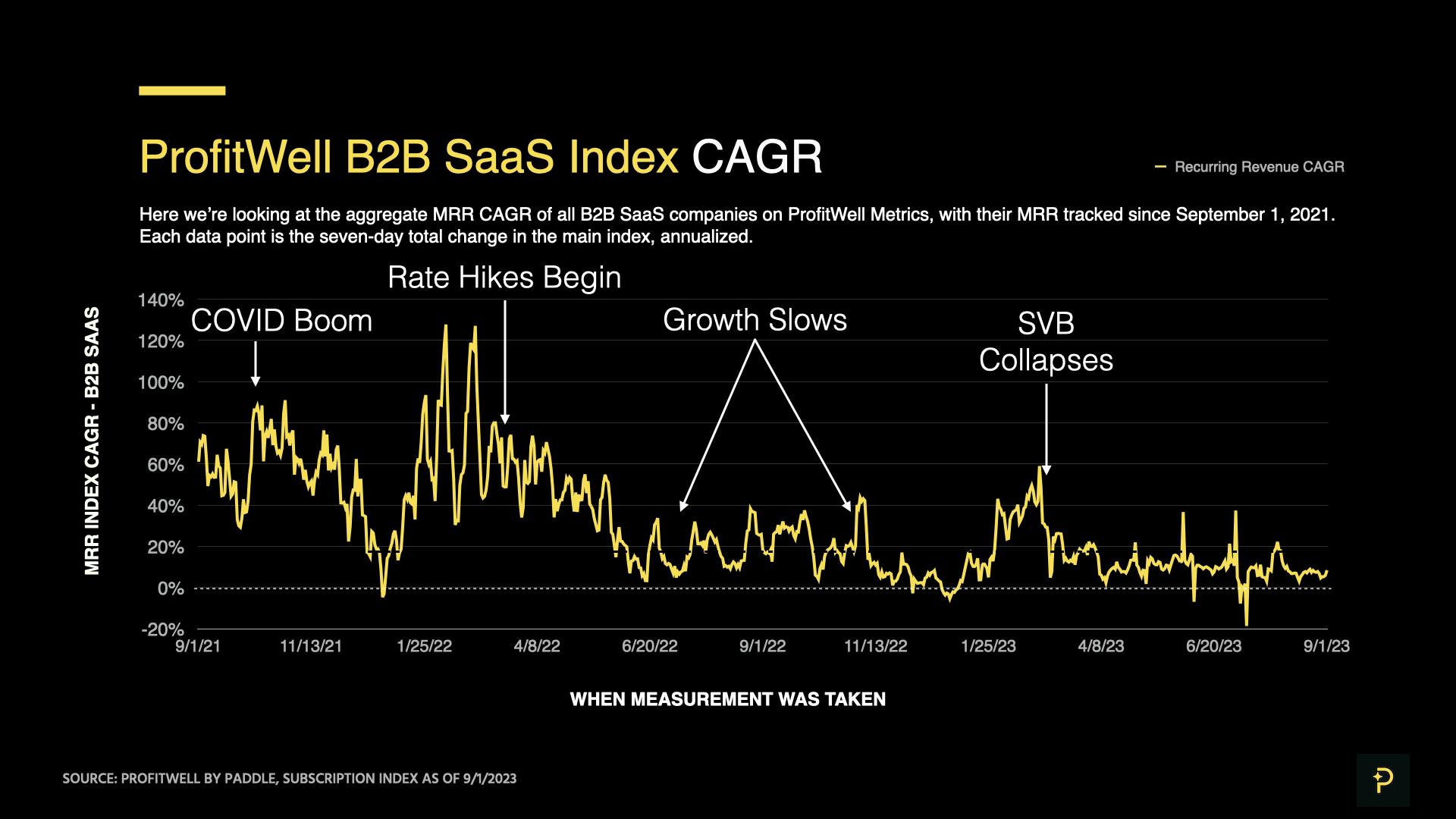

B2B SaaS revenue growth slowed further in July and August, as the industry entered its usual summertime lull.

Companies saw lower sales to new customers, as both B2B buyers and sellers are less active at this time of year. But this had an alleviating effect on retention, which stayed about the same in July and improved in August.

This is the latest in our ongoing SaaS market reports, which track the movement of the ProfitWell B2B SaaS Index, and its underlying growth and retention trends. Subscribe to the Paddle newsletter to get these updates in your inbox.

