September brought a strong rebound to the B2B and B2C SaaS markets, after an unusually volatile Q2 & Q3.

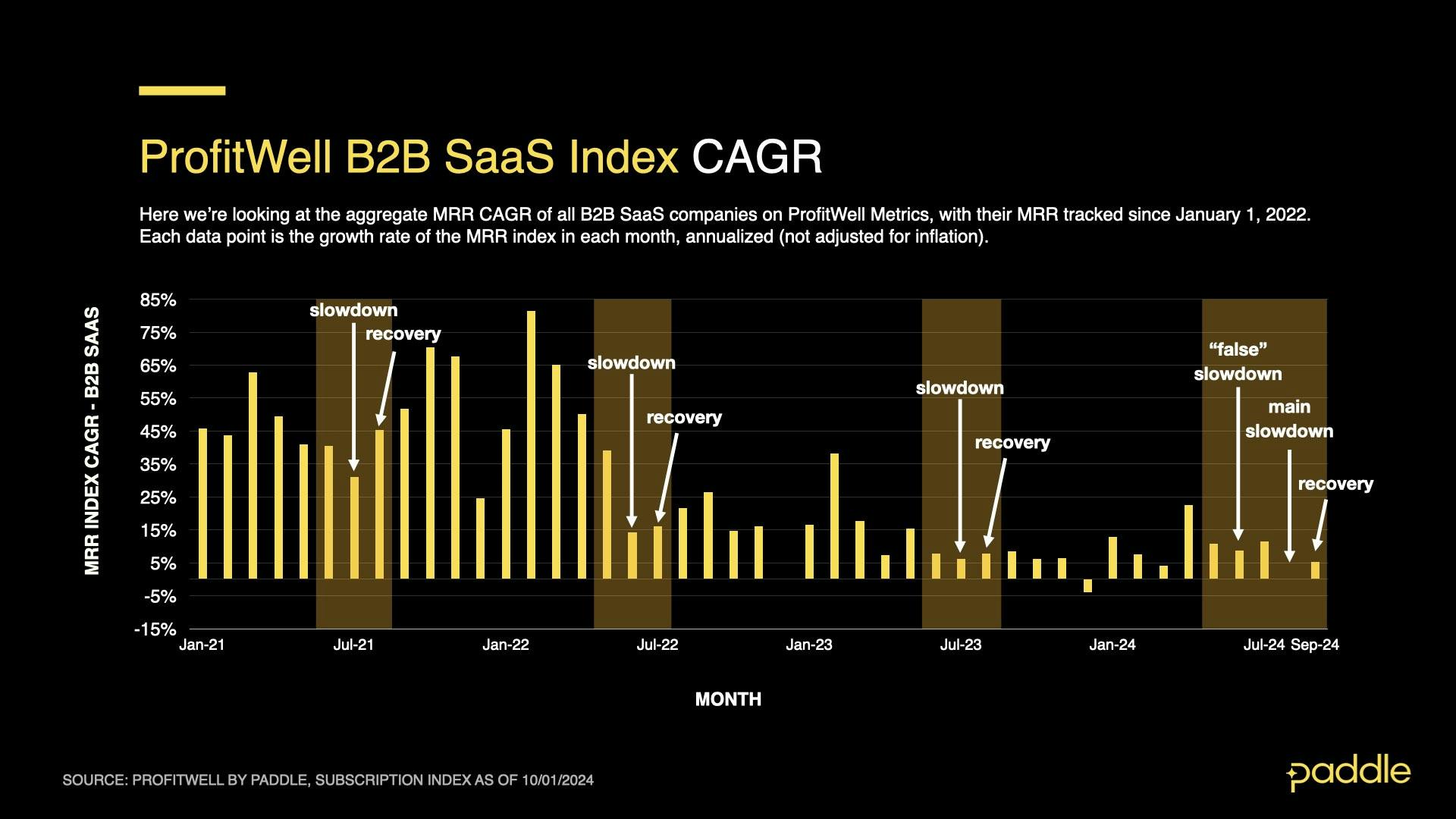

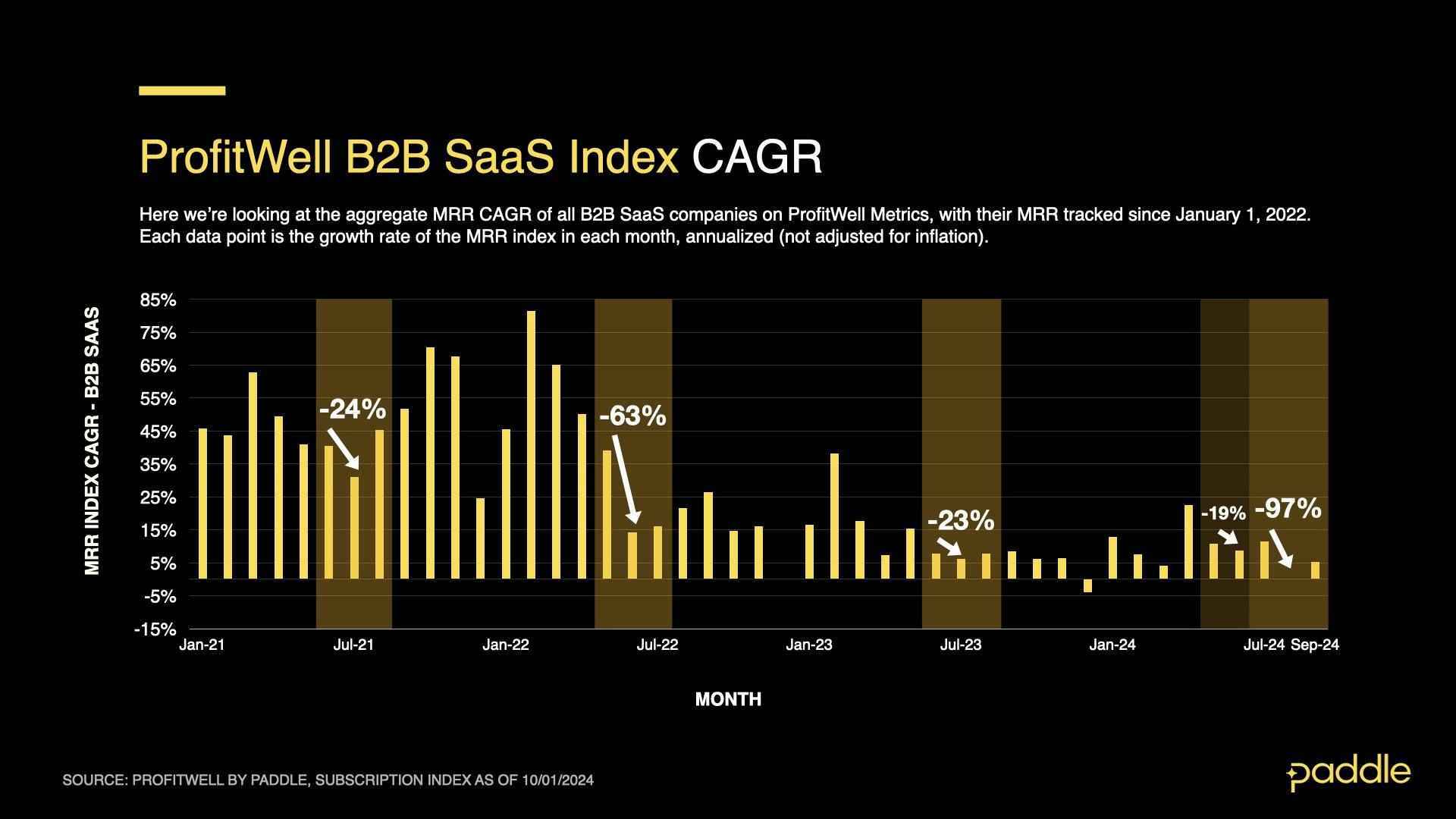

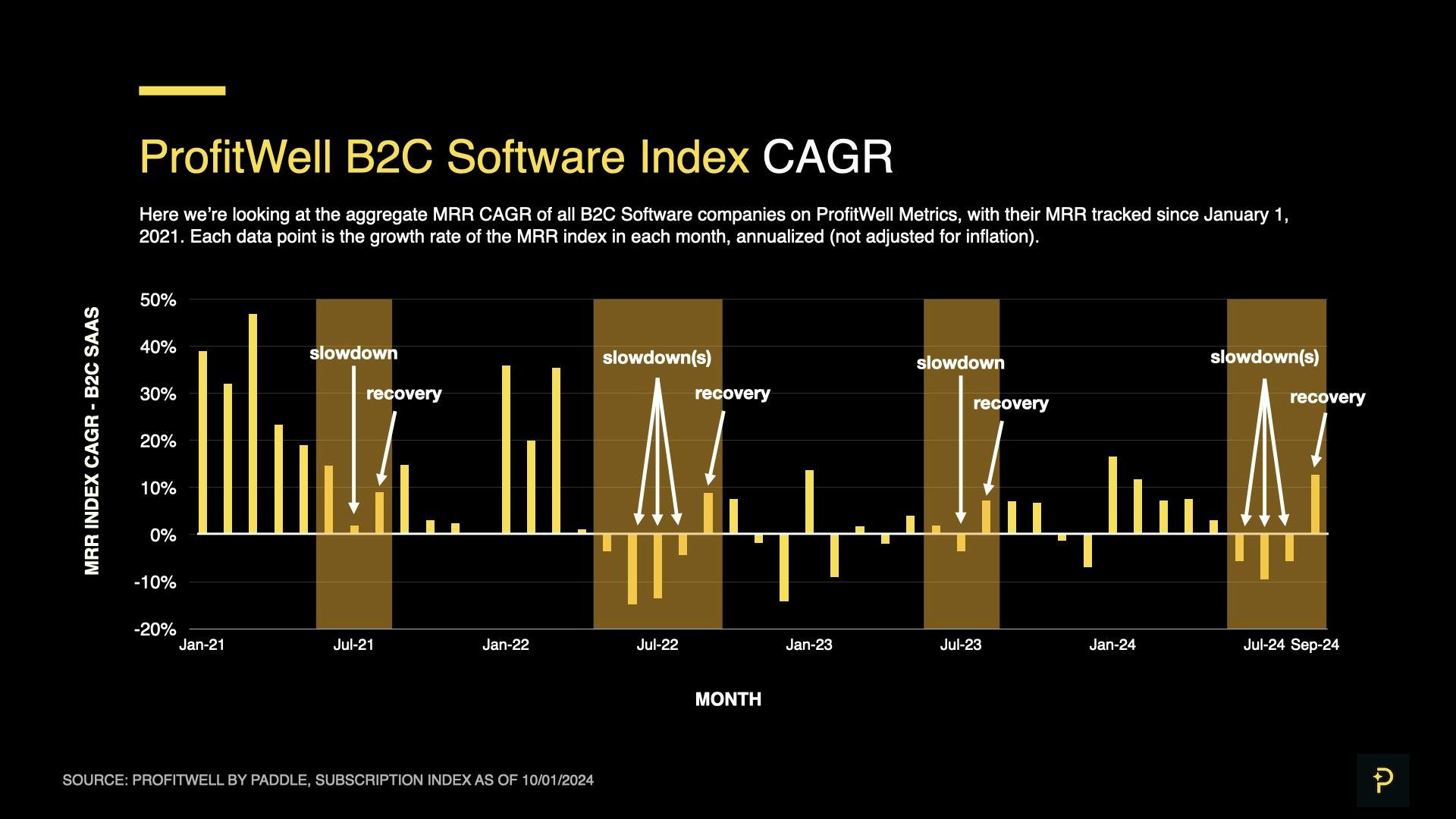

Entering the summer, we anticipated a seasonal dip in subscription software spend (as consumers and employees took time off), but we did not expect the slowdown to last nearly 4 months, or for a “false recovery” to occur, with growth rates temporarily recovering for a few weeks, only to drop again in August.

Despite the bumpy ride, we can confidently state that this summer’s seasonal slowdown is officially over, with B2B on a clear path to recovery (hitting 5.3% CAGR and trending upwards), and B2C achieving its second best growth month in 2024, at 12.7% CAGR.

Moreover, with the Fed’s 0.50% interest rate cut, we anticipate B2B & B2C SaaS will demonstrate stronger than expected growth in Q4, surpassing our initial forecasts of 11% & 8% CAGR respectively.

So give yourself a pat on the back for weathering the summer slump, while we explore the factors driving a strong Q4 for SaaS 👇

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine 2024 performance.

Subscribe to the SaaS Market Report newsletter to get these updates in your inbox.

KP and Gavin discuss this month's data. Scroll down to read the full report.

B2B rebounds (for real this time)

