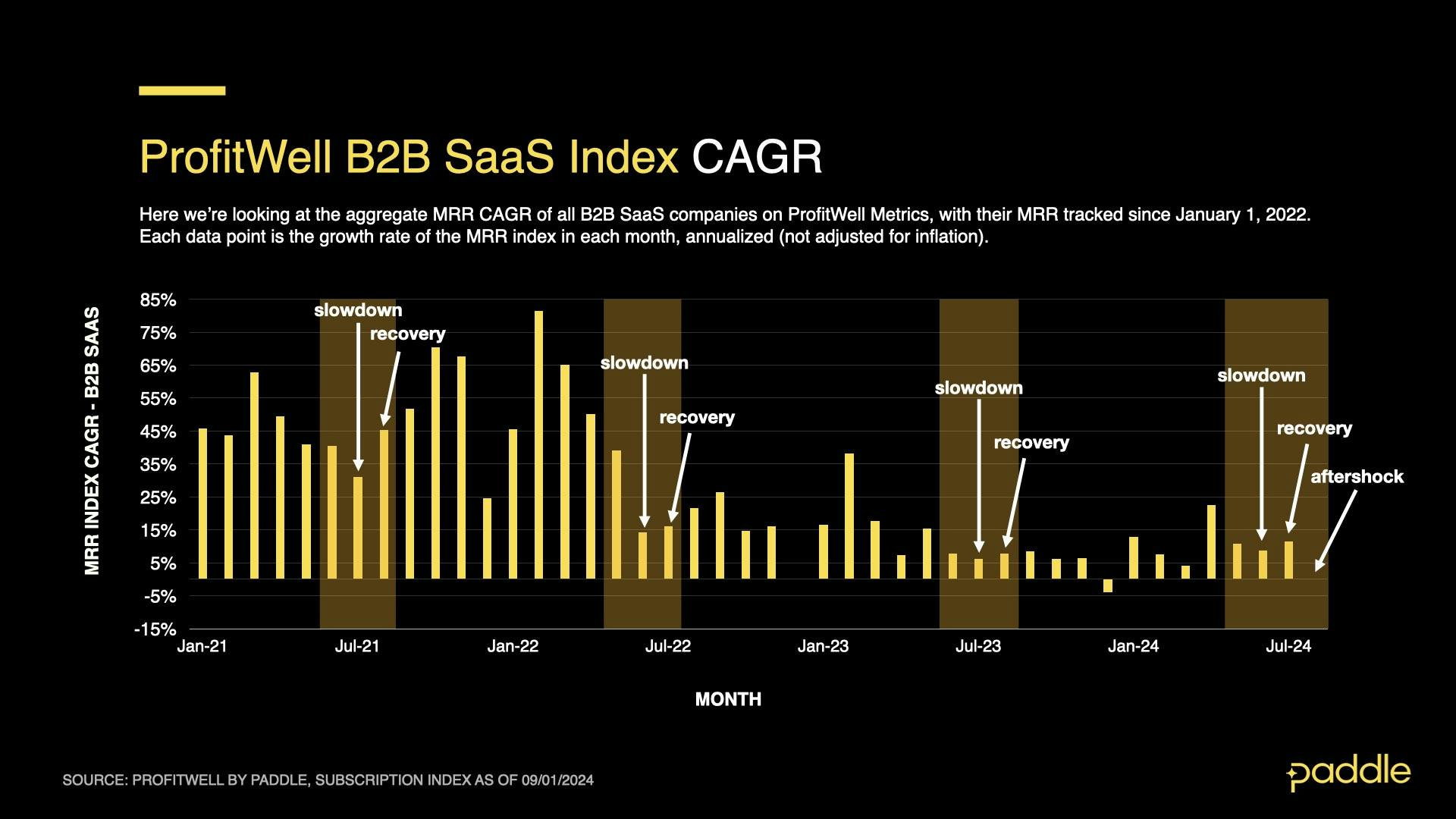

August was a roller coaster for the SaaS market - it brought an unexpected aftershock to the B2B SaaS sector, with growth dipping again following the summer slowdown in June and subsequent rebound in July. While this temporary setback may have caught some off guard, it comes amid promising economic news.

The Fed’s decision to cut interest rates from 5.33% to 4.83%, spurred by inflation dropping to 2.5% (their lowest point in over 3 years), is a major win for SaaS. These rate cuts, with more likely on the way in 2025 (provided that inflation hovers around the Fed’s 2% target), will provide a much-needed catalyst for future growth.

On the B2C side, the outlook is even brighter. Clear signs of a recovery from the SaaS market’s summer slowdown emerged in the latter half of August, with a full recovery to previous growth rates expected in September. As we look ahead, the combination of lower borrowing costs and rebounding growth points to a strong 12 months for SaaS companies.

So, grab a cup of coffee (or maybe something stronger after this roller coaster of a month), and let’s break down this month in SaaS as we move toward Q4. 👇

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine 2024 performance.

Subscribe to the SaaS Market Report newsletter to get these updates in your inbox.

Ben and Gavin discuss this month's data. Scroll down to read the full report.

