Summer has brought a slowdown to subscription software, with B2B SaaS slowing in June then rebounding this July, while B2C growth has steadily declined to its lowest levels since December 2022, over the last two months.

As we’ll discuss in July’s SaaS market report, data from Profitwell Metrics (tracking revenue for over 34,000 SaaS companies) shows the slowdown isn’t cause for alarm, nor is it indicative of an emerging downwards trend. In fact, we expect the SaaS market to fully rebound by the end of August - perhaps even surpassing growth rates before the summer slowdown.

With that preface out of the way, and a fresh drink in hand (you are taking some vacation time this summer right?) - let’s dive into the July SaaS Market Report 👇

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine 2024 performance.

Subscribe to the SaaS Market Report newsletter to get these updates in your inbox.

Ben and Gavin discuss this month's data. Scroll down to read the full report.

B2B recovers, positioned for a strong August

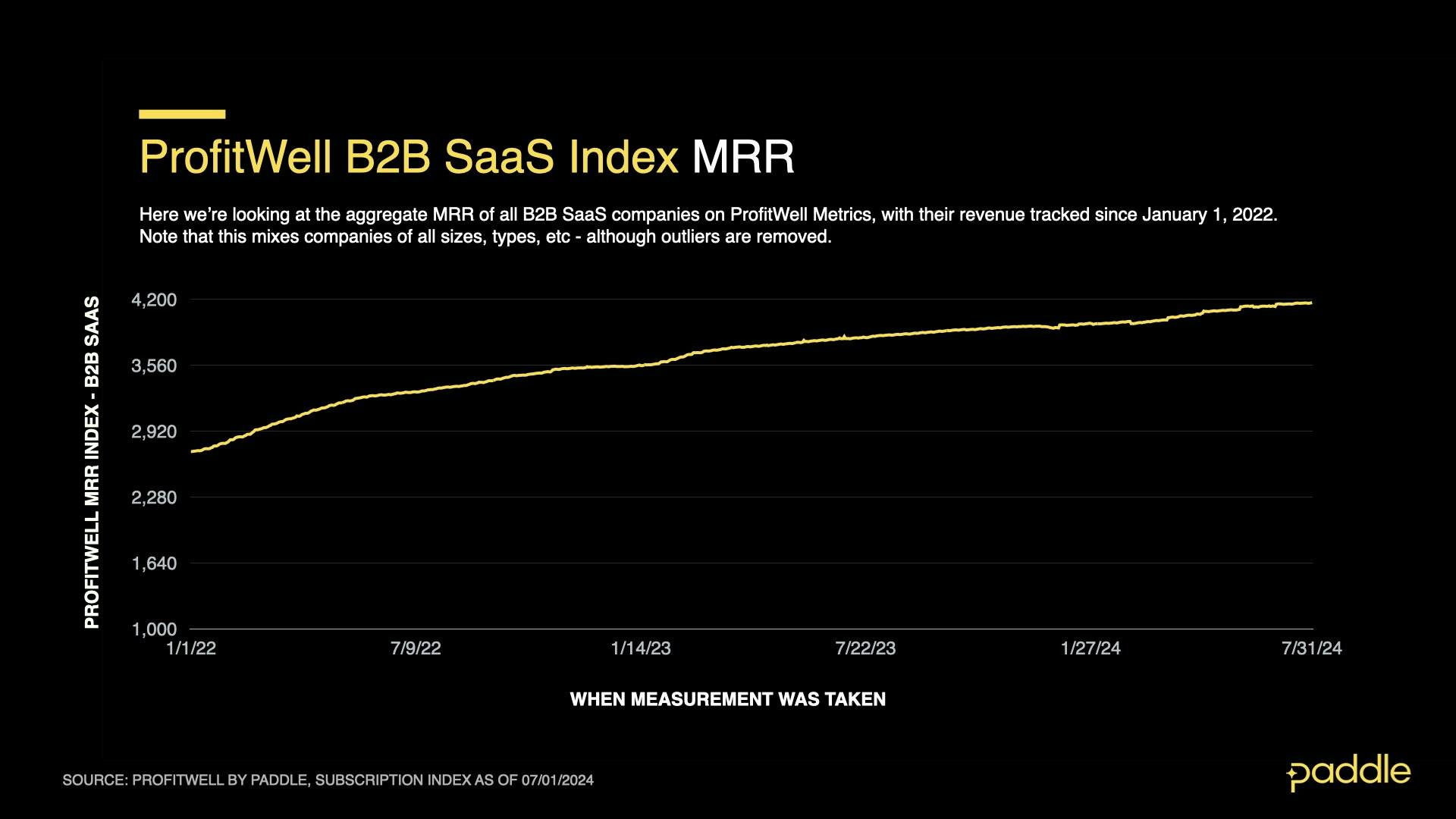

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

This July, B2B SaaS growth made a full recovery to pre-summer levels, after experiencing diminished growth in June.

The B2B SaaS Index, tracking the cumulative revenue growth of B2B companies using Profitwell since 2019, reached an all time high of 4168.