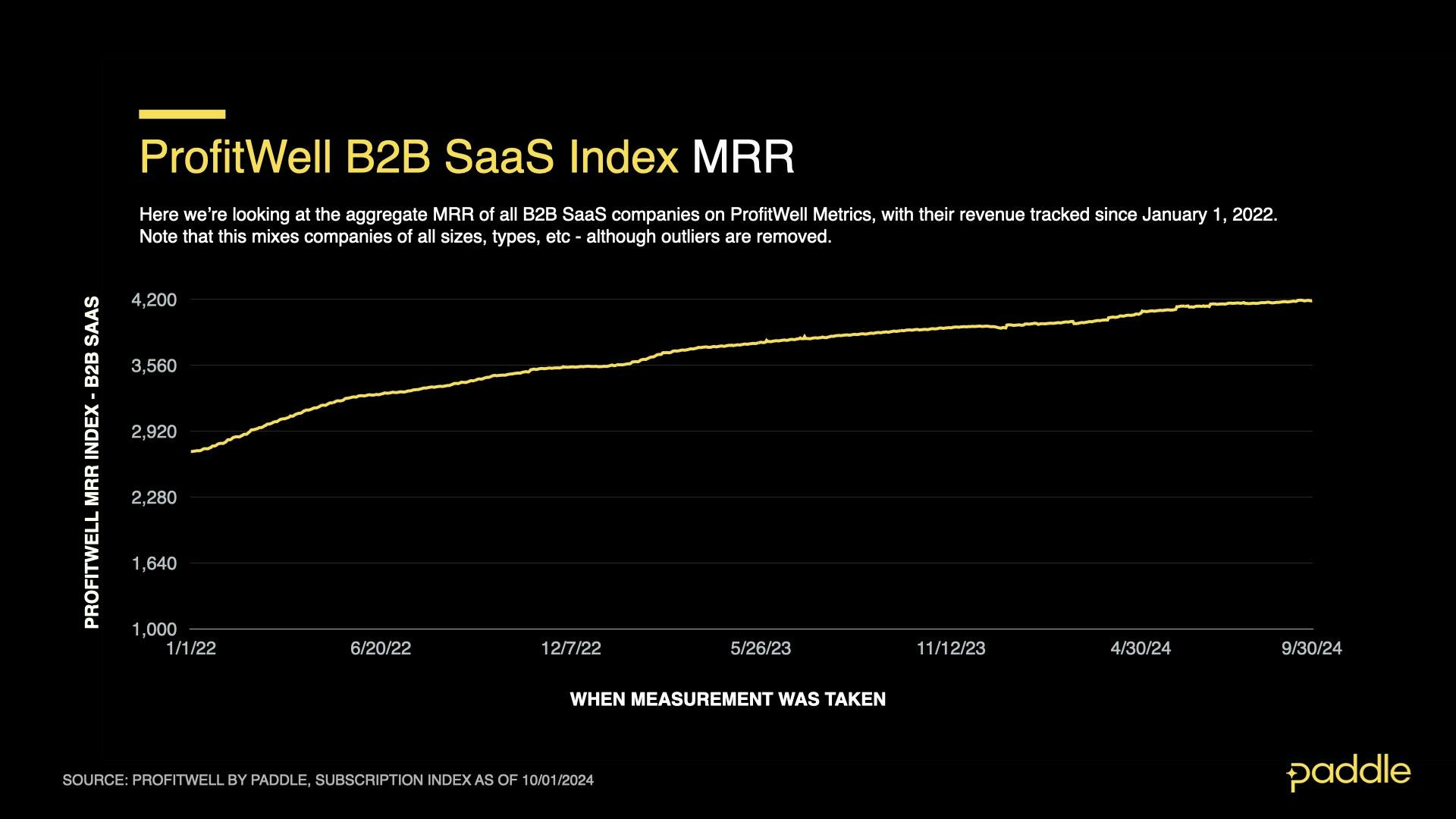

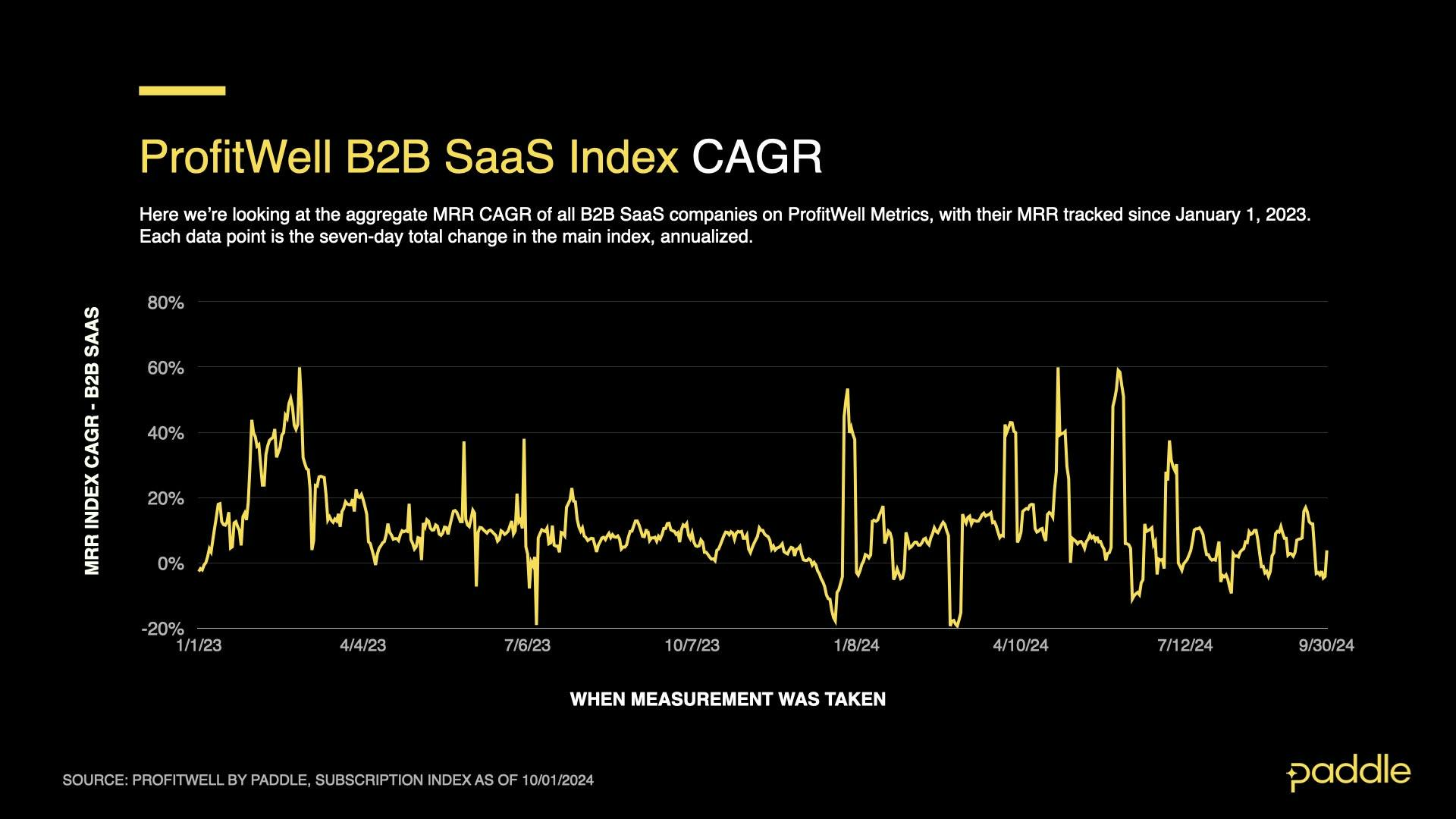

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

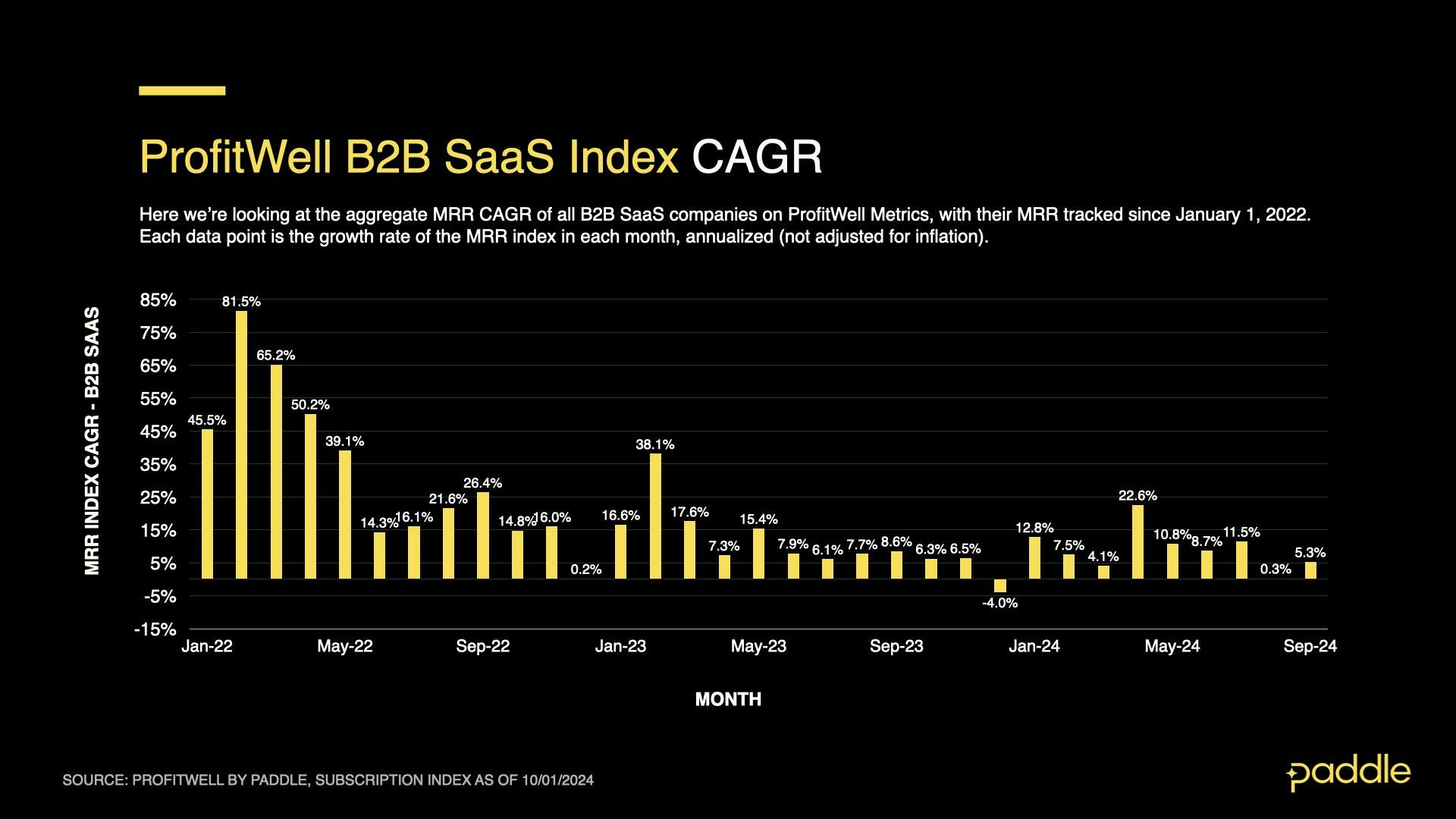

B2B showed clear signs of recovering from its seasonal slowdown this September, rebounding to an average growth rate of 5.3% CAGR (up from a dismal 0.3% CAGR in August) and a Profitwell MRR index value of 4191.

This marks the end of an unusual summer for B2B, where the anticipated seasonal dip in software spend occurred 2 months later than expected, and was preceded by a “false” slowdown in June (with B2B growth slowing by 19%), before the “main” slowdown occurred in August, with growth dipping by an enormous 97%.

This also makes 2024’s summer slowdown the largest we’ve seen since the Profitwell SaaS index was started in 2019; with the B2B SaaS market typically dropping by just 32% over the summer months.

Clear skies ahead for B2B

While a growth rate of 5.3% CAGR marks a solid recovery from the chaos of summer, it’s clear that B2B has even more room to grow.

Examining Profitwell’s growth data at the day-level, we find that growth has steadily trended upwards throughout the month, with the third week of September averaging a growth rate of nearly 13% CAGR.