B2B drops sharply, amid delayed summer slowdown

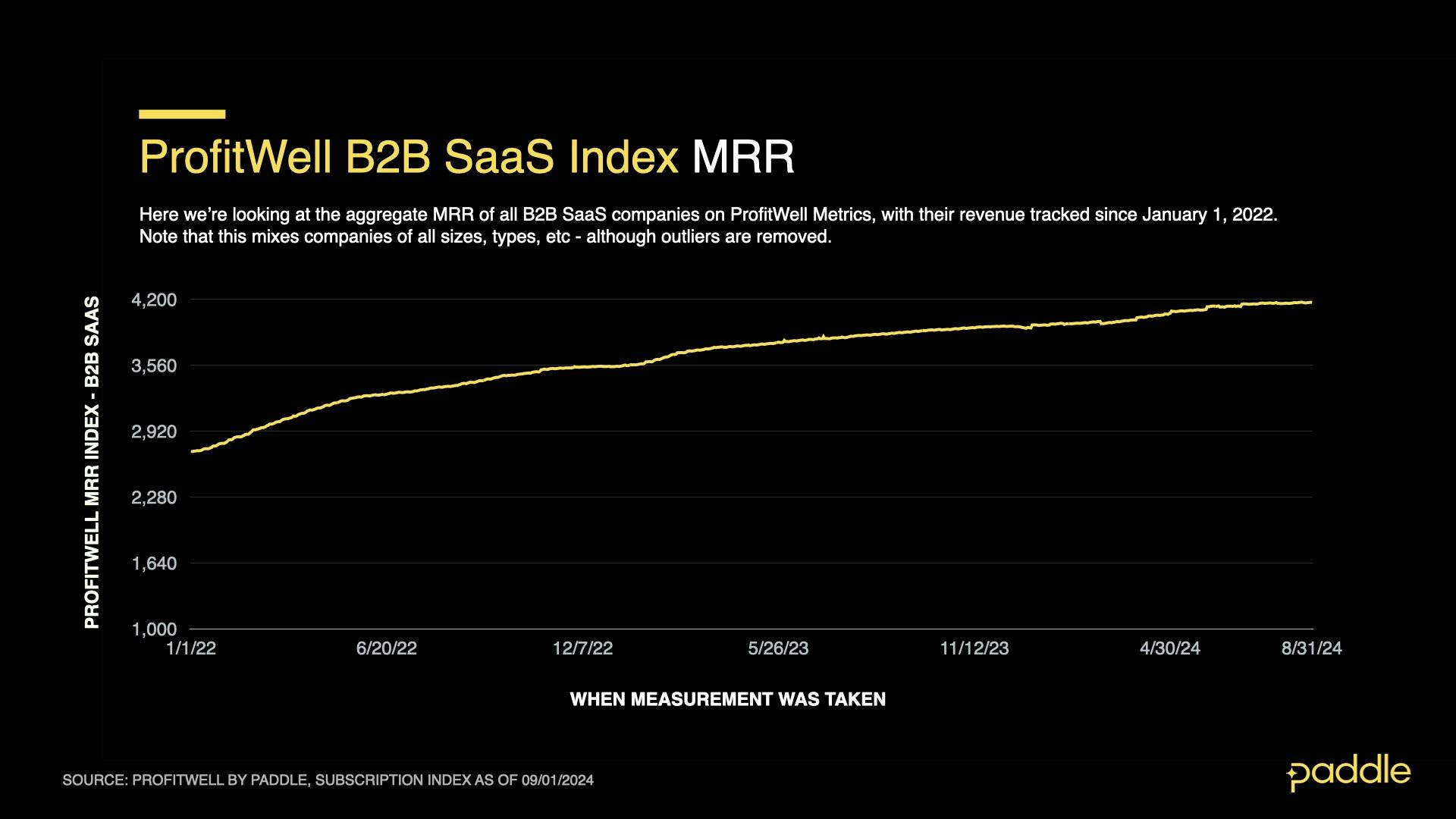

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

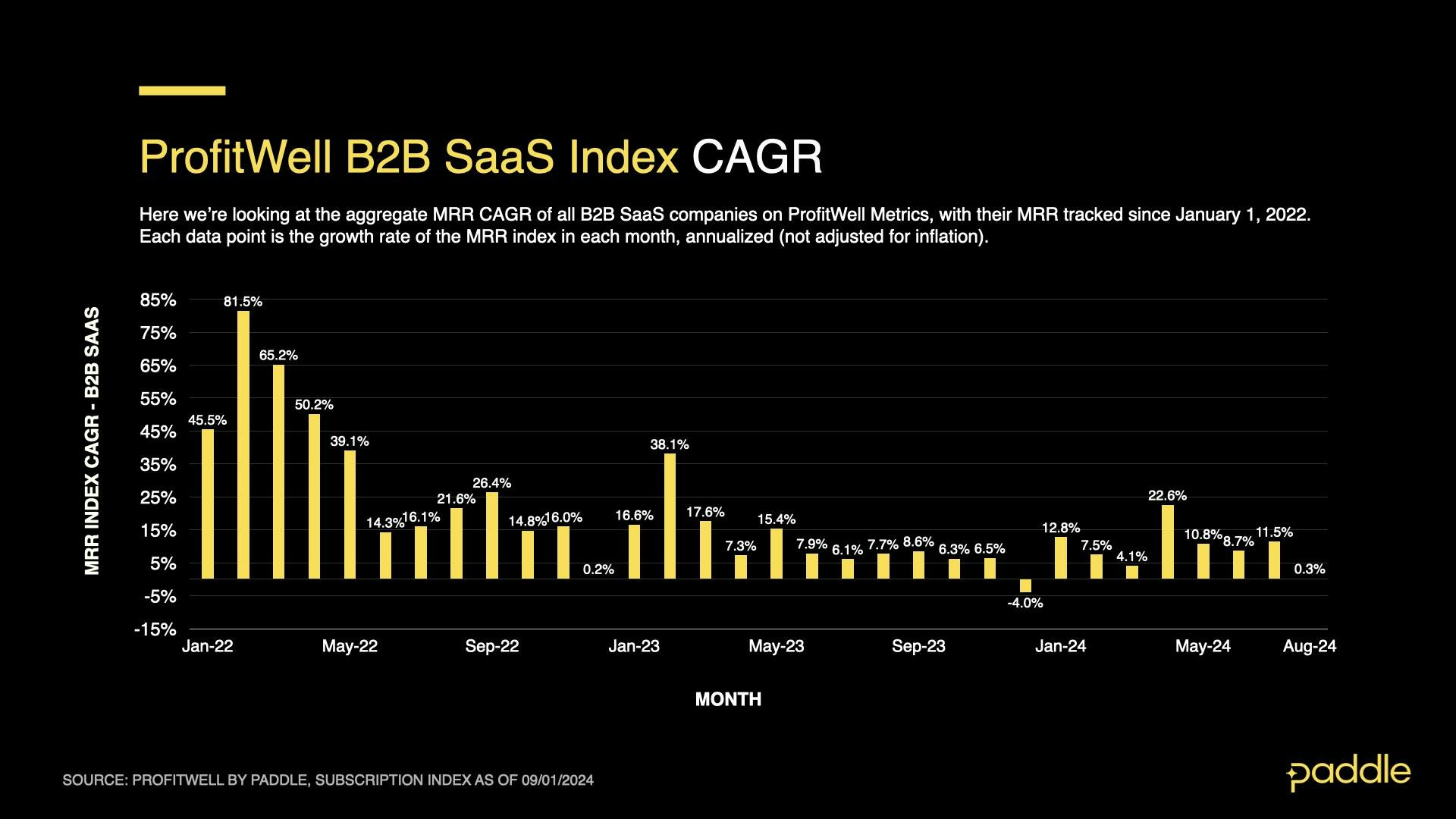

Looking at B2B’s August performance, you’d be forgiven for thinking the worst - B2B CAGR dropped down to 0.3%, and an MRR index value of 4169.

This appears to be a large ‘aftershock’, or at least a delayed summer slowdown (a seasonal dip in spending, driven by employees taking time off and purchasing less business software), after B2B’s initial drop to 8.7% CAGR in June, and recovery to 11.5% CAGR in July.

We too were lulled into thinking 2024’s summer slowdown was over by July, based on previous years’ slowdowns recovering by August, at the latest.

By digging into the driving forces of SaaS revenue growth - new sales, churn, upgrades and downgrades, we find indicators that August’s drop to 0.3% CAGR is indeed a delayed summer slowdown, rather than a new, downwards trend in B2B growth.

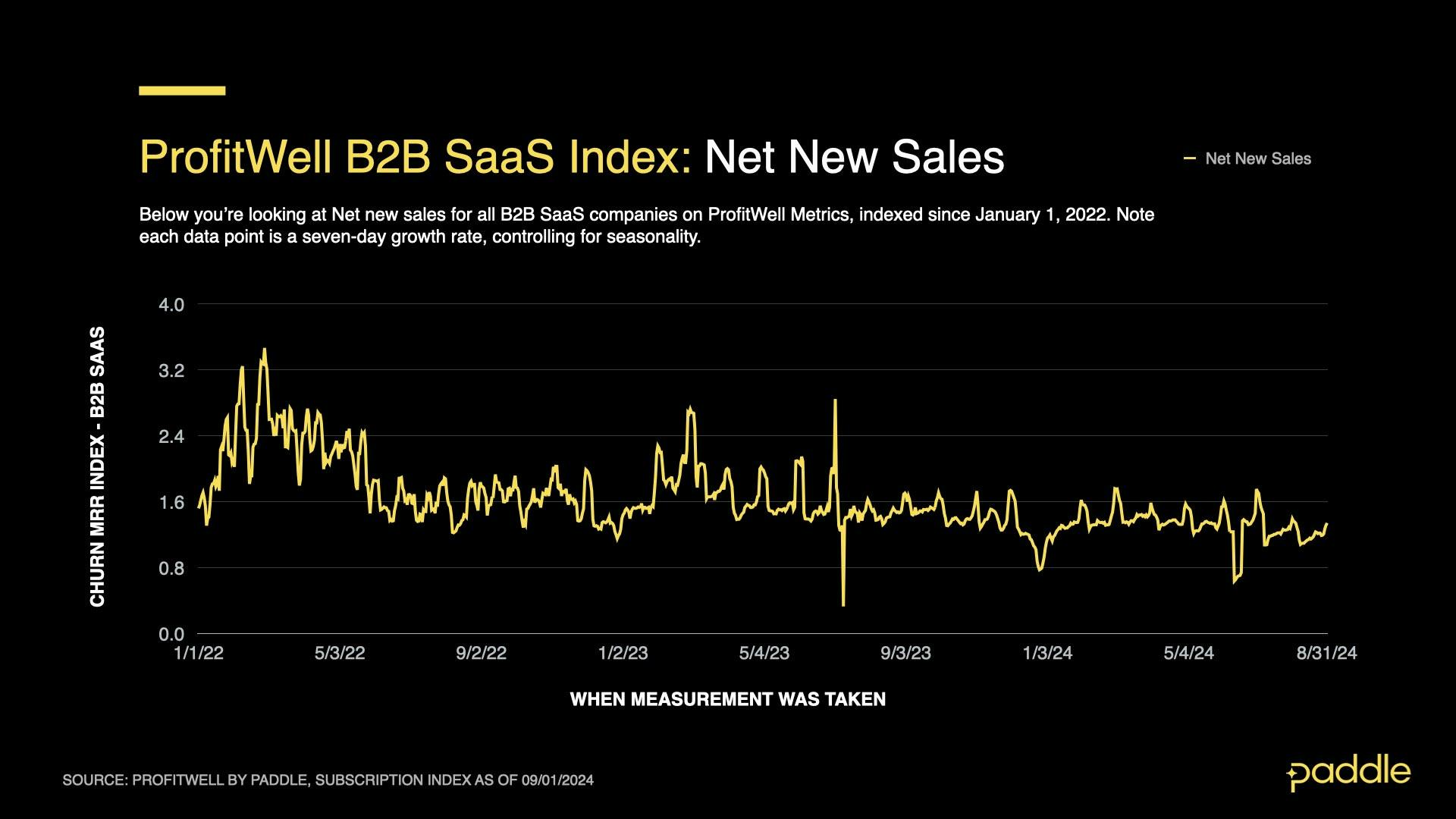

Starting with net new sales, we find a 7.1% drop compared to July’s average, with the Profitwell New Sales Index average at 1.211.