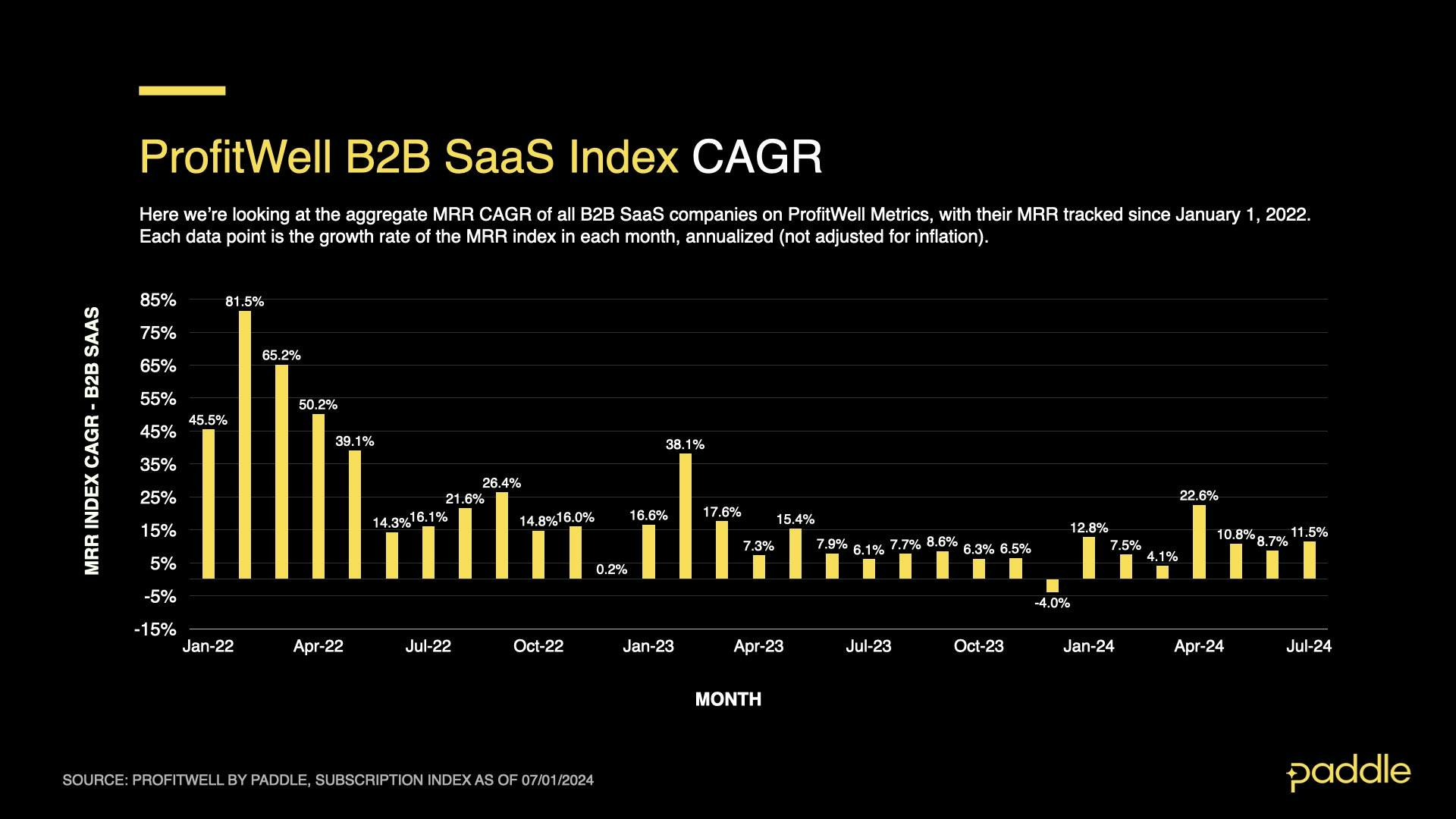

July’s growth reached 11.5% CAGR - closely in line with our predictions for an average of 11% CAGR in 2024.

This is up from 8.7% CAGR in June, indicating that B2B has now fully recovered from its “summer slowdown” (a yearly occurrence, as employees take time off and purchase less B2B software).

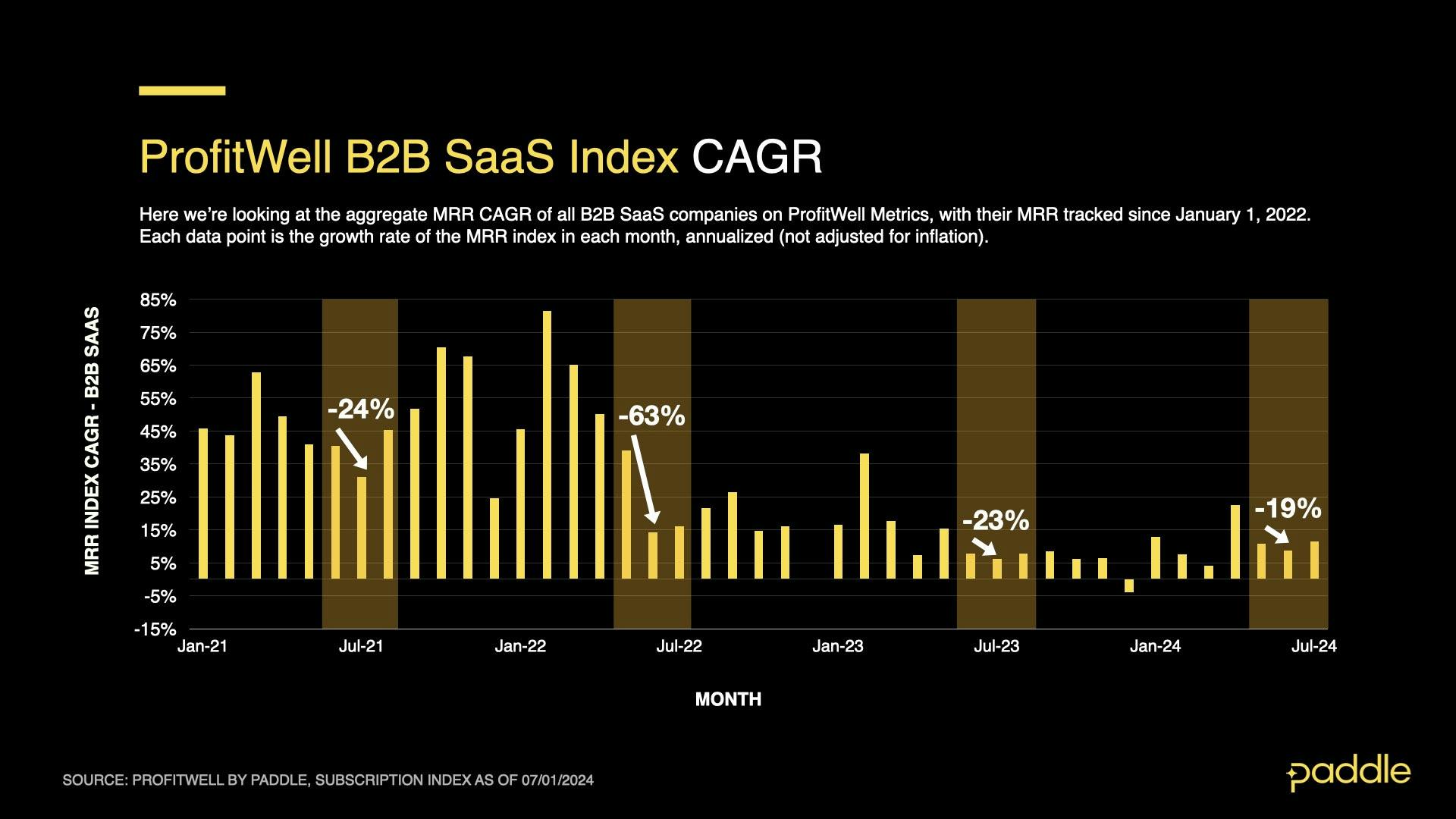

In fact, this is the softest summer slowdown for B2B since the SaaS Index was created in 2019; with a dip in CAGR of only 19%. This can likely be attributed to B2B’s unusually high stability this year, as interest rates have been held steady for the last 12 months.