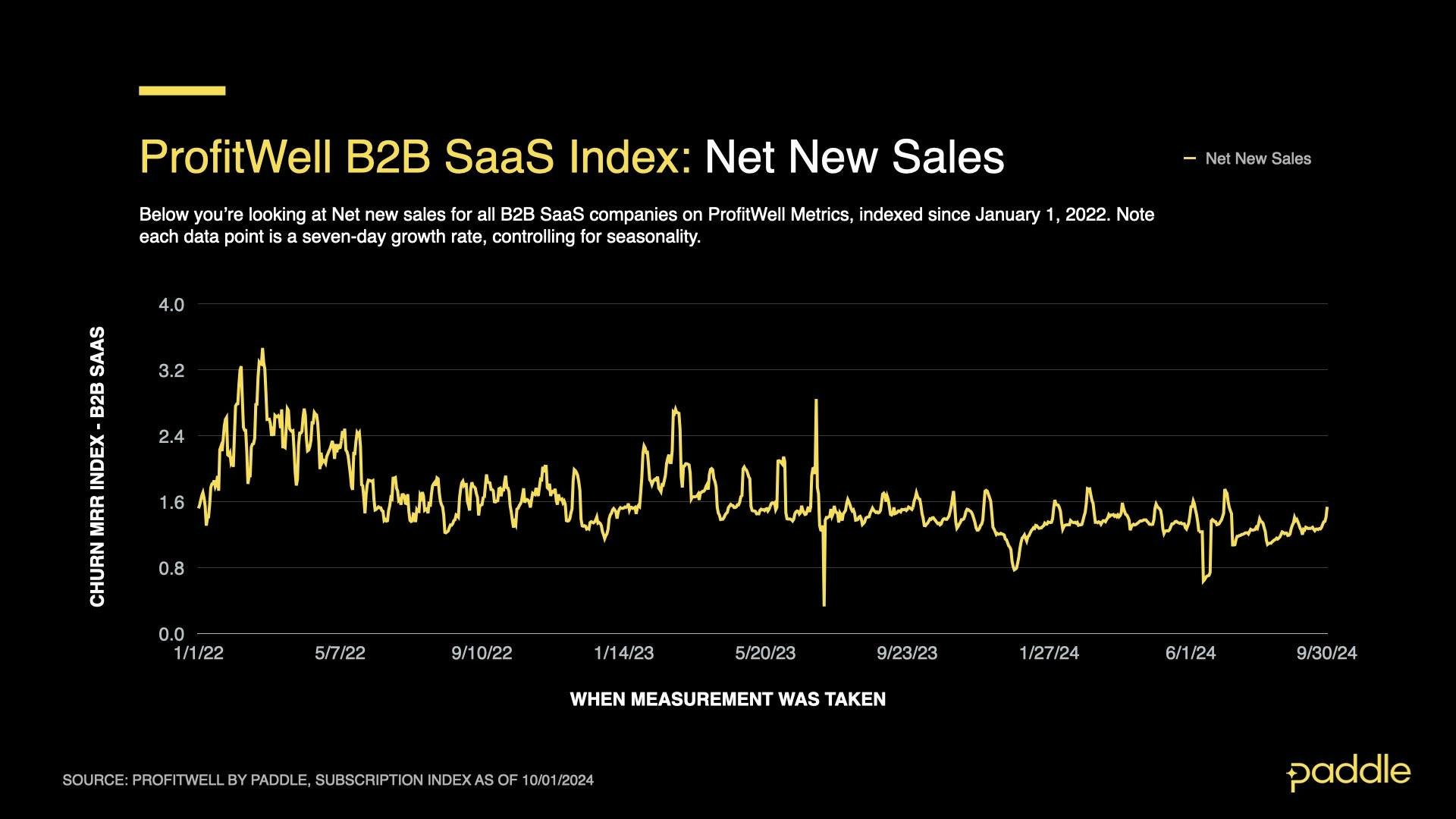

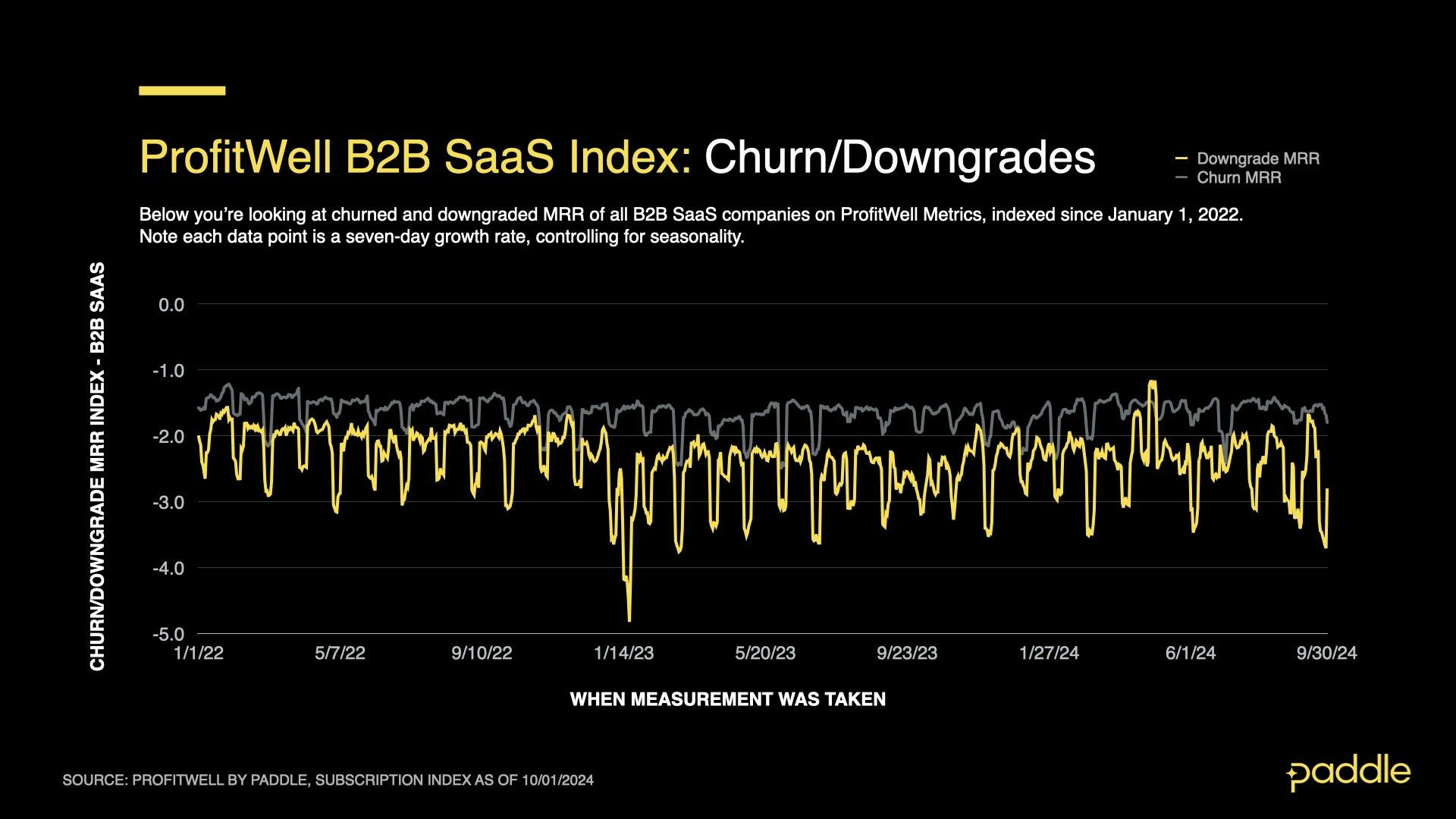

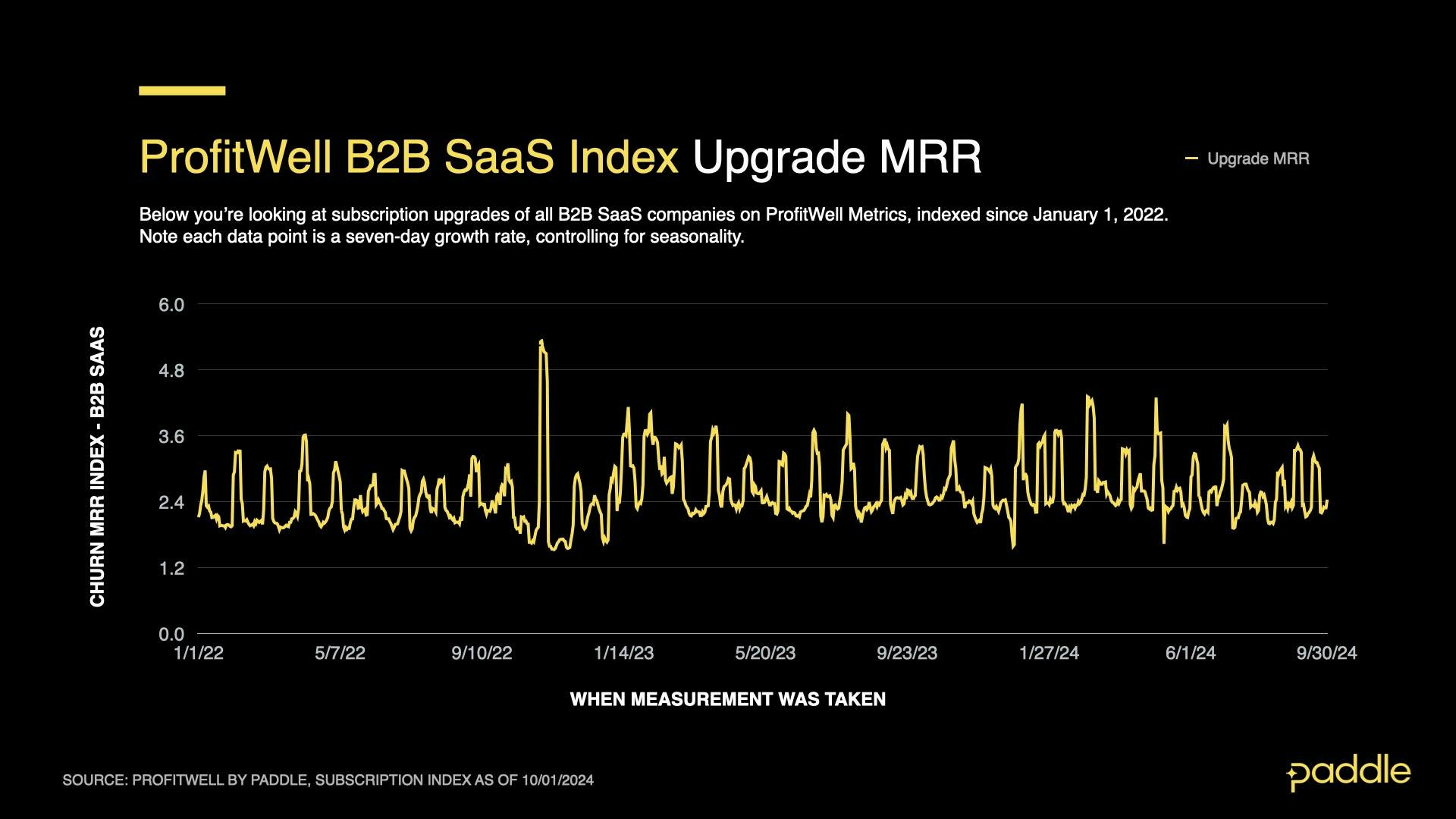

Analyzing the Profitwell B2B Indices (tracking new sales, churn, upgrades and downgrades) we also find signs pointing to B2B’s continued growth.