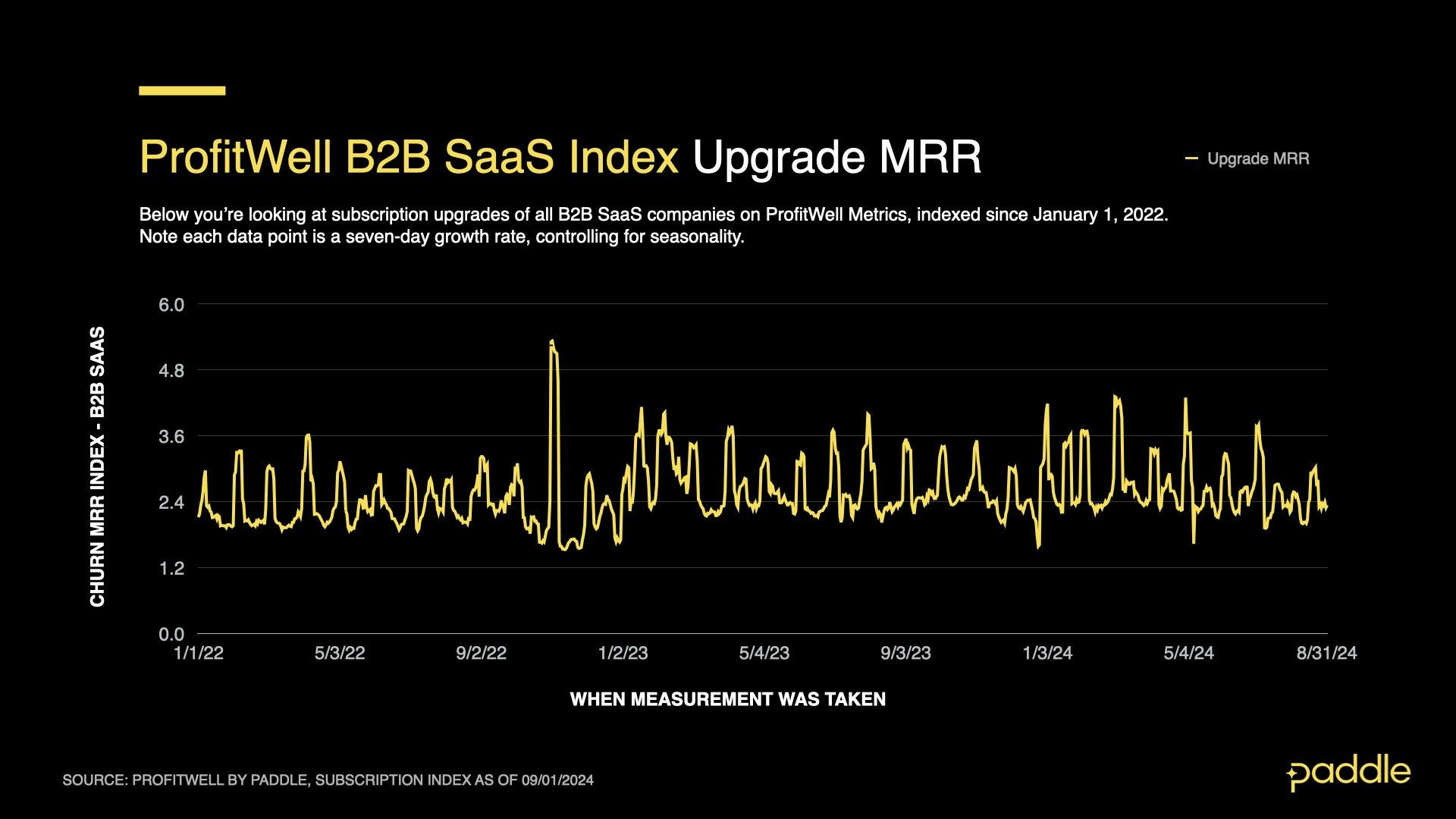

Upgrades also dropped, falling by 7.0% compared to July’s average, hitting an index value of 2.428.

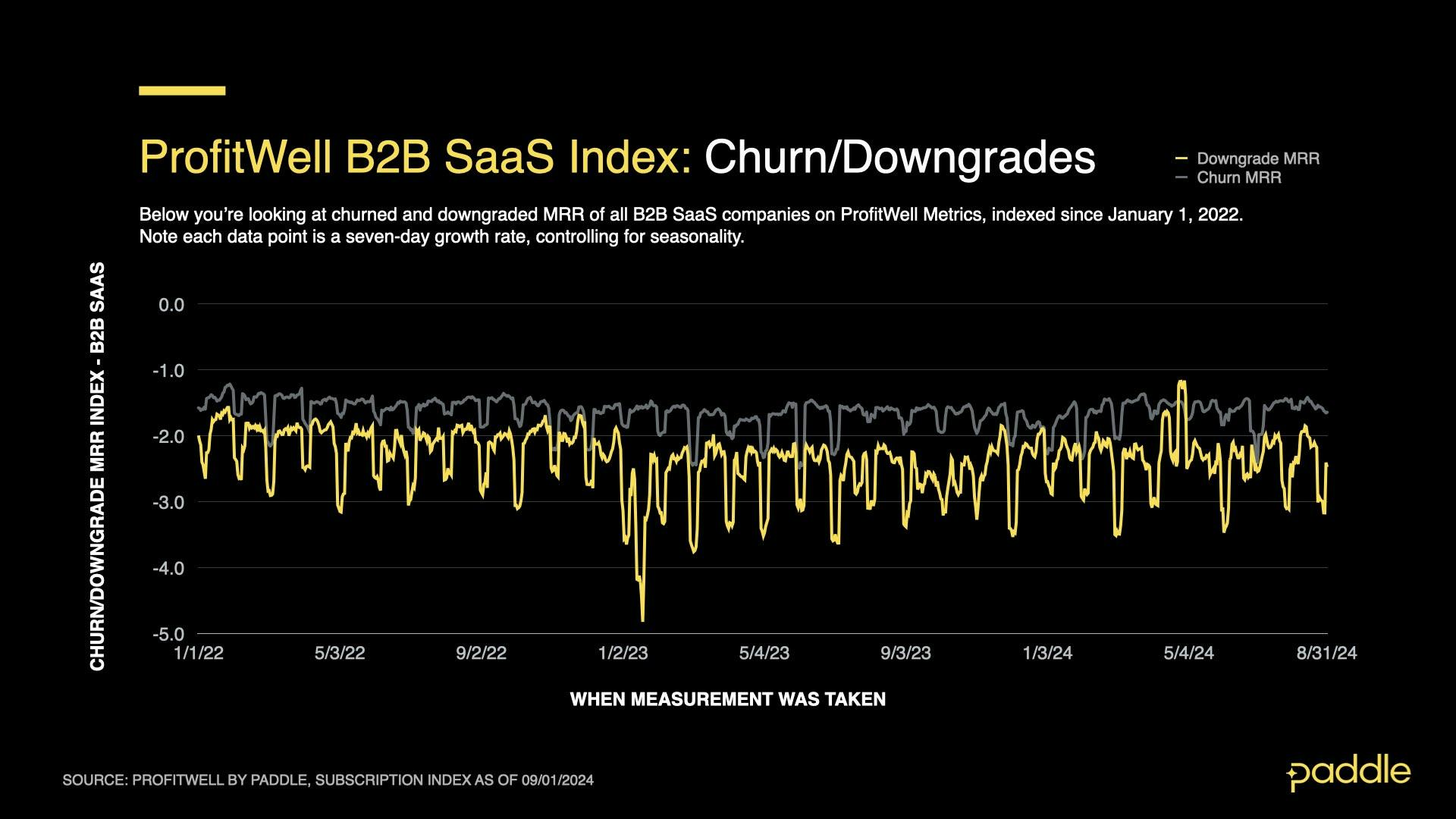

Churn dropped too, decreasing to an index value of 1.543, a 6.5% drop compared to July - putting some upwards pressure on B2B growth, but not enough to counteract the drop in new sales and upgrades.