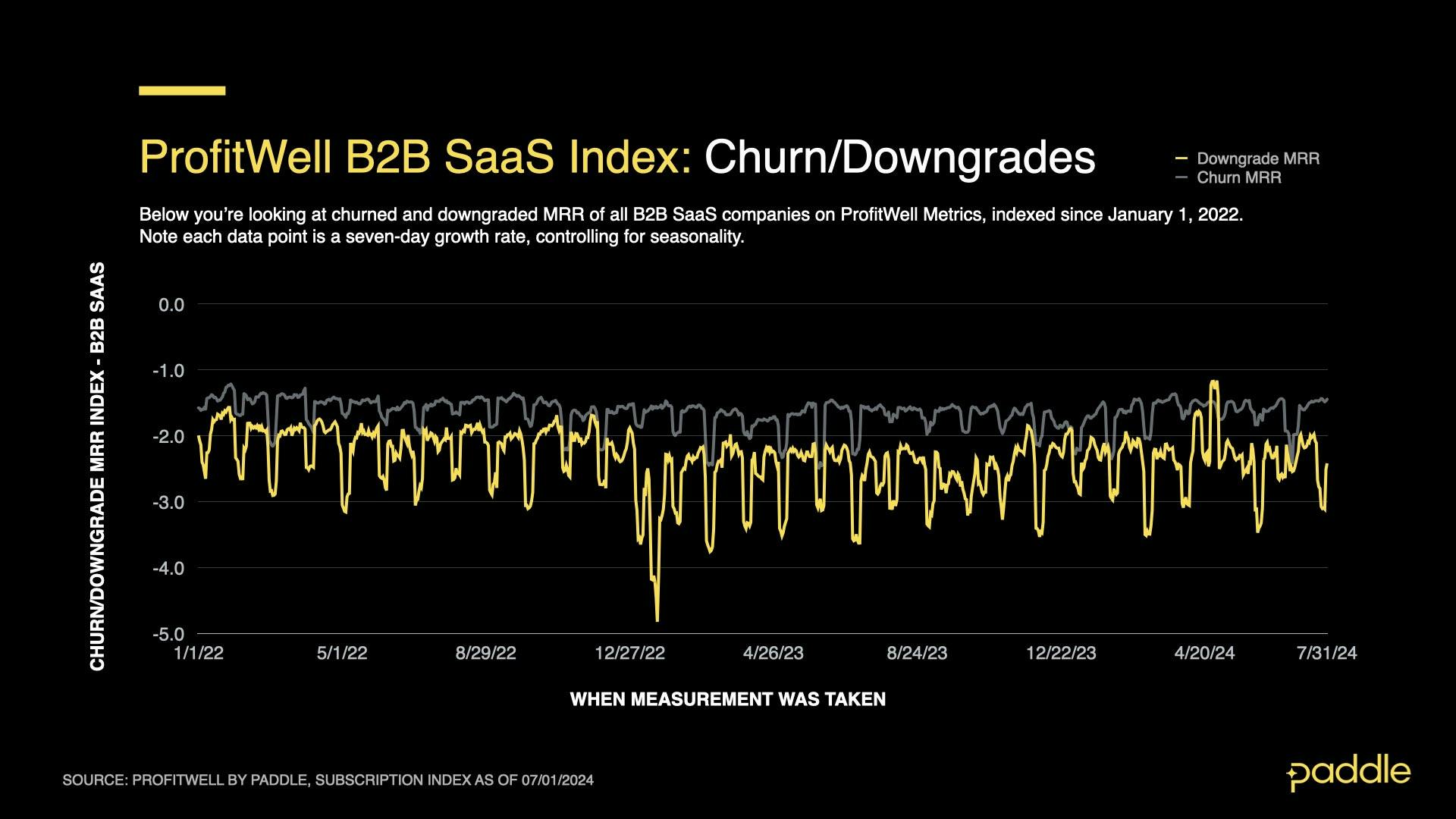

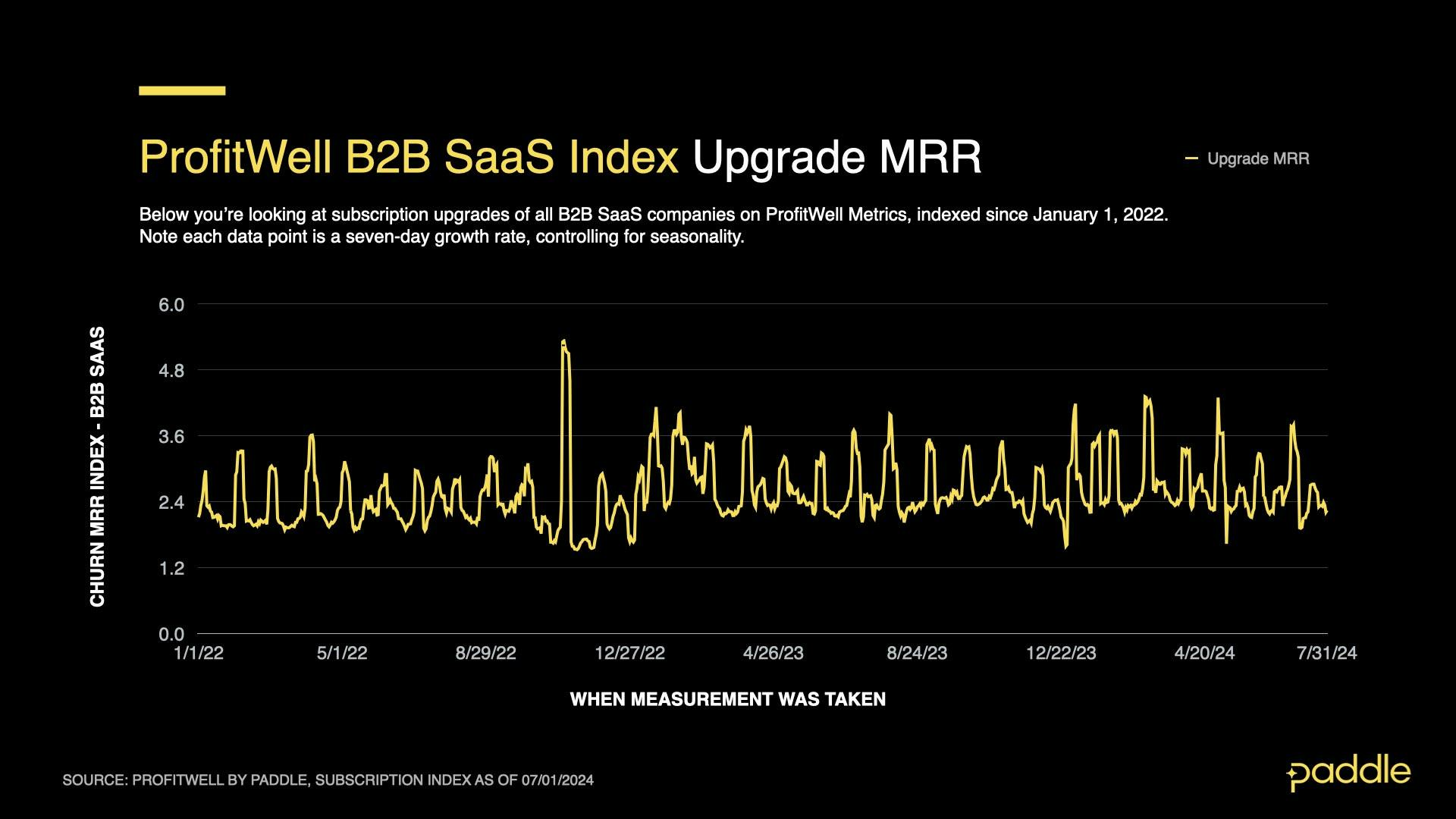

Sales rebound, downgrades settle

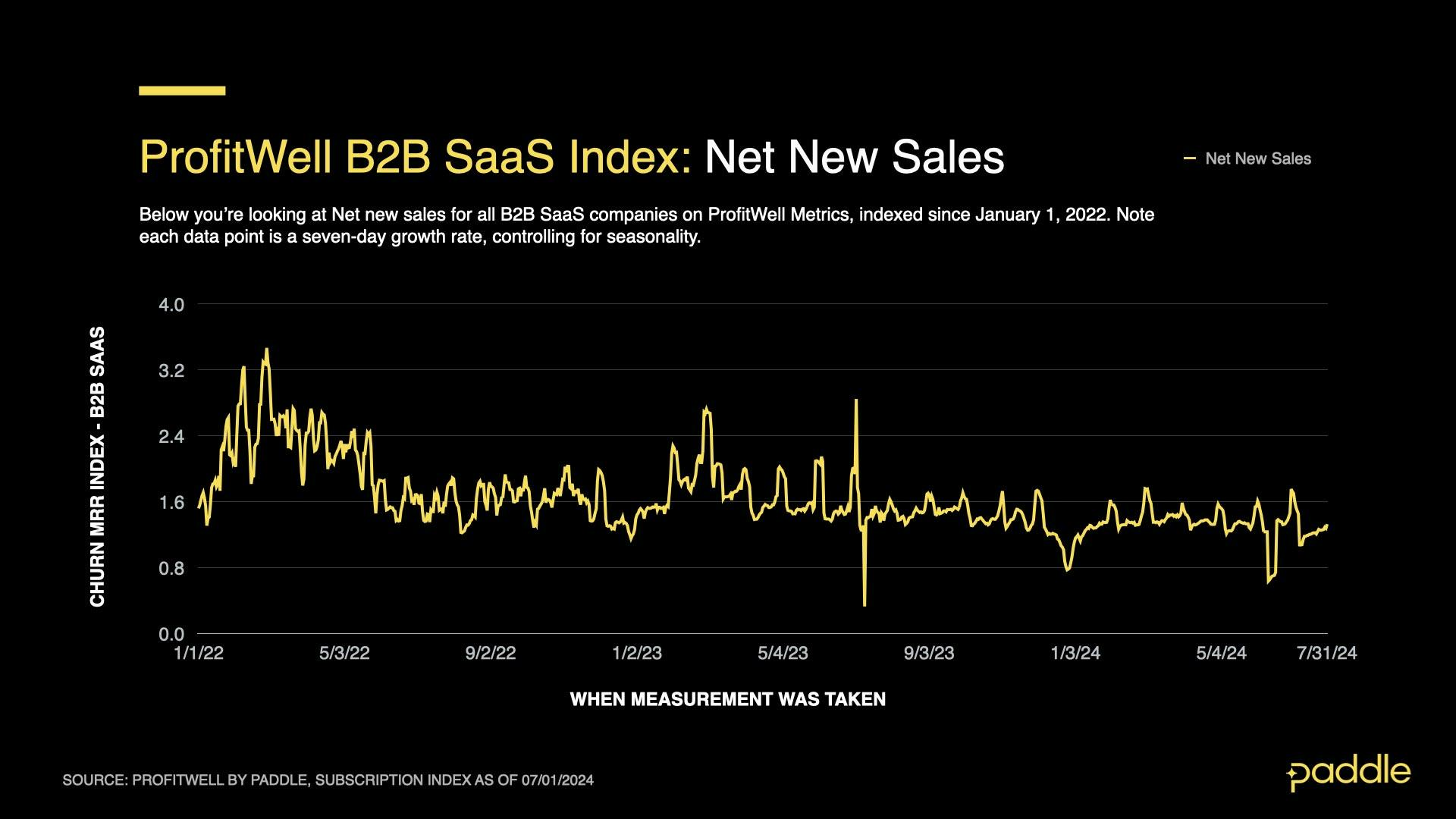

Digging deeper, into the Profitwell indices for factors that directly drive growth - net new sales, churn, upgrades & downgrades - we find that July’s recovery was driven by a rebound in new sales, while downgrades settled back to normal levels.

For the ProfitWell B2B SaaS Sales Index, a 1.00 reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales. The ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Examining the New Sales index, we find a 6% increase in the index’s average value, to 1.303, compared to June’s average of 1.230.

While this does represent a rebound from June’s slow sales, it’s important to note that New Sales would need to grow another 4.8% to reach its 2024 average, before the summer slowdown. This is a potential indicator that B2B has further to recover, beyond the 11.5% CAGR reached this month.

Downgrades also drove B2B’s July recovery, with a 7.7% drop to an index value of -2.381, down from its 2024 high in June, of -2.580.

It’s also worth noting that downgrades need to drop by another 5% before fully recovering to levels before the summer slowdown - leaving open the door to growth beyond 11.5% CAGR for B2B in the coming months.

On the other hand, both churn and upgrades have remained stable throughout the summer, and beforehand - July included. They have neither driven the summer slowdown, nor the subsequent recovery.

Churn decreased by 1.0% in July, to an average index value of -1.651 (ie, 1.651x the rate of churn seen when the index was started in 2019).

Upgrades were even more stable in July, with a near-zero decrease (-0.1%) from June, dropping to an index value of 2.610.