Here we see a burst of activity, with new sales, churn, upgrades and downgrades all increasing in September. This is consistent with a “rebound” from a summer slump, as the employees who took time off, return to the office and work through a backlog of software purchasing decisions - integrating new vendors, buying more seats, or even switching software providers.

Starting with new sales, we find a 7.9% increase compared to August, with the sales index averaging to 1.307 over September.

Churn grew by 6.3%, hitting an average index value of -1.641, while downgrades increased by 15.3%, averaging -2.731 on the index.

Finally, upgrades grew by 11.2%, reaching an average index value of 2.699.

With summer over, and employees settling back into their routines, we can expect this “burst of activity” to subside, and the new sales, churn, upgrade, and downgrade indices to settle back to their nominal values, from before the slowdown.

Taking this into account, we predict that the new sales index will climb another ~5%, back to its pre-summer average; while the downgrade index falls ~15% to settle on its average value from before the slowdown.

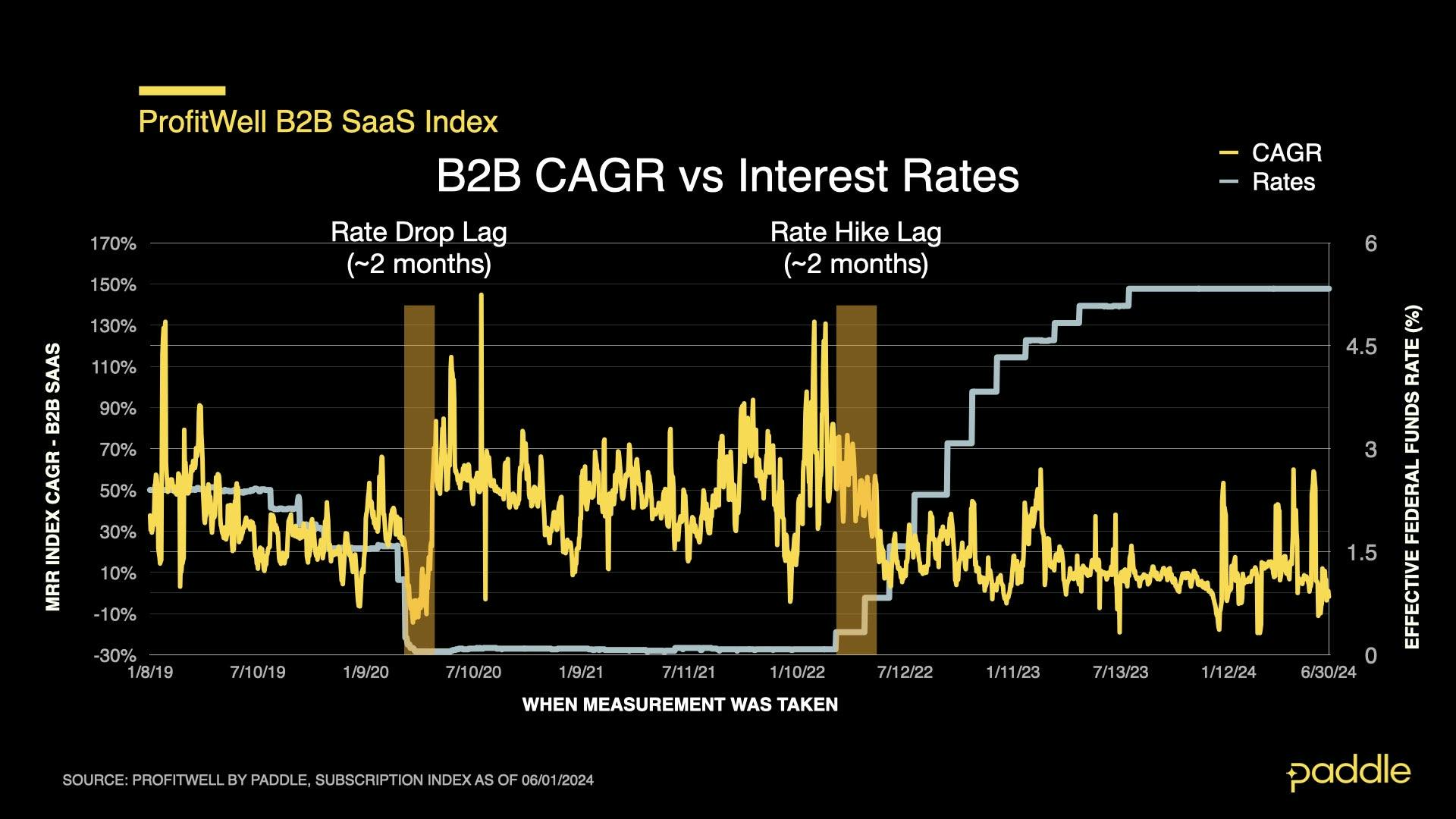

Combining this with the acceleration in growth we expect to see in November (with historical Profitwell data demonstrating a 2 month delay before interest rate changes impact the B2B SaaS market), we can expect B2B SaaS growth to hit 11% CAGR in October, then begin to climb past this number for the rest of Q4.