Downgrades, on the other hand, remained relatively stable, dropping by only 0.5% compared to July’s average, reaching an index value of -2.369.

A classic seasonal slowdown

By taking all of these growth factors into account, we find the “fingerprint” of a (delayed) seasonal slowdown - a drop in net new sales and upgrades - as employees take time off of work for the summer, and spend less time purchasing and using business software.

As such, we still stand by our previous assessment that we’ll see a quick recovery to our projected 11% CAGR for B2B SaaS, albeit in September, instead of August.

In fact, by including the Fed’s rate 0.5% interest rate cut in our projections, we expect even stronger growth in the last quarter of 2024.

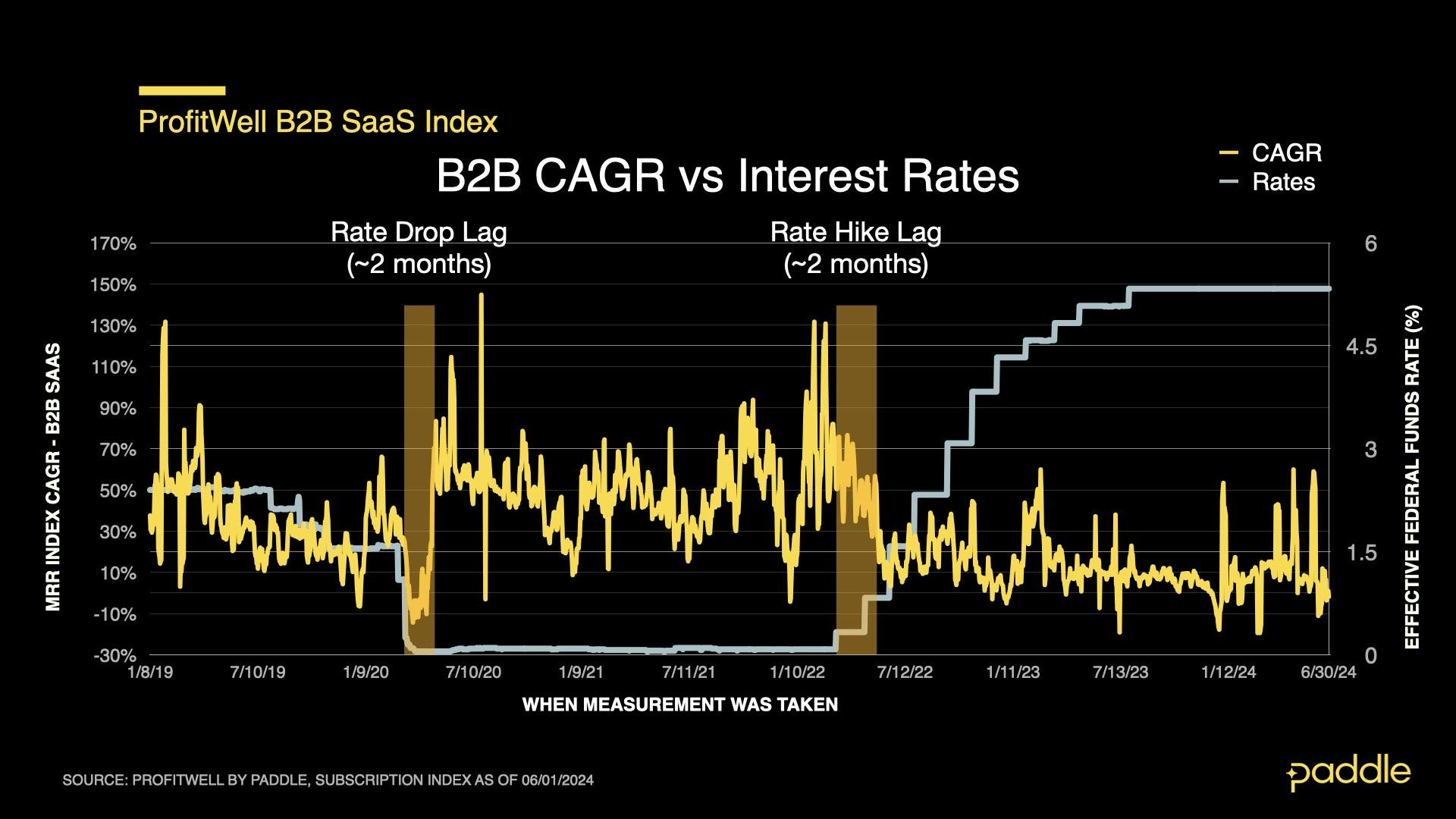

By examining Profitwell Metrics data on previous rate changes in 2020 and 2022, we find a consistent 2 month lag between changes in interest rates, and their effect on the B2B SaaS market.

Accordingly, we can confidently forecast that B2B SaaS will recover to 11% CAGR in September, and remain at that level until November, where B2B will begin to grow past 11% CAGR.

We still expect a temporary dip in December due to the winter holidays - however, B2B will quickly recover in January of 2025 (according to previous years’ data) - then continue to accelerate beyond 11% CAGR for the remainder of the year, should the Fed continues to cut interest rates, as they have been forecasted to.