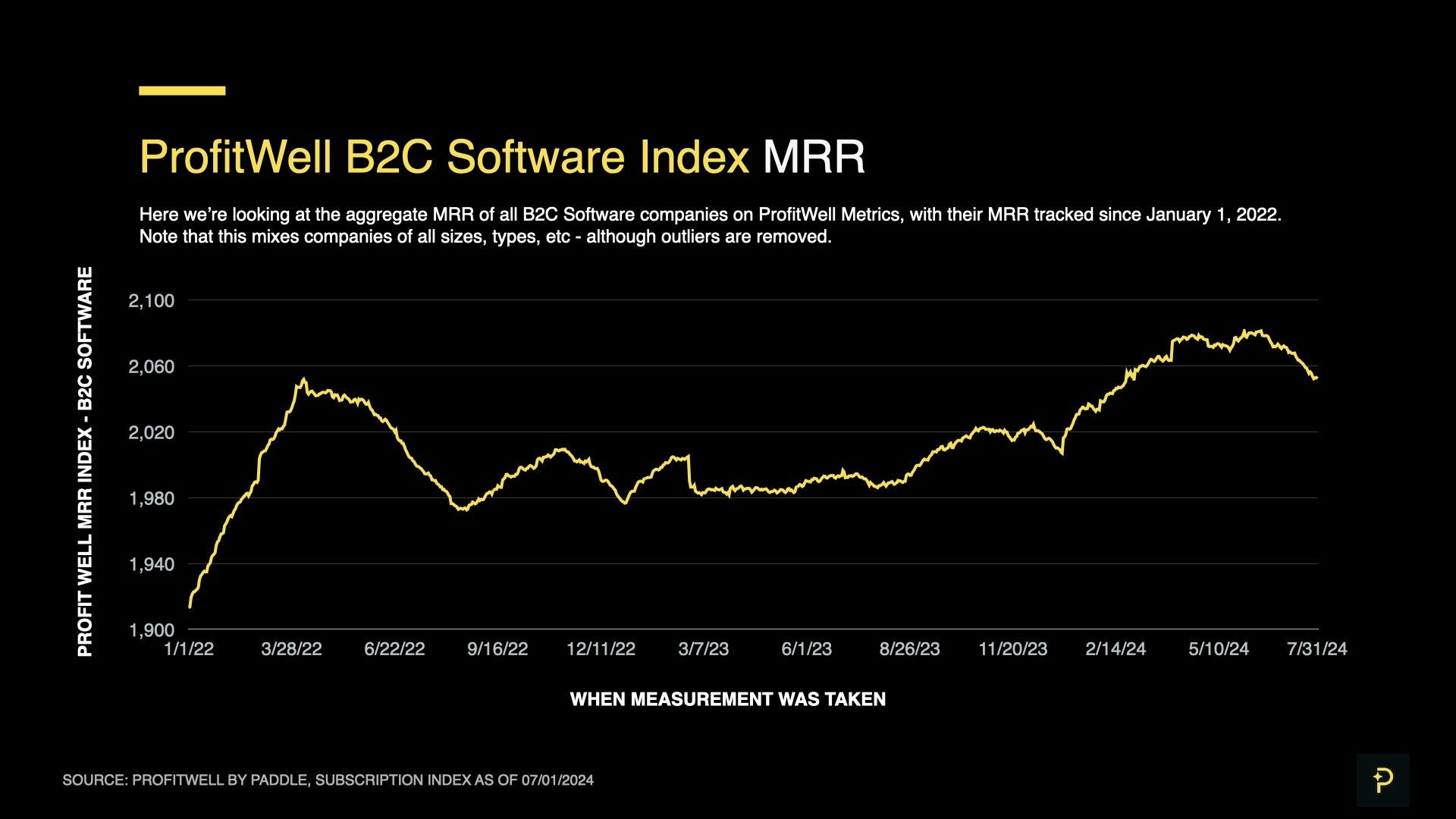

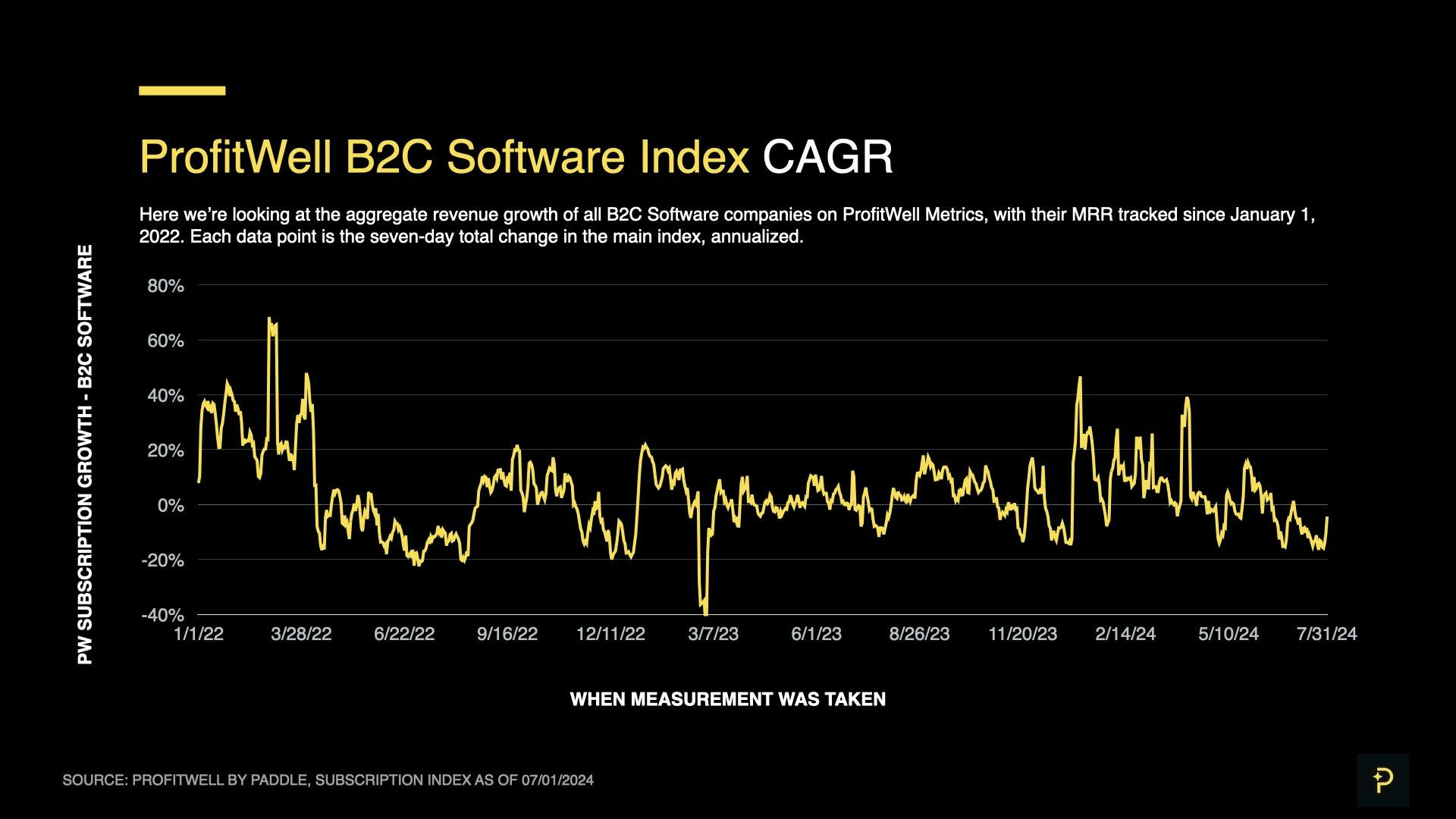

B2C remains sluggish for the summer

B2B slowed to a dismal -9.5% CAGR in July, continuing its fall after dropping to a negative growth rate in June. This is unsurprising, especially compared to B2B’s quick recovery, as business software spend is far more insulated from individual employees taking time off for the summer.

The B2C SaaS Index dropped to a value of 2052 - its lowest since February, after months of consistent growth since the beginning of 2024.

Barring a 1-day spike at the beginning of the month, all of July saw negative CAGR on a day-to-day basis.

