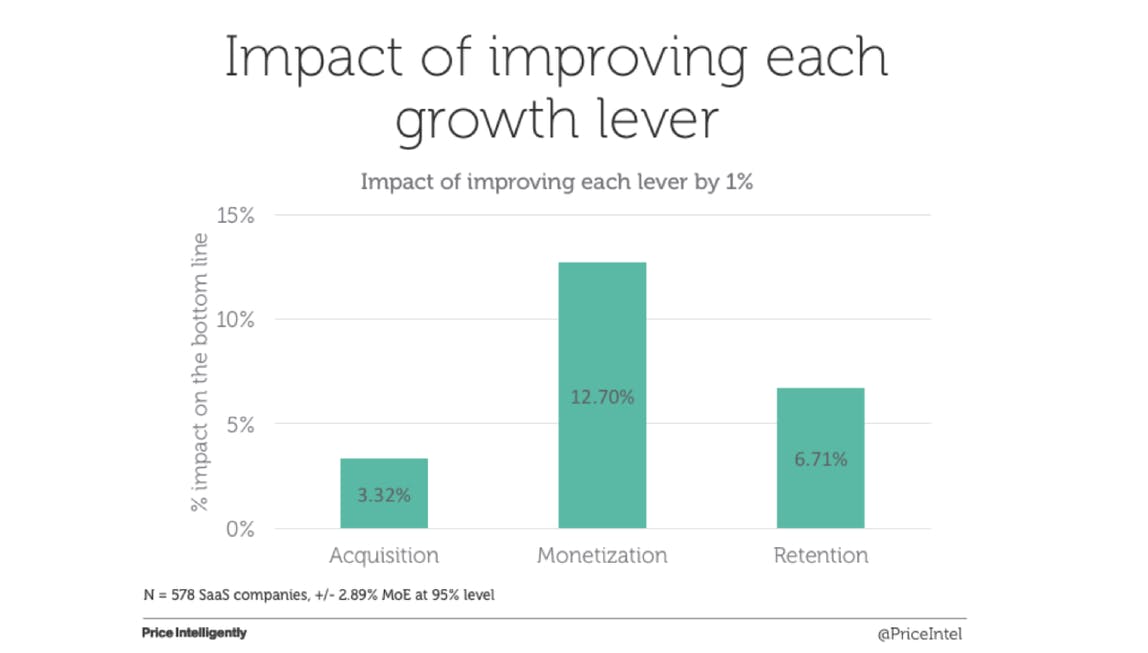

The numbers back this up. A 1% improvement in customer acquisition results in a 3.32% increase in bottom-line revenue. Meanwhile, a 1% improvement in customer retention results in a 6.71% improvement to your bottom-line.

Of course, retaining more users and reducing your churn rate aren’t easy. It requires monitoring churn constantly, which is more complex than most people think. For a bit of help, tools like ProfitWell Metrics make it easy to calculate churn rates, retention rates, lifetime values, and other metrics for free.

Subscription companies spend a lifetime battling churn. But, over time, you’ll be able to work toward building a bulletproof retention process and reducing churn that lets you find all of the tiny changes you can make to reduce churn. And the benefits, of course, are worth every bit of struggle.

Step 5: Rinse and repeat

This is where the subscription flywheel really starts turning. As more and more happy subscribers stick around, you’ll bring in steady revenue every month, without the ongoing acquisition costs that non-subscription businesses face each time the monthly clock resets.

As the flywheel starts turning faster, subscription growth begins to compound. The magic of compounding means small improvements to your subscription revenue can accumulate into big money over time.

Dunning is a great example. Fighting churn is a huge problem, and even fighting involuntary churn can feel overwhelming. But simple steps like tracking customer credit card expiration dates, communicating charging failures to customers, and keeping security protocols updated are all manageable problems. In isolation, fixing these problems might feel like you’re only inching you towards your churn goals. But when you add them all up, they make a difference:

By making these small changes to involuntary churn rates, a company that starts with 1,000 customers and charges $100 per month will have $475,000 more after 18 months.

That's the power of the subscription revenue model—small changes compound to create big results.

Build a sustainable (and profitable) subscription business

Regardless of whether you’re selling software or soft serve, the subscription revenue model can help build sustainable long-term revenue and spend less on finding new customers.

Building a subscription business is a game of inches—but with the right processes and tools, it’s a game you can win. As long as you keep improving, you’ll slowly reduce your churn, grow your subscription revenue, and retain subscribers for the long run.