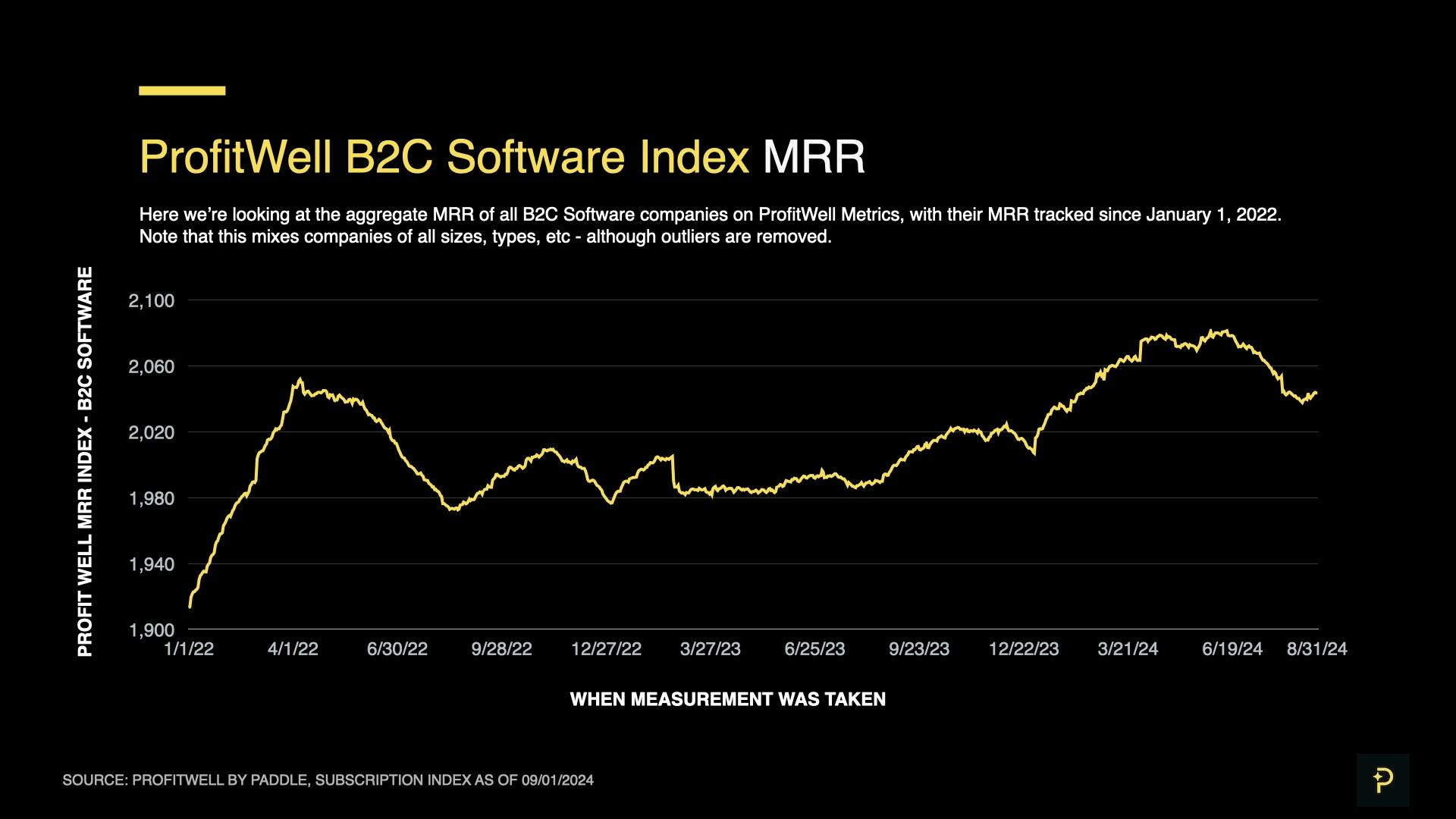

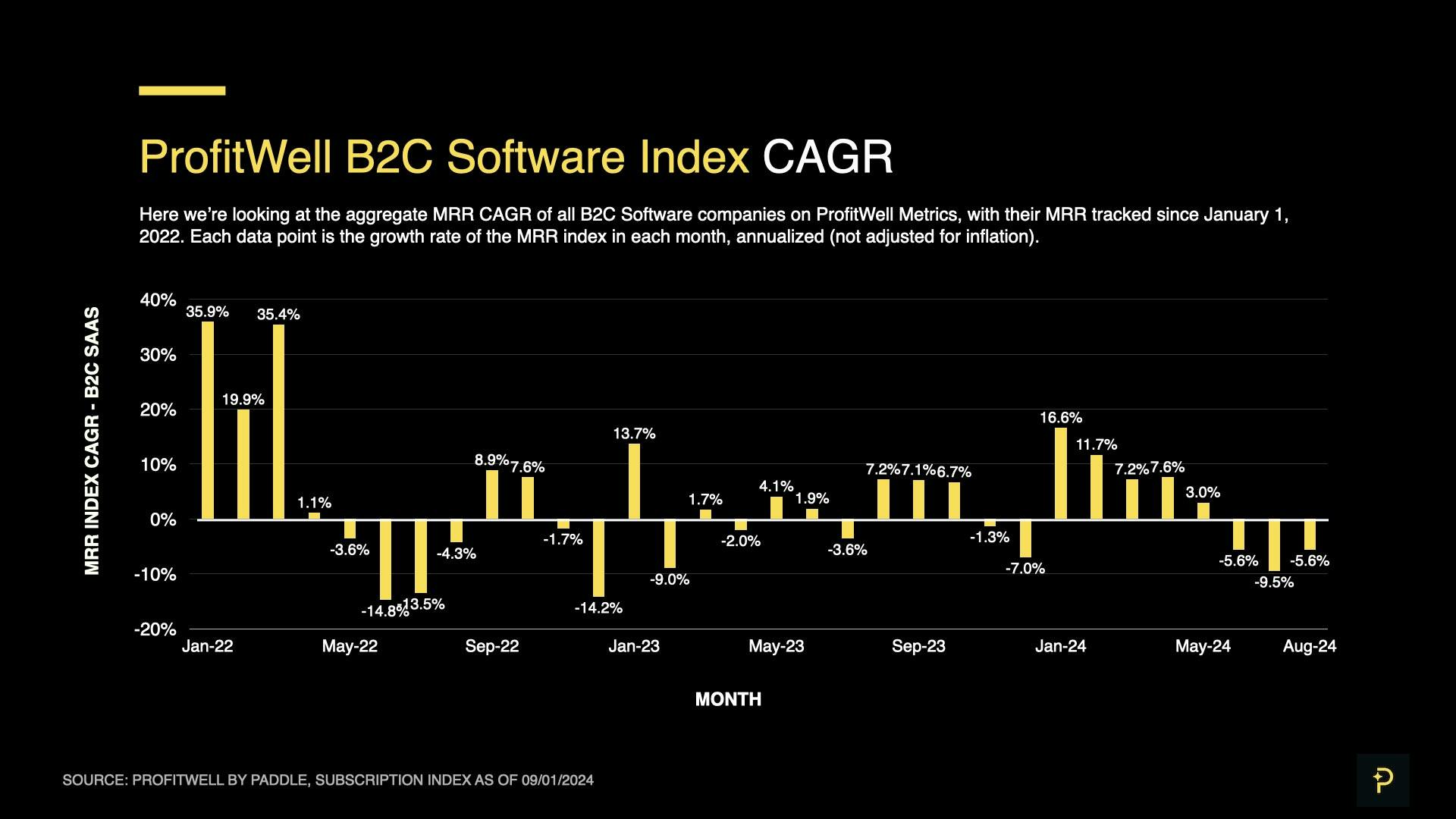

B2C recovery, despite August's negative CAGR

At the surface level, B2C’s growth also appears to be dismal, with August's CAGR averaging to -5.6%, and an MRR index value of 2044 (down from 2053 in July).

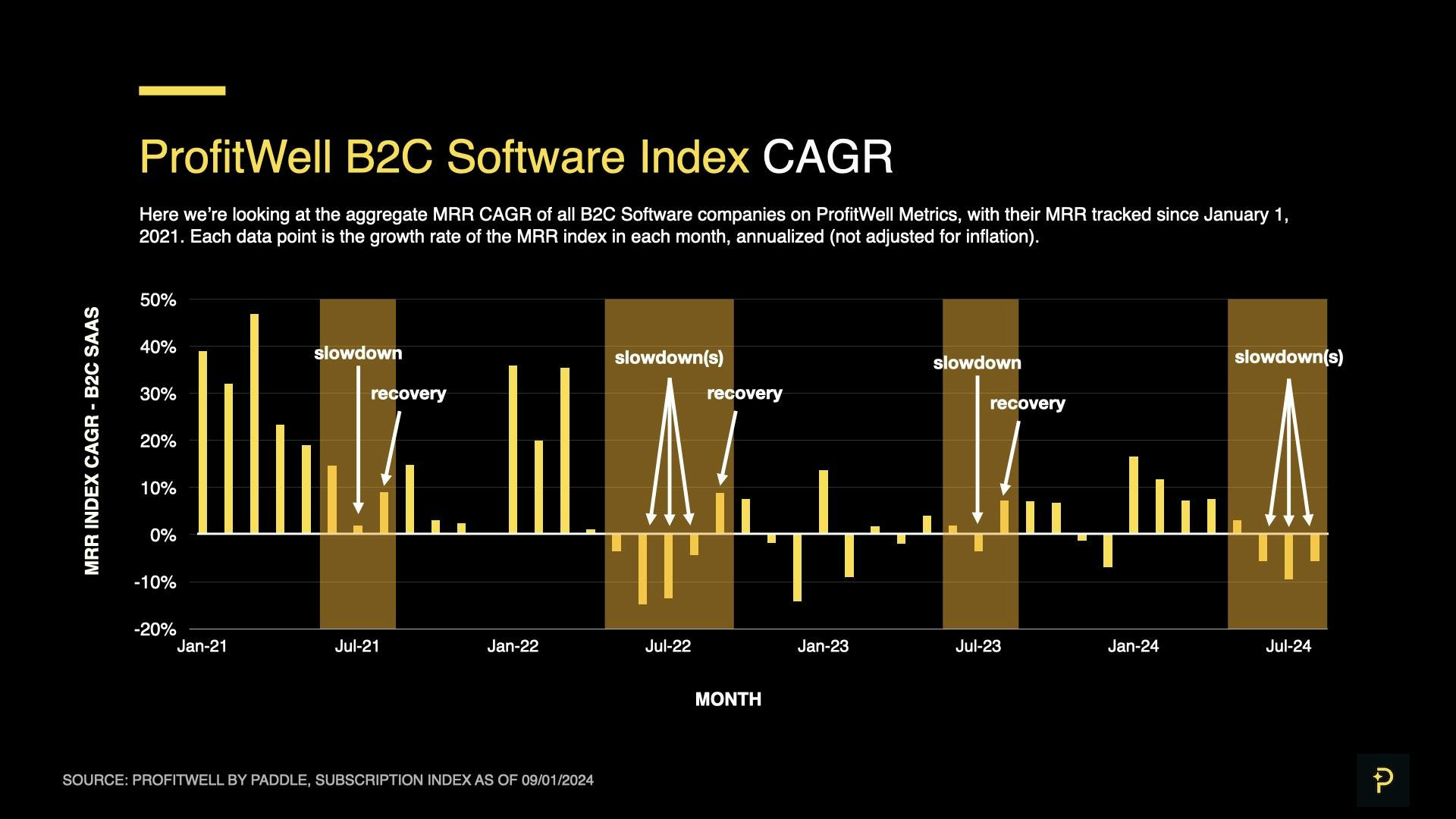

This would make 2024’s summer slowdown the longest for B2C that we’ve seen since the summer of 2022 (when the market was at its most volatile in several years).