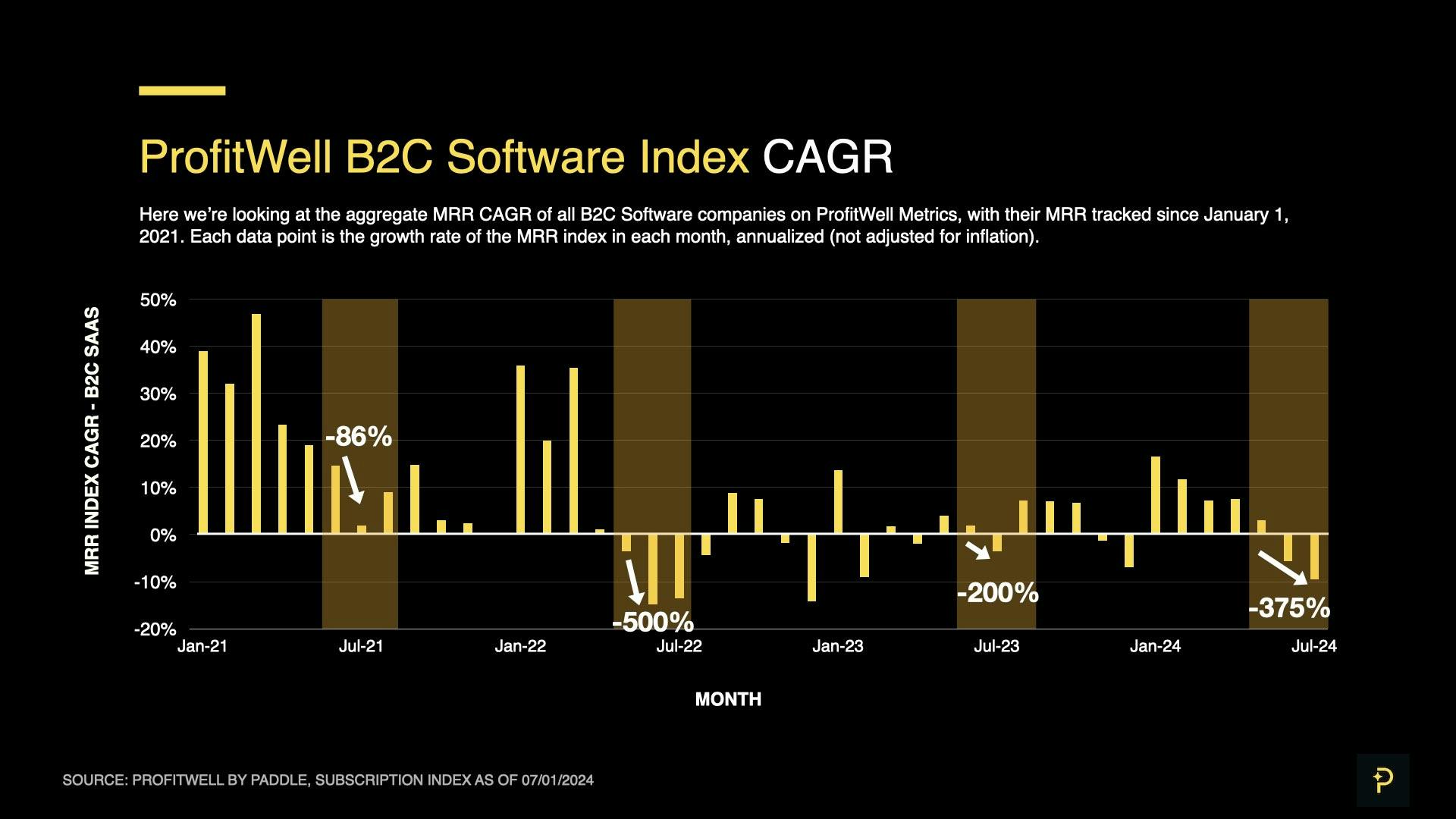

Looking back at historical B2C CAGR data however, shows that B2C’s June / July performance, while scary, is not abnormal, and will likely revert to pre-summer levels in August.

In fact, B2C’s 2024 summer dip of 375% between May and July is fairly typical, with 2022’s dip far exceeding it at 500% (granted, 2024 was an extremely volatile year for SaaS). Moreover, data from the past 5 years of the Profitwell SaaS index shows that recovery consistently happens by August of the same year.