B2C's lightning recovery

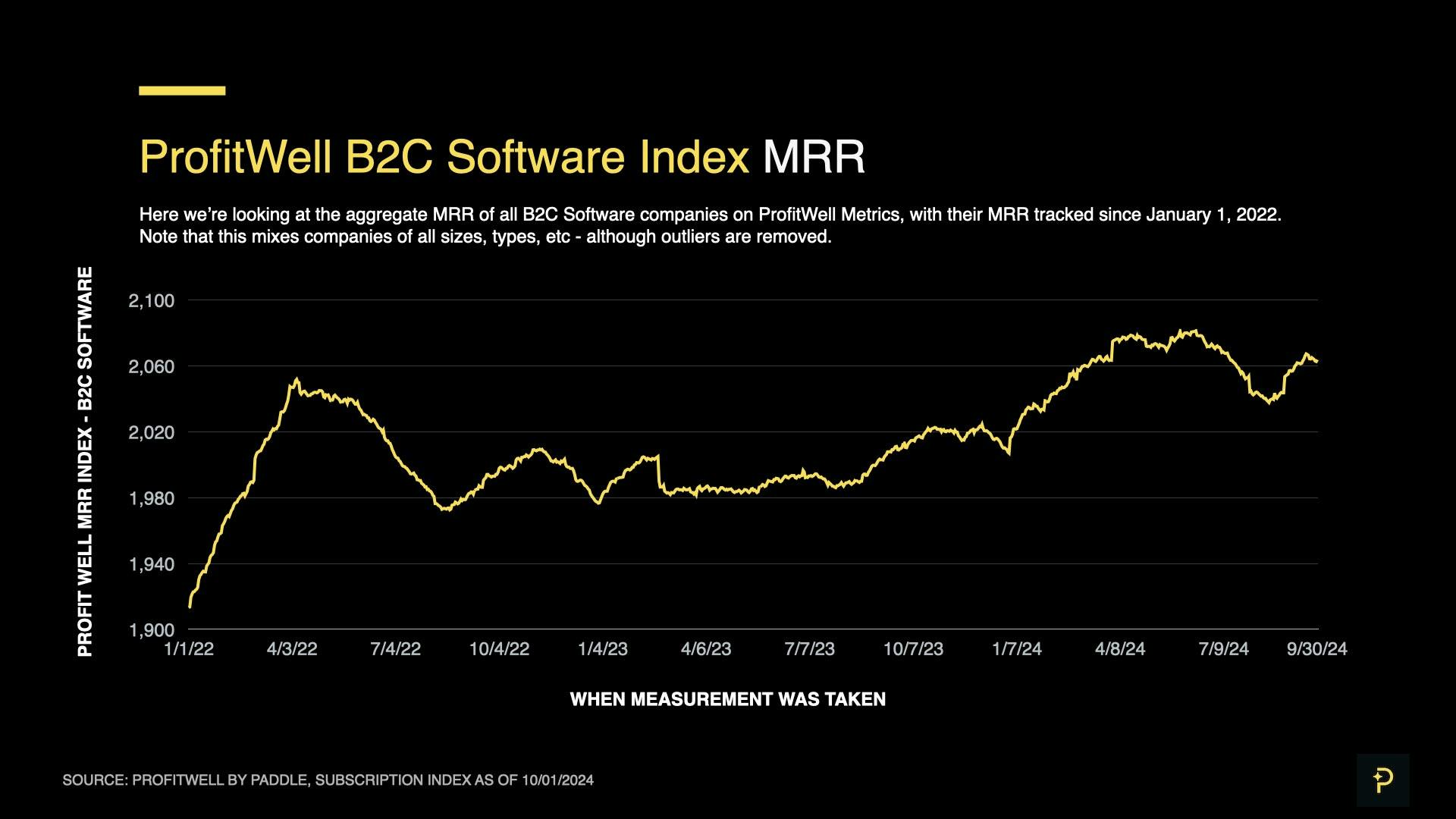

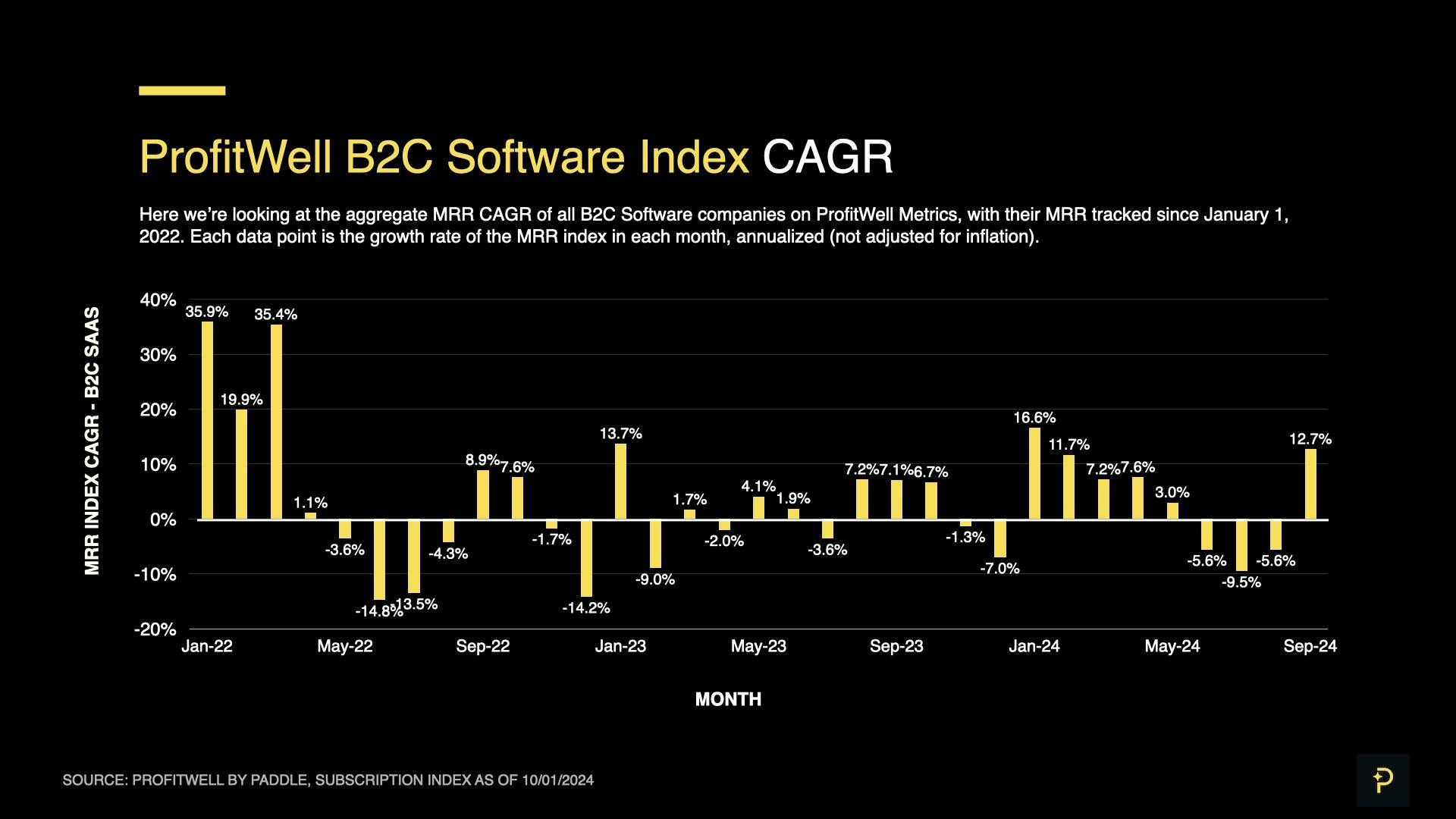

September saw B2C hit a growth rate of 12.7% CAGR and an MRR index value of 2064 - its strongest growth rate since January, when B2C was recovering from a seasonal slowdown from the winter holidays.

The B2C market’s recovery this month concludes a nearly 4 month long summer slump, one of the longest we’ve observed since the Profitwell SaaS Index began in 2019. This year’s slowdown was only matched by 2022’s slowdown, which was exacerbated by rising inflation, and significant interest rate hikes.

B2C’s rebound this month was also larger than expected, gaining over 18% CAGR in a single month, as B2C growth increased from -5.6% CAGR in August to 12.7% CAGR in September.