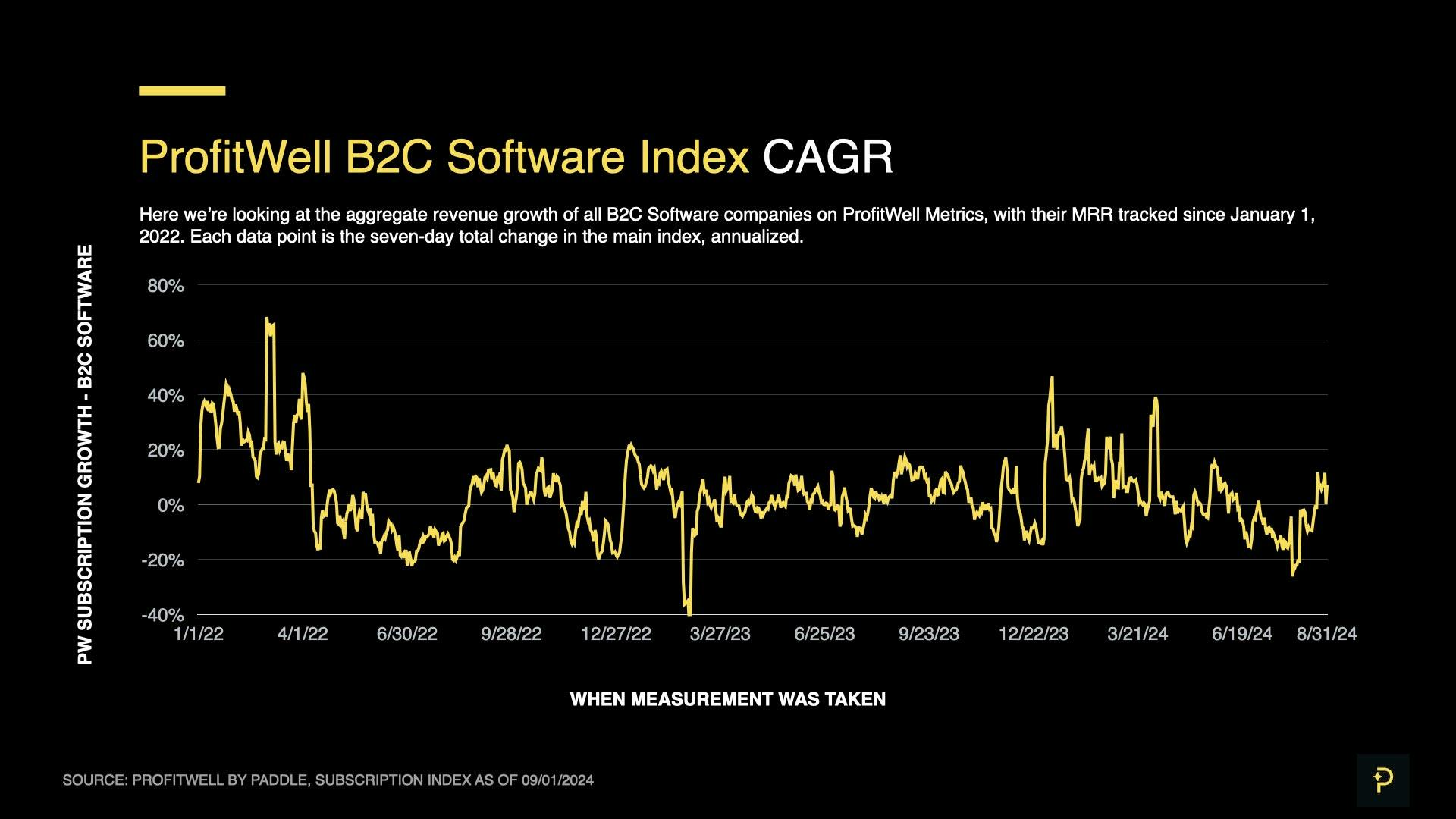

However, August's CAGR of -5.6% was a significant jump from July’s -9.5% CAGR, and by examining CAGR data at the day level, instead of as a monthly average, we find clear evidence that B2C has started to recover from its summer slowdown.

A full recovery, in just a week?

Here, we find that B2C CAGR grew steadily into the positives in the latter half of August, compensating for a dismal start to the month, even averaging to 6.7% CAGR in the final week of the month.