B2C sales still sluggish, downgrades elevated

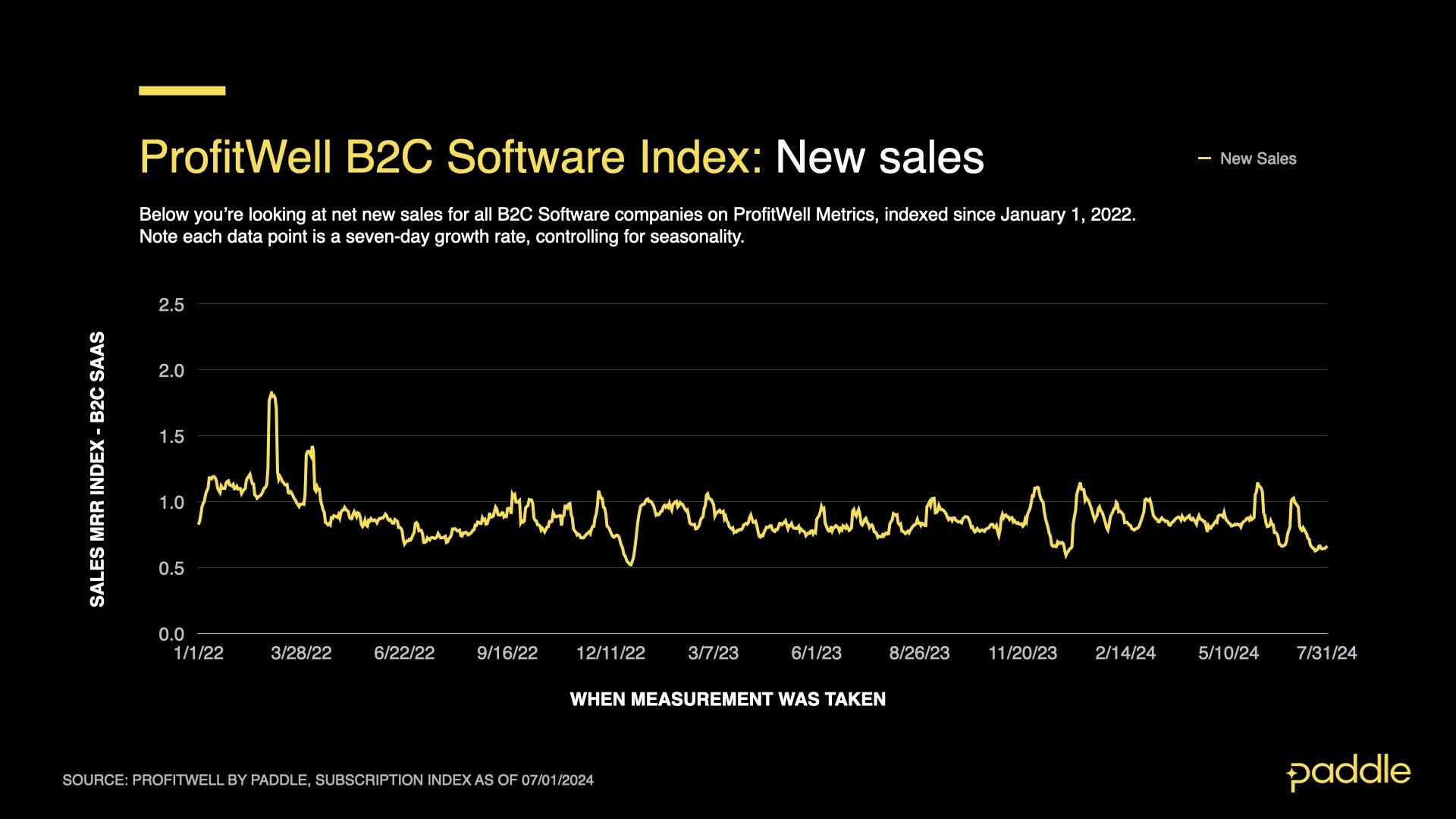

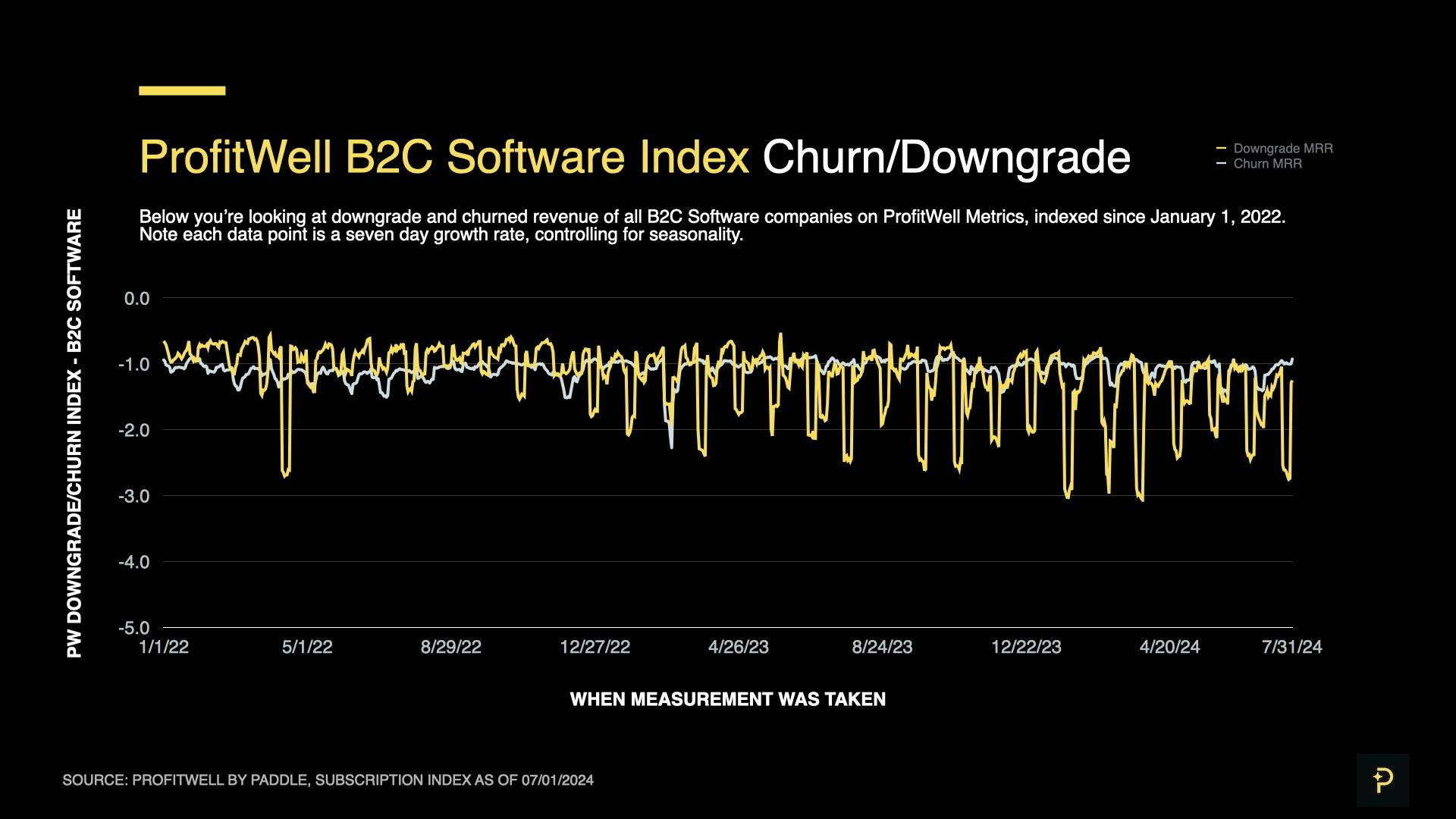

Examining the factors driving growth - new sales, churn, upgrades & downgrades - we find that the majority of B2C’s July slowdown came from a slowdown in sales and a jump in downgrades.

The New Sales index dropped significantly, by 9.8%, to an average value of 0.763 in July - its lowest value in 18 months.

Meanwhile, churn has remained stable, with a 1.1% decrease to an index value of -1.118.

Downgrades on the other hand, increased by a whopping 16.6%, to an average value of -1.723 - the highest downgrade index value seen since March 2020.

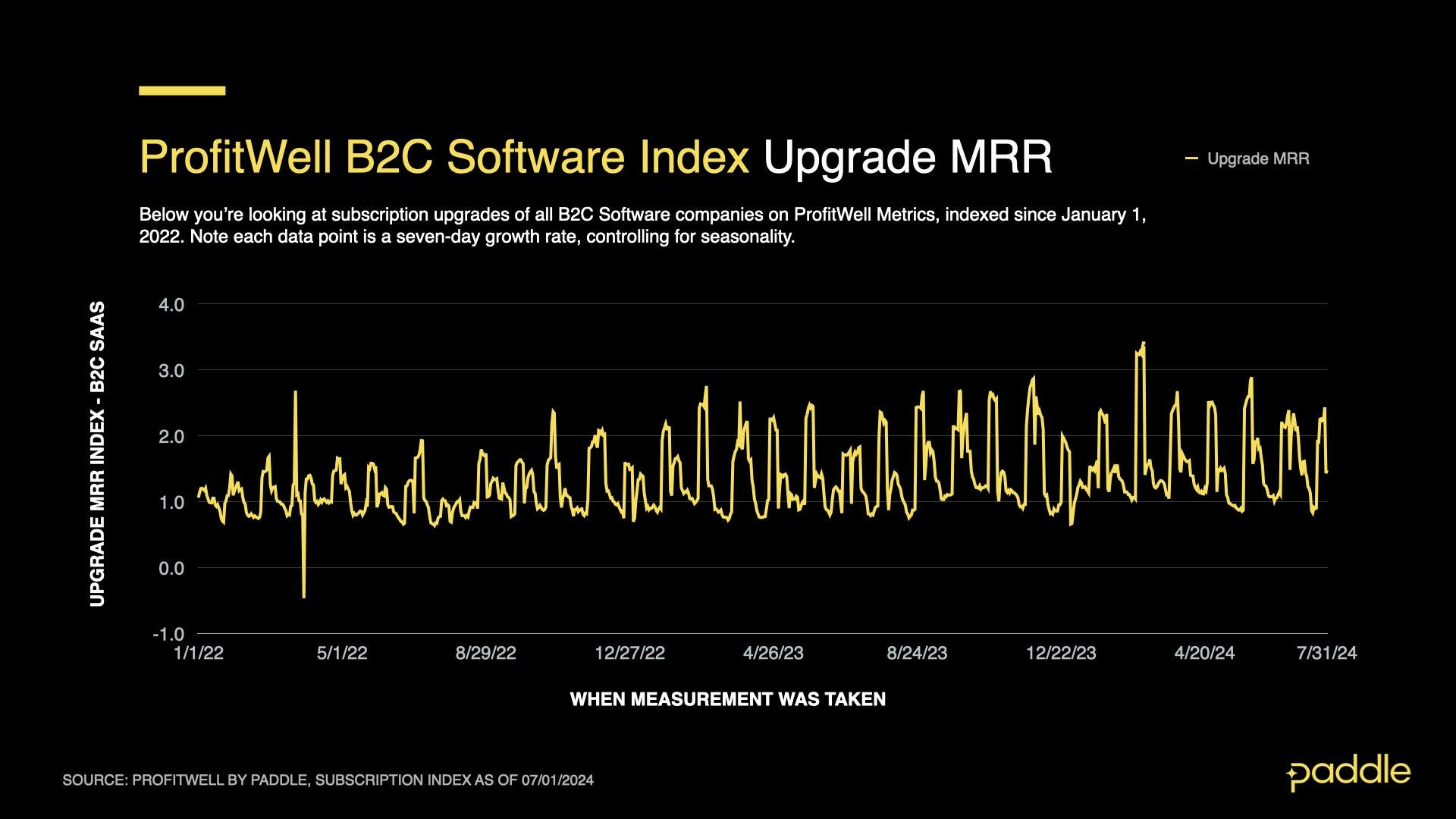

Finally, the Upgrade Index saw a moderate increase of 7.1%, to a value of 1.659 - continuing a slight upwards trend seen in June, where upgrades saw an increase of 5.2%.

While the upwards movement in upgrades was not enough to offset B2C’s overall summer slowdown, it is worth keeping an eye on, in the coming months. After B2C’s likely recovery in August, continually increasing upgrades may push B2C’s overall growth rate above our prediction of 8% CAGR for 2024.