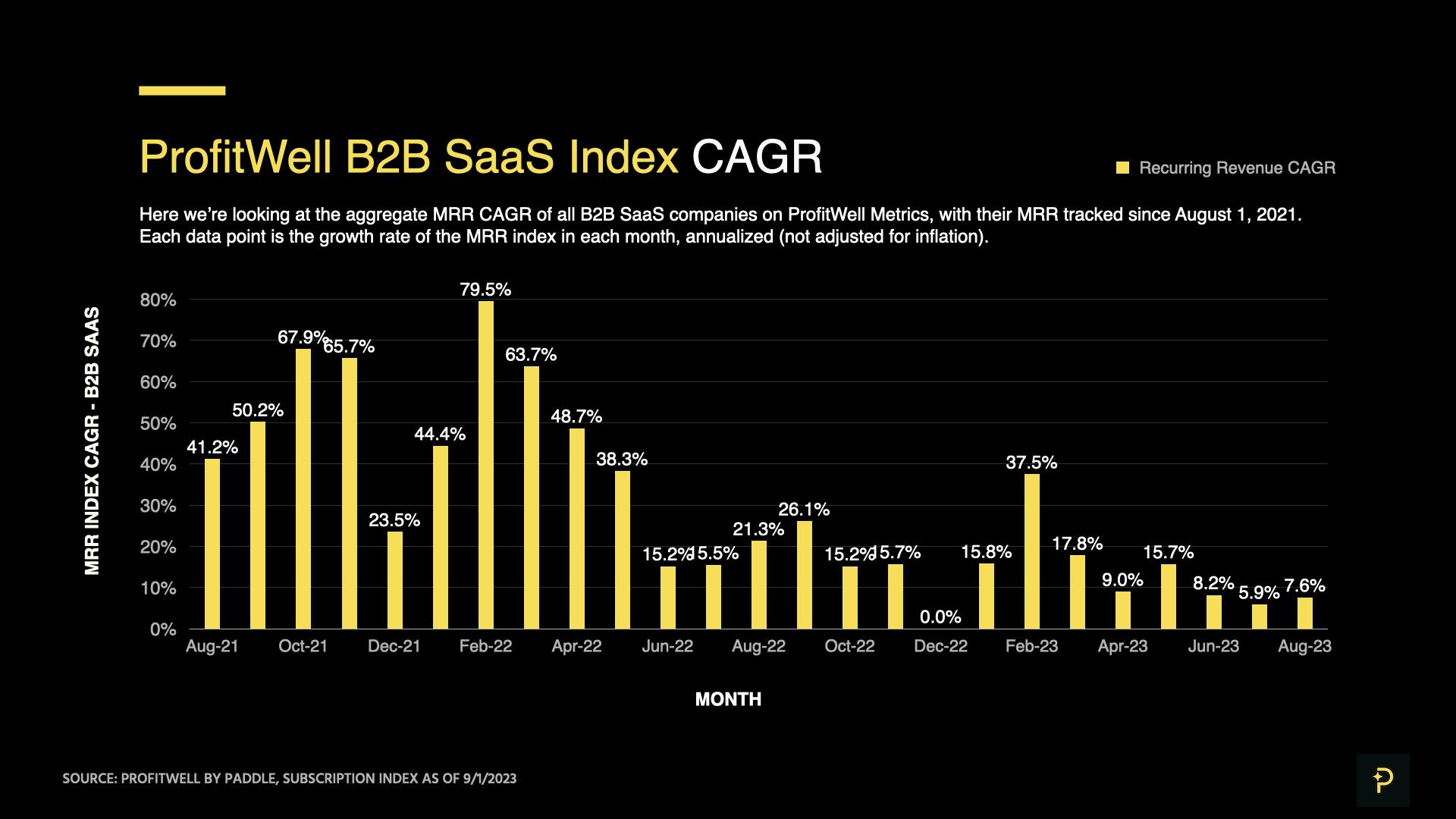

July and August MRR growth averaged about 6-8%

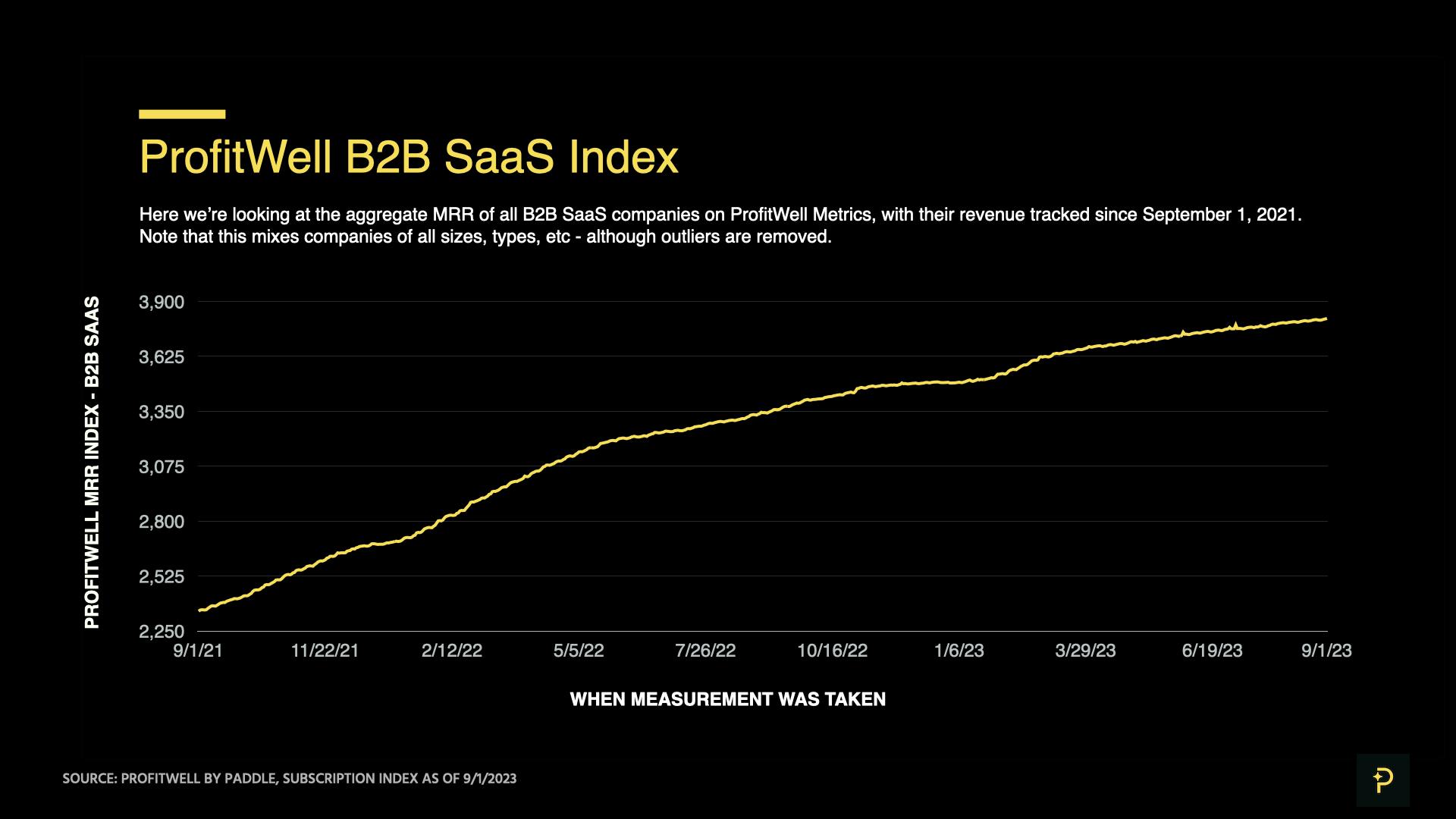

The ProfitWell B2B SaaS Index tracks the cumulative Monthly Recurring Revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation.

Explore the free demo of ProfitWell Metrics here.

The ProfitWell B2B SaaS Index increased at an annualized rate of 5.9% in July, and 7.6% in August.

This represents a further slowdown from earlier in the year. The index showed that MRR grew at annualized rates of 8.2% in June, and 10.4% for Q2 overall.

Compared to growth rates of over 15% last year, these figures show the effect of higher interest rates continuing to trickle through the industry.

And with Q4 usually being the worst-performing quarter for revenue, September will be a critical time for SaaS companies to win new sales before bracing for churn in Q4.

New sales were down for summer 2023...