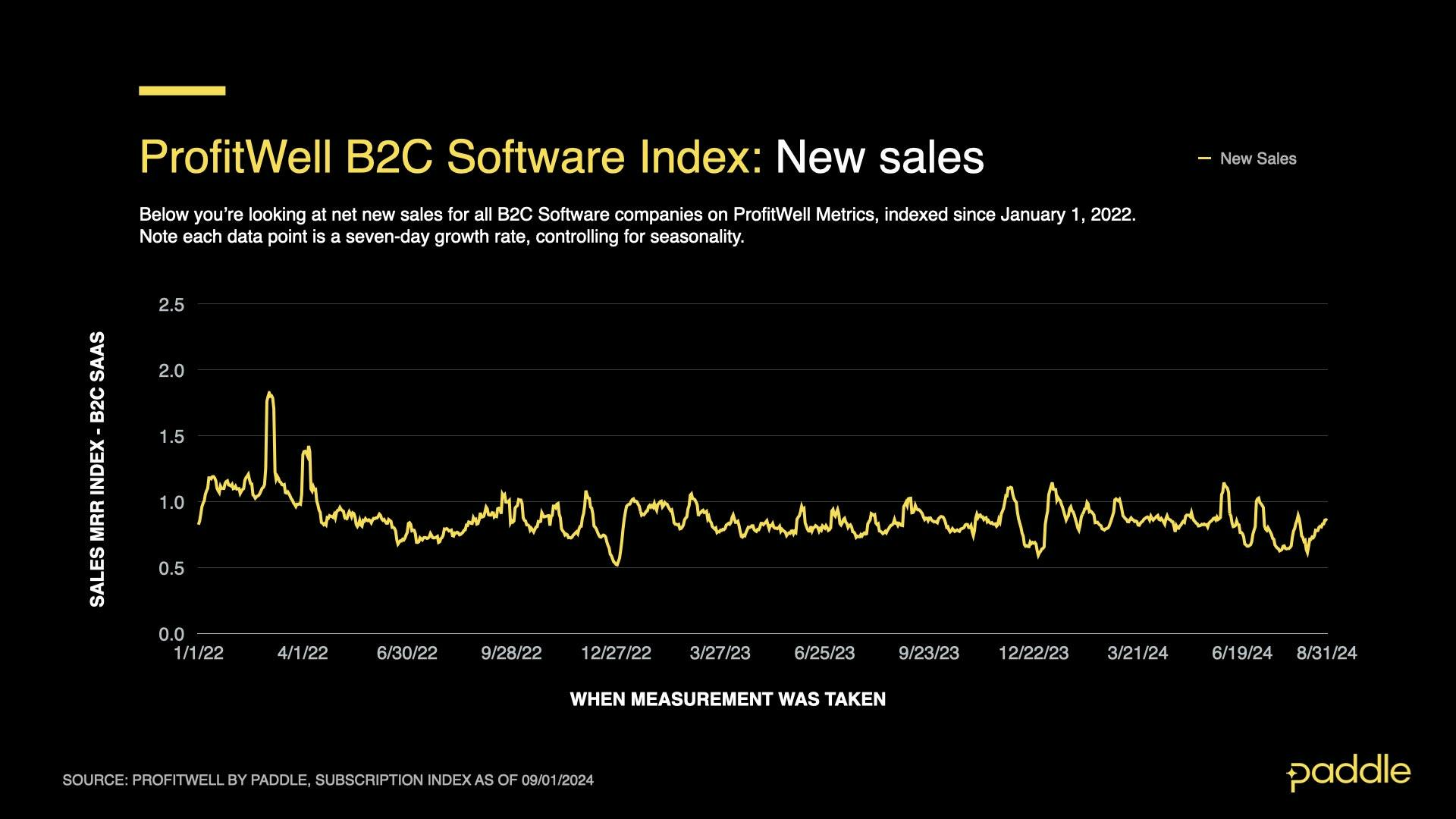

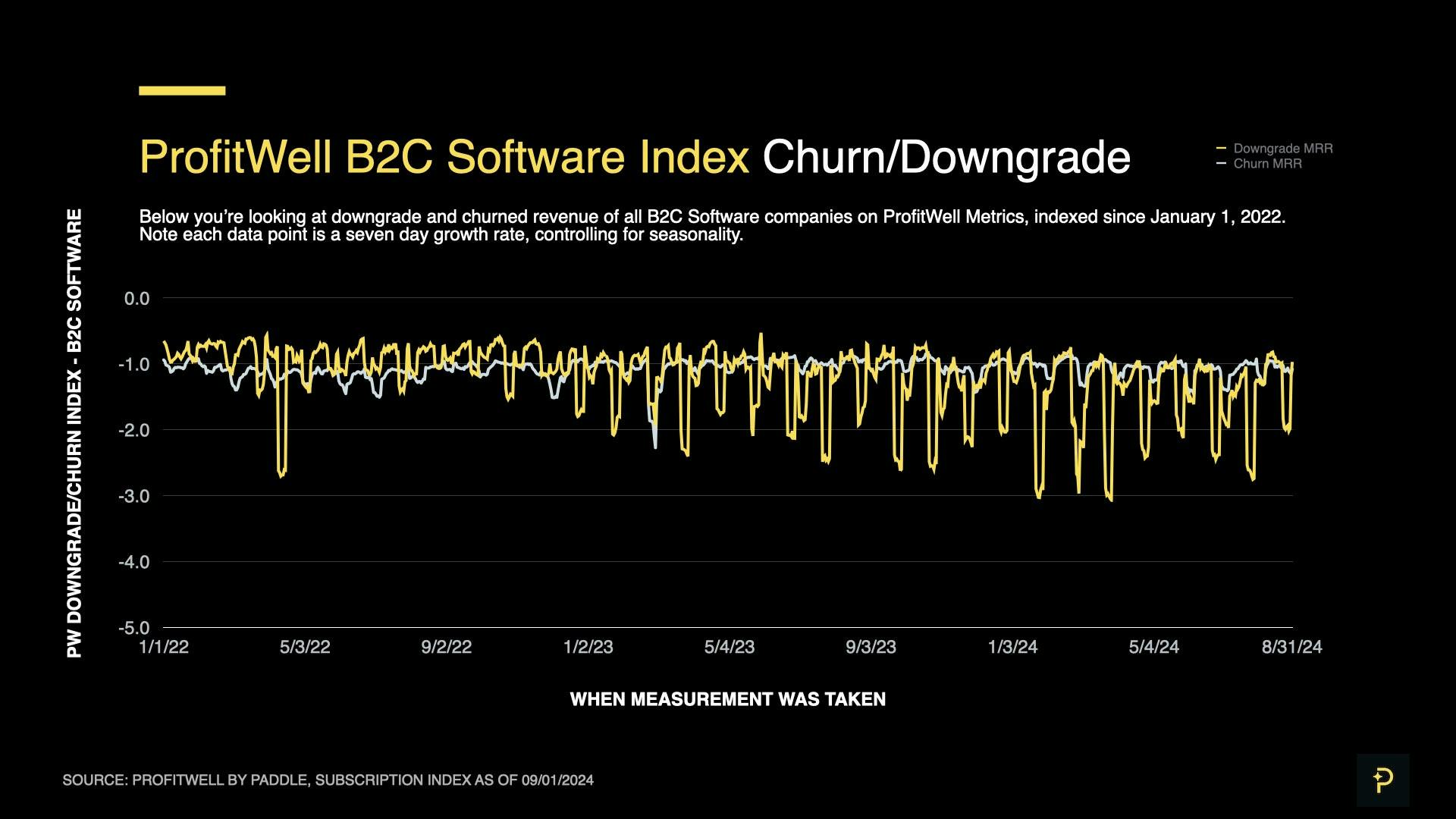

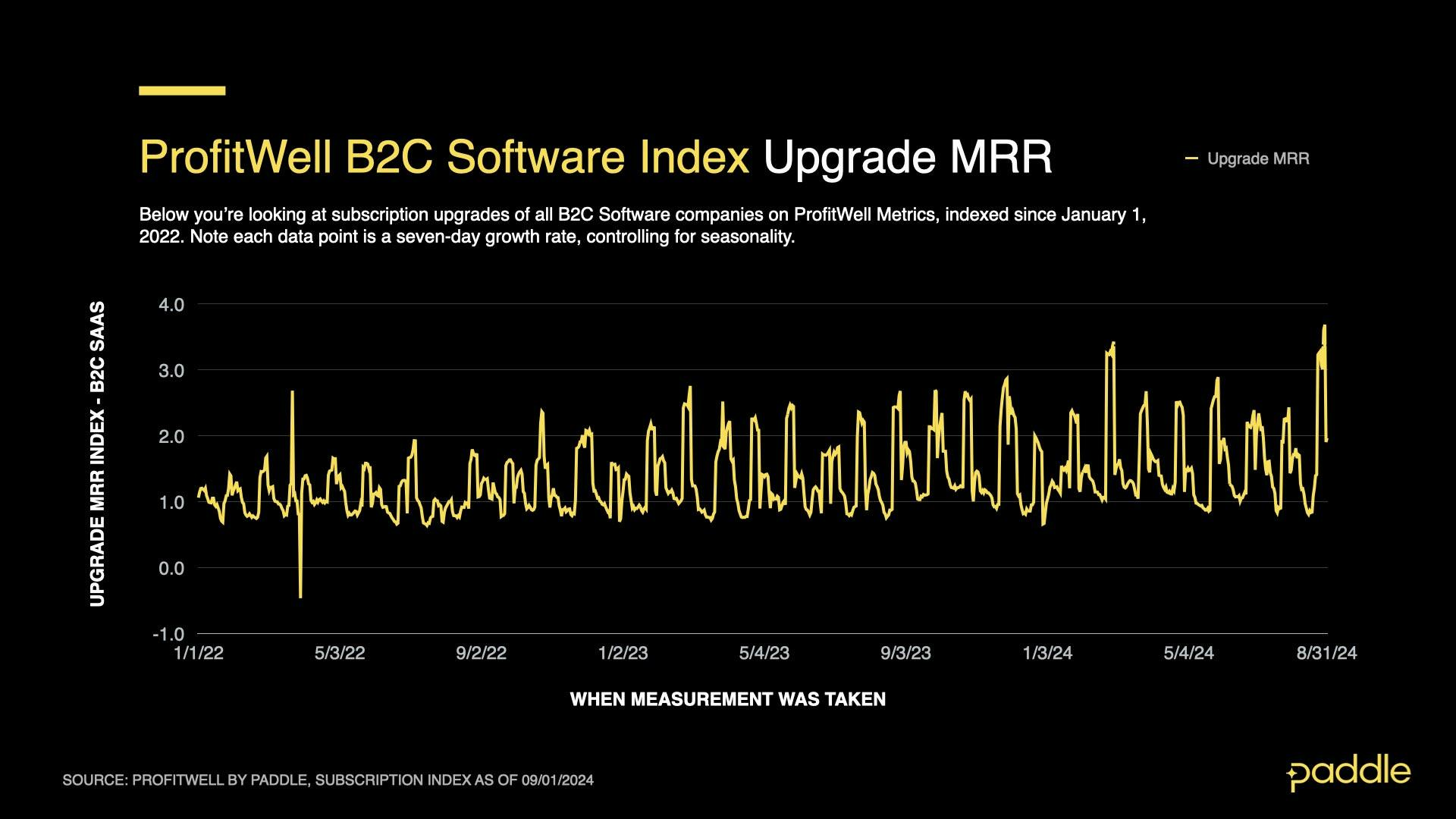

Again, looking at the driving forces behind B2C growth - new sales, churn, upgrades and downgrades - we find that our August recovery was driven by all four growth factors, with an increase in new sales and upgrades, and a drop in churn and downgrades (with the latter falling significantly).