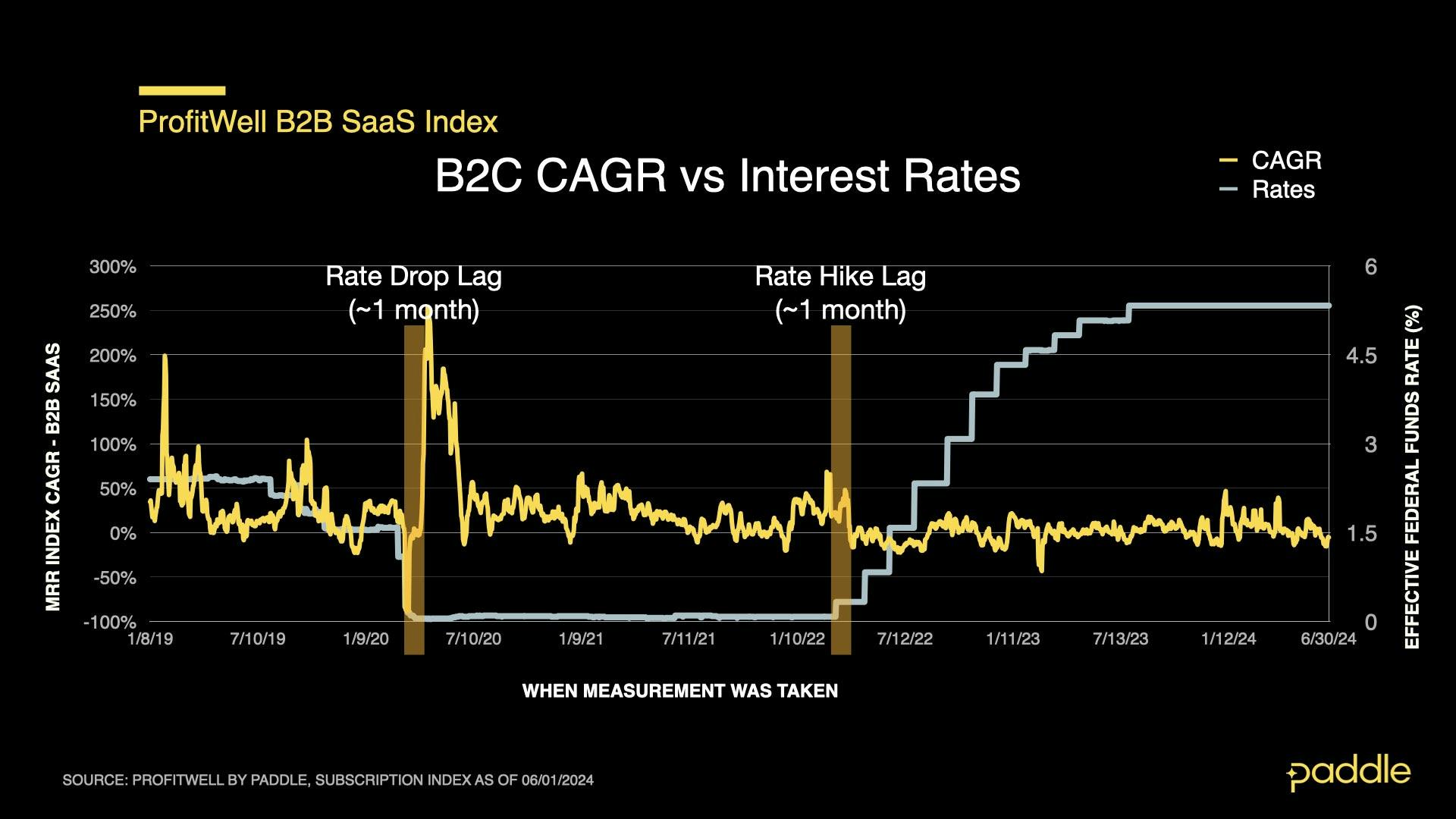

This was likely driven by the Fed’s interest rate cut in September, with historical Profitwell data demonstrating that the B2C market typically reacts to interest rate changes in less than a month.

A surge in sales (and everything else)

The driving forces of B2C growth - new sales, churn, upgrades and downgrades - point to a recovery similar to the B2B market. Consumers returned from the summer holidays this September, starting work and school again, and generally spending more time indoors.

This drove a “burst of activity” across our new sales, churn, upgrade and downgrade indices, as consumers’ general usage of subscription software increased, and they made decisions about whether to upgrade, downgrade, or switch subscription software products.

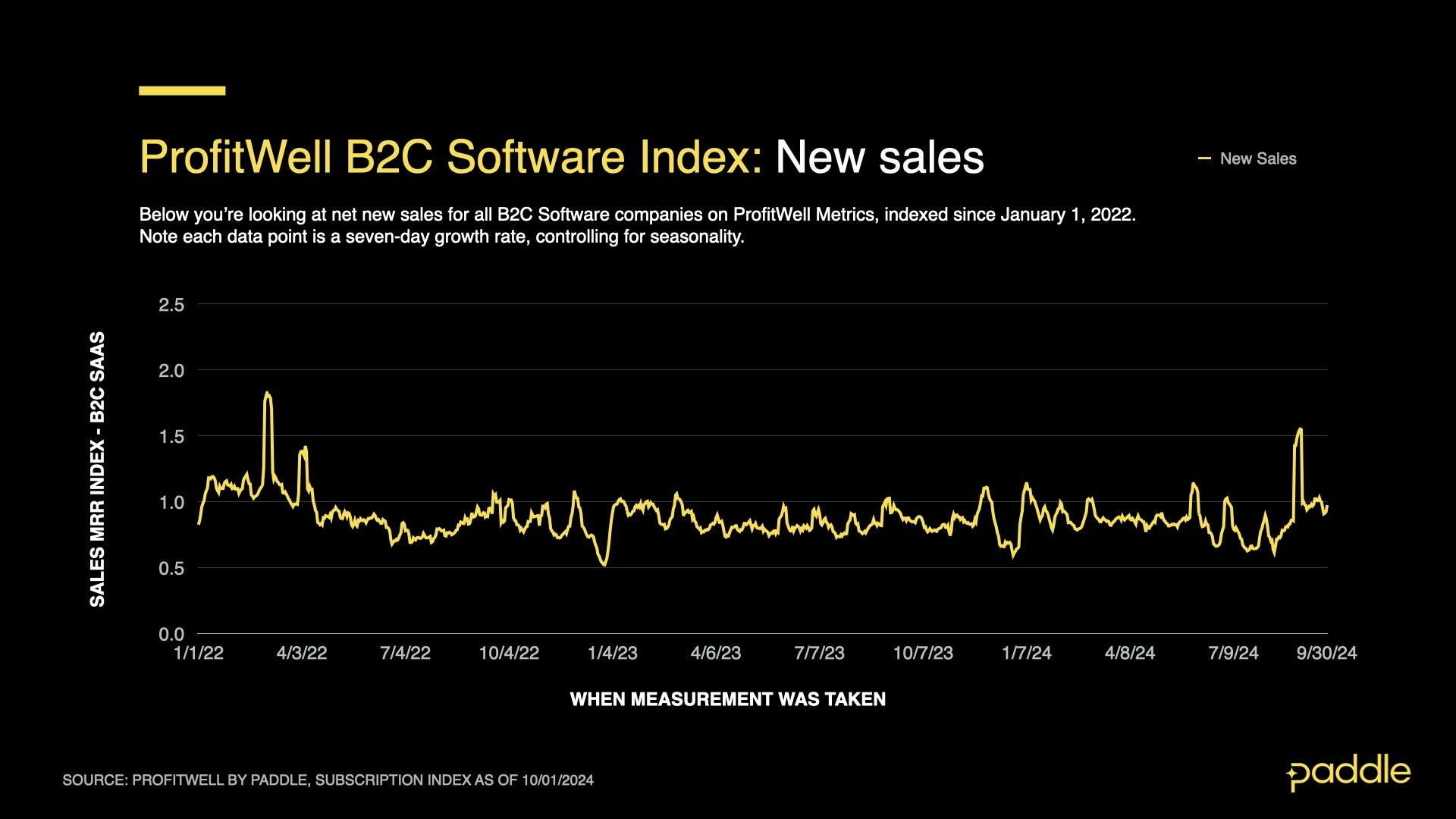

The Profitwell new sales index saw the greatest increase, making up for 3 months of declining sales, and hitting an average index value of 1.089. Driven by an enormous 41.4% surge, this was the largest spike seen since April 2020, during the volatile opening days of the pandemic.