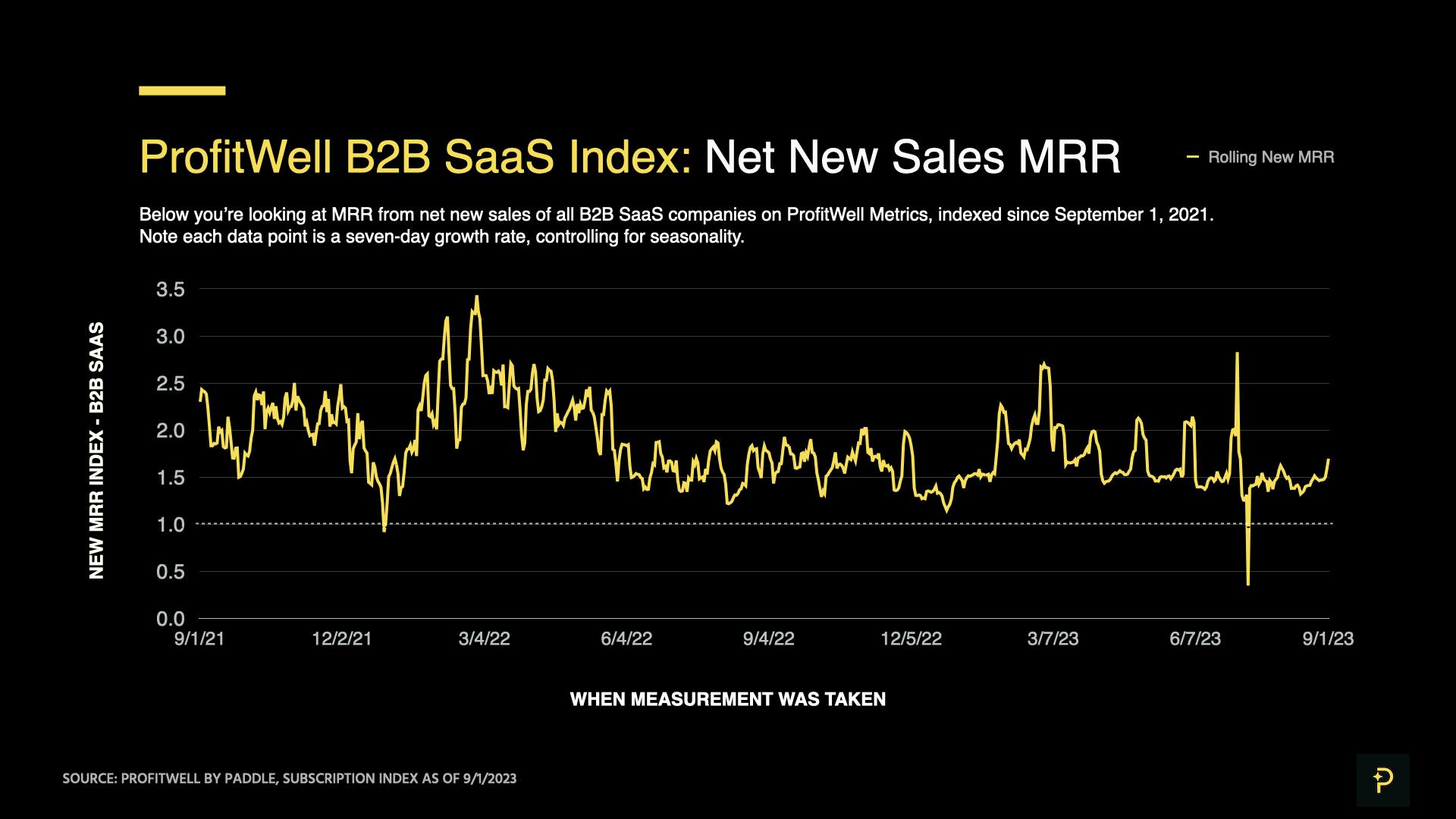

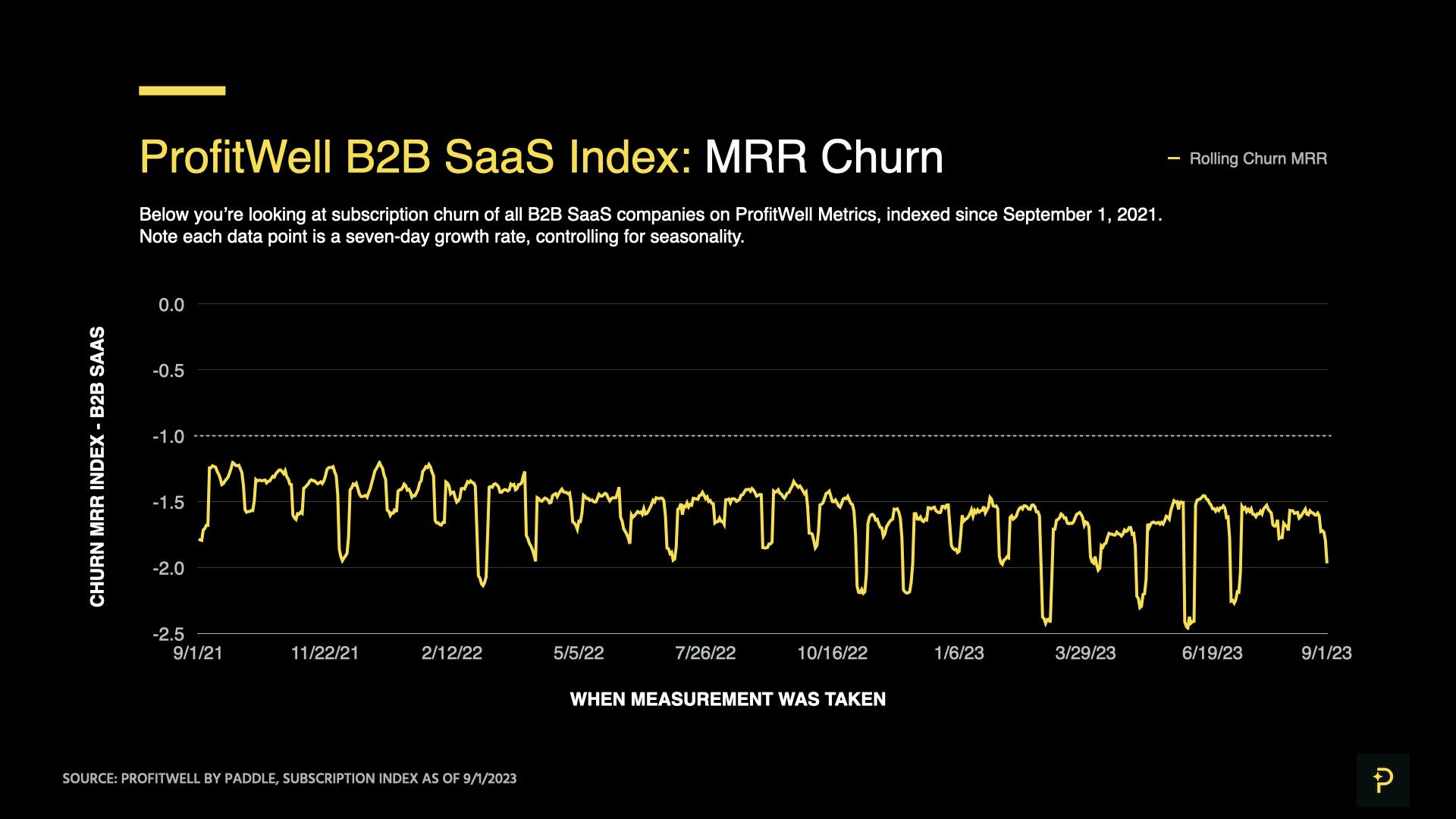

The ProfitWell B2B SaaS New Index is a seven-day rolling average of MRR from net new sales, expressed as a multiple of typical daily sales in 2019. A 1.00 index reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales (the ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators and not direct inputs into the main SaaS index.

The ProfitWell B2B SaaS New Index averaged 1.51 in July, a 5.8% decline from June. It then averaged 1.46 in August, a further 3.4% monthly decline.

This indicates that SaaS sales to new customers declined in July and August, while retention did not increase. Thus, these lower summer sales drove most of the slowdown in overall revenue growth.

...but customer retention saw a seasonal respite

Revenue churn benefitted from the summer lull, with customers briefly spending less time on scrutinizing existing expenses. Retention stayed about the same in July, and then improved in August.

The ProfitWell B2B SaaS Churn Index averaged -1.73 in July, indicating that churn’s impact on revenue was 0.9% lower than in June. The index then averaged -1.64 in August, a further 5.1% reduction in revenue churn.

While this is an improvement, these still show churn eating away at MRR at historically high levels. These recent churn estimates are about 9% higher than the same period last year, meaning companies would have to close more sales just to achieve the same growth rates.

Moreover, this is likely a temporary respite driven by seasonality. While revenue churn was lower in August than in many of the previous six months, it’s likely to intensify by the end of the year.

Quickly identifying and implementing retention strategies will need to be a core focus for SaaS operators going into Q4, which is typically one of the worst times of year for churn.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market’s headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market report from July 2023? Read it here.

Subscribe below, and be the first to receive the next SaaS market report.