Examining the new sales index, we find that new sales grew significantly in the last half of August, after a sluggish start to the month.

The sales index reached a peak value of 0.856 on August 31, despite averaging to just 0.771 over the entire month. As such, August's overall average was only 0.9% higher than July's, despite a rapid recovery in the final week.

Downgrades however, were the main driver of B2C’s August recovery, dropping by an enormous 27.6%, to an average of -1.248 on the Profitwell downgrade index.

A 3.2% drop in churn also contributed (albeit very little) to B2C’s recovery, with the churn index falling to an average of -1.082 in August.

Finally, upgrades increased by 6.2% compared to July, reaching an index value of 1.762, after a large spike in upgrades towards the end of August.

B2C positioned for a strong 2025

Based on B2C’s rapid recovery in the last week of August, it’s clear that B2C growth will fully recover to its previously forecasted levels of 8% CAGR by the time September’s growth data is available.

In fact, by including the Fed’s rate cut to 4.83% in our predictions, we expect B2C to follow a similar trajectory to B2B in the last half of the year.

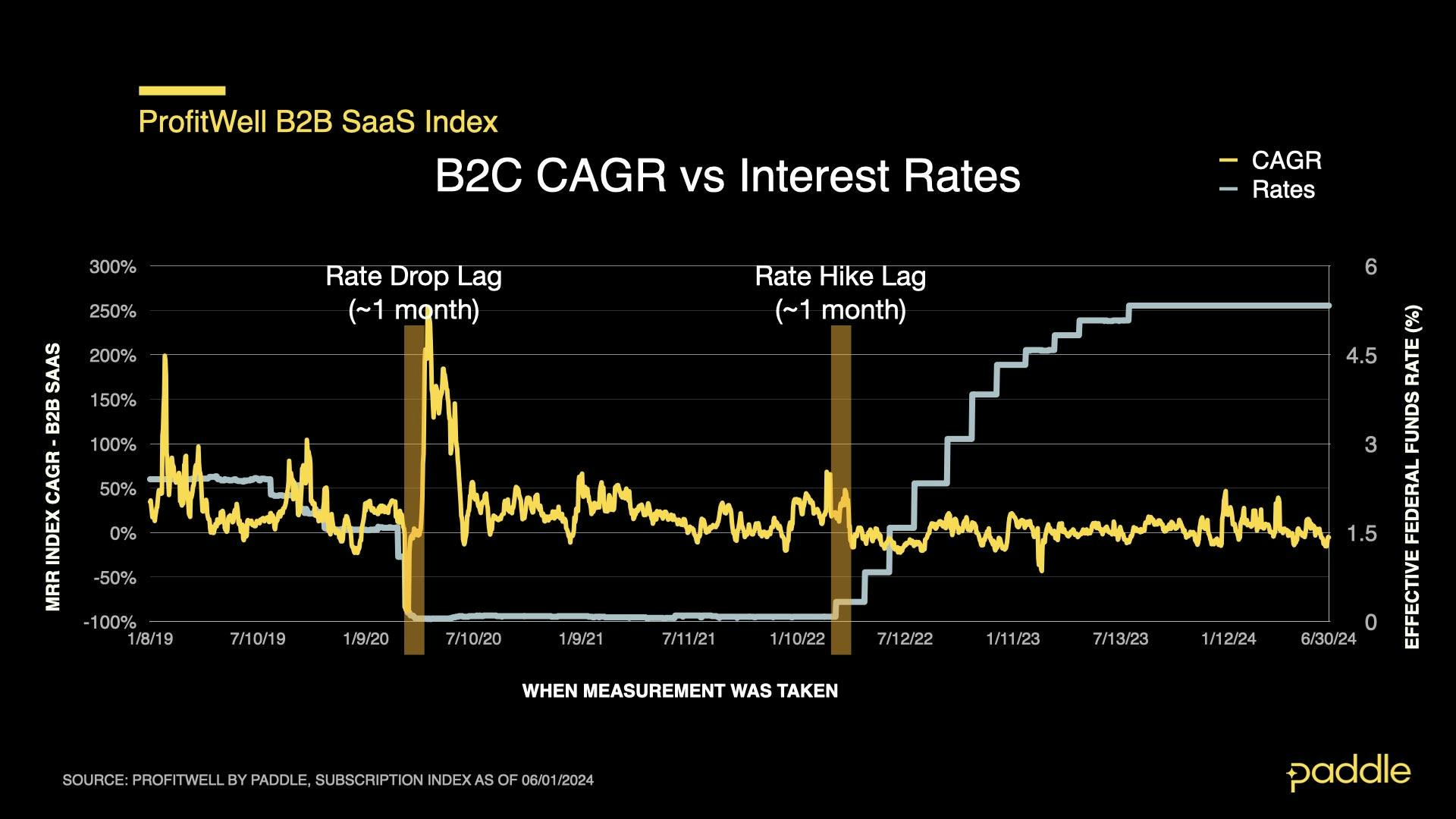

Profitwell Metrics data from 2020 and 2022 shows that the B2C SaaS market responds to changes in interest rates with a 1 month lag.

As such, we expect B2C growth to rebound to 8% CAGR in September, then gradually accelerate beyond 8% CAGR from October to December, where it will temporarily drop due to the winter holidays.

From there, we expect B2C growth to fully recover in January, and continue to slowly accelerate for the rest of 2025, should the Fed continue to drop interest rates.

Strategies to consider

Barring seasonal slowdowns and black swan events, the B2B and B2C SaaS markets are poised for steady growth, especially with the Fed forecasted to drop interest rates by another 2%, throughout 2025.

Now is the perfect time to double down on customer retention and efficient growth strategies, so that when the market heats up in late 2025, any money you raise will go further in acquiring customers, expanding revenue, and gaining a foothold in new markets.

Improve retention by building trust

Building customer trust is key with subscription software products, because your customers pay you continuously, and expect continuous value. You can reinforce the value your product offers by communicating your product vision and actively seeking customer feedback. This will help create a sense of ownership in your product, and create the impression that your product is becoming more valuable over time.

Consider using changelogs and in-app messaging to keep your users informed about updates and improvements. We also recommend building customer feedback panels and investing in content & events to share the latest improvements to your products.

To dive deeper into these customer retention strategies, don’t miss our upcoming Paddle Happy Hour series, where we speak with Beamer (and other leading companies), to explore how transparency and communication can build trust and long-term growth

Grow trust with transparent subscriptions

Transparency around subscriptions, cancellations, and payment flows is another essential retention strategy. Customers who feel in control of their subscription are more likely to stay loyal, while expansion through upsells and cross-sells becomes smoother.

If it’s easy for customers to update or modify their subscriptions, they will be less anxious about upgrading their subscriptions or purchasing additional products, boosting your conversion rate.

Moreover, making the checkout process frictionless, with features such as saved payment methods, currency localization, or one-click checkout, are proven methods of improving checkout conversion rates.

Check out the innovations and upcoming releases, designed to make subscriptions transparent and frictionless, from our latest Paddle Forward event!

Find hidden growth in key regions

To drive efficient growth, we suggest identifying the regions where your product resonates the most. SaaS products often gain traction in specific markets where the need for your solution is greatest or where the cultural context aligns with your messaging. By focusing your marketing efforts on these regions, you’ll unlock more efficient growth per dollar spent.

One of the best ways to do this is segmenting your customers by region, and then comparing the performance of each region against revenue metrics such as LTV, retention, and ARPU. From there, you’ll be able to identify the regions where your ideal customers live, then customize your growth and product strategies to better capture those customers.

Profitwell Metrics, which now has the ability to segment users by region (note: this feature is only available for Paddle Billing customers), is an excellent tool for uncovering these growth opportunities. It also offers industry standard subscription metrics, right out-of-the-box. Best of all, it’s completely free. Check it out here!

We publish monthly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here

Subscribe below to be the first to receive the next SaaS Market Report.