Strategies to consider

Anticipating seasonality

As we’ve seen, B2C (and to a lesser extent, B2B) software spend is prone to large, regular swings in growth, sales, and upgrades throughout the year. Knowing when these periods of decreased spending are likely to occur, can help you manage your cash flow - even providing you the opportunity to mitigate slowdowns and keep growth stable.

By examining revenue data from Profitwell Metrics, we’ve identified a few of these annual slowdowns. On average, we find their effect on revenue growth to be as follows:

- June & July (B2C): -290%

- June & July (B2B): -32%

- November & December (B2C): -164%

- November & December (B2B): -121%

If you’re a B2C SaaS operator, and you’re looking for tactics and strategies for taking advantage of the upcoming Black Friday spending surge, consider signing up for our upcoming webinar on unleashing Black Friday success!

Be careful with discounts

You might be tempted to offer seasonal discounts to boost revenue during slowdowns, or encourage sales during holiday surges like Black Friday.

However, you must be extremely thoughtful when building your discount strategy, as you run the risk of devaluing your product offering. By discounting your SaaS, you lower the perceived value of your product to customers, and lower their willingness to pay over the long-term - increasing future churn, as the discount expires or your customer switches to another discounted competitor.

Instead of using discounting to drive growth during slowdowns, consider adding a “free” or cheaper “entry-tier” to your offering, allowing more price sensitive customers to experience the value of your product before being prompted to upgrade, to access more features.

Another option is offering extra value (e.g., more seats or additional services) at your current pricing, for a limited time. Like discounts, this tactic can drive urgency and give customers the feeling that they scored a great deal - without hurting your product’s perceived value in your customers’ eyes.

Checkout our discount pricing strategy guide to learn about the pitfalls of discounting SaaS products, and explore alternate pricing strategies.

Find new efficiencies to maintain growth

While navigating a period of slow growth, segmenting your customers, and applying different pricing strategies to each group is an excellent way to expand your customer base - including those with less willingness to pay, while also serving your customers with the greatest need (at premium prices).

By identifying customers who would benefit from your product, but aren’t willing to pay up front, you can build customer segments from their common characteristics - later personalizing your marketing & on-boarding experience, so they experience the utility of your product before they’re upsold or prompted to pay.

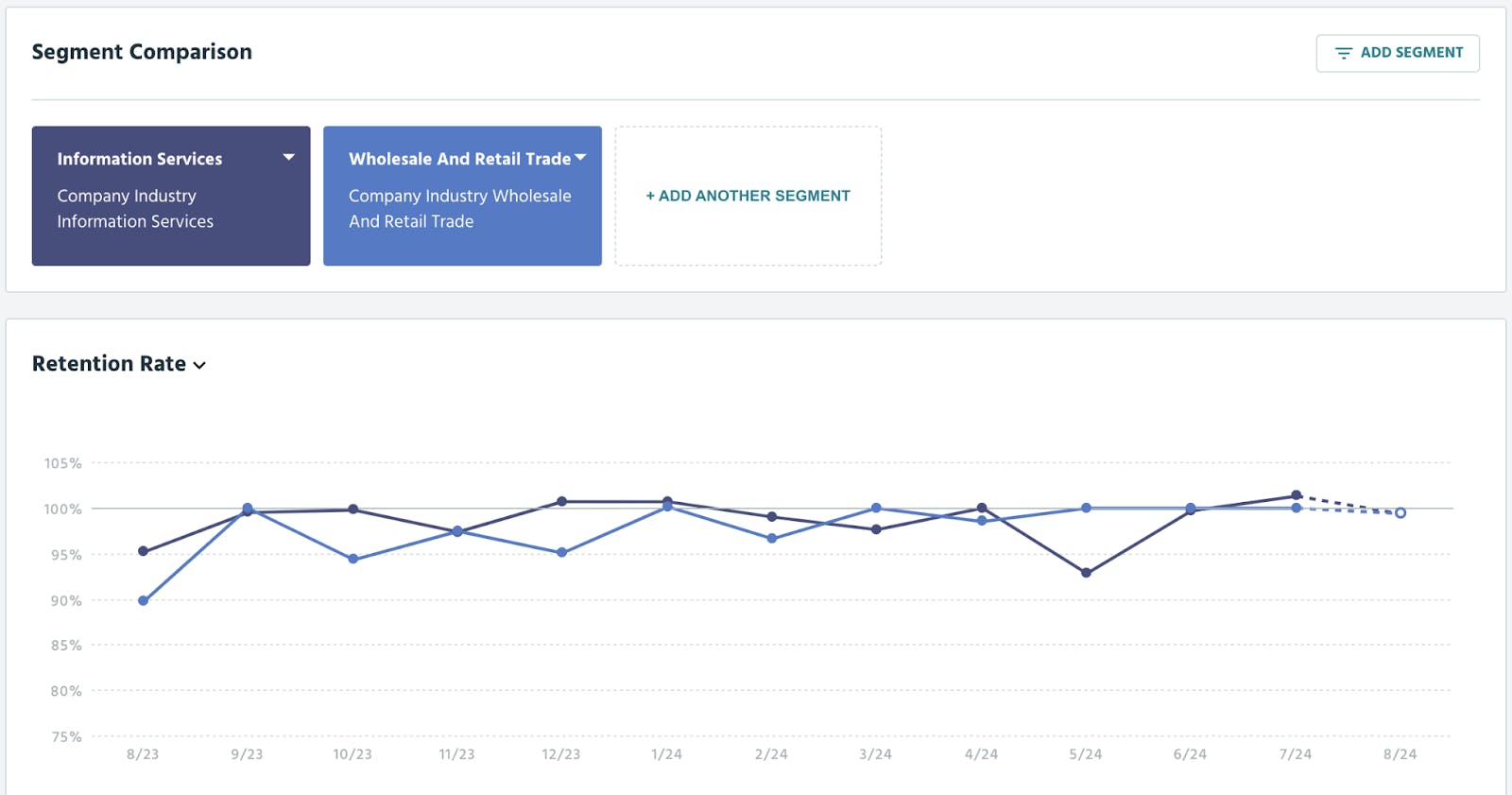

One of the leading tools for segmentation & revenue analysis is Profitwell Metrics - it allows you to segment customers by location, product engagement, age of account, revenue, industry and more - before comparing these segments with subscription metrics including LTV, net retention rate, and churn. Best of all - it’s free for companies of all sizes. Explore our demo here.

Keep up with developments in subscription software

B2C’s summer slowdown, while temporary, is another great opportunity for consumer app companies to find efficiencies in their subscription economics.

One of the greatest emerging opportunities for subscription app companies is monetizing on the web - instead of just on the app store - and avoiding Apple’s 30% transaction tax. Efficiency gains this large are rare, and often can mean the difference between struggling to keep the lights on, and becoming massively profitable. So naturally, we’re quite excited about it at Paddle.

We’ve put together an in depth guide about how to navigate web monetization, and the main strategies to implement. Check it out here!

We’ll also be covering developments like this and more, in our upcoming Paddle Forward event this September - including ways to remove friction & optimise conversion in the checkout process, tactics for reducing churn and improving payment acceptance, and much more. Click here to sign-up!

We publish monthly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here

Subscribe below to be the first to receive the next SaaS Market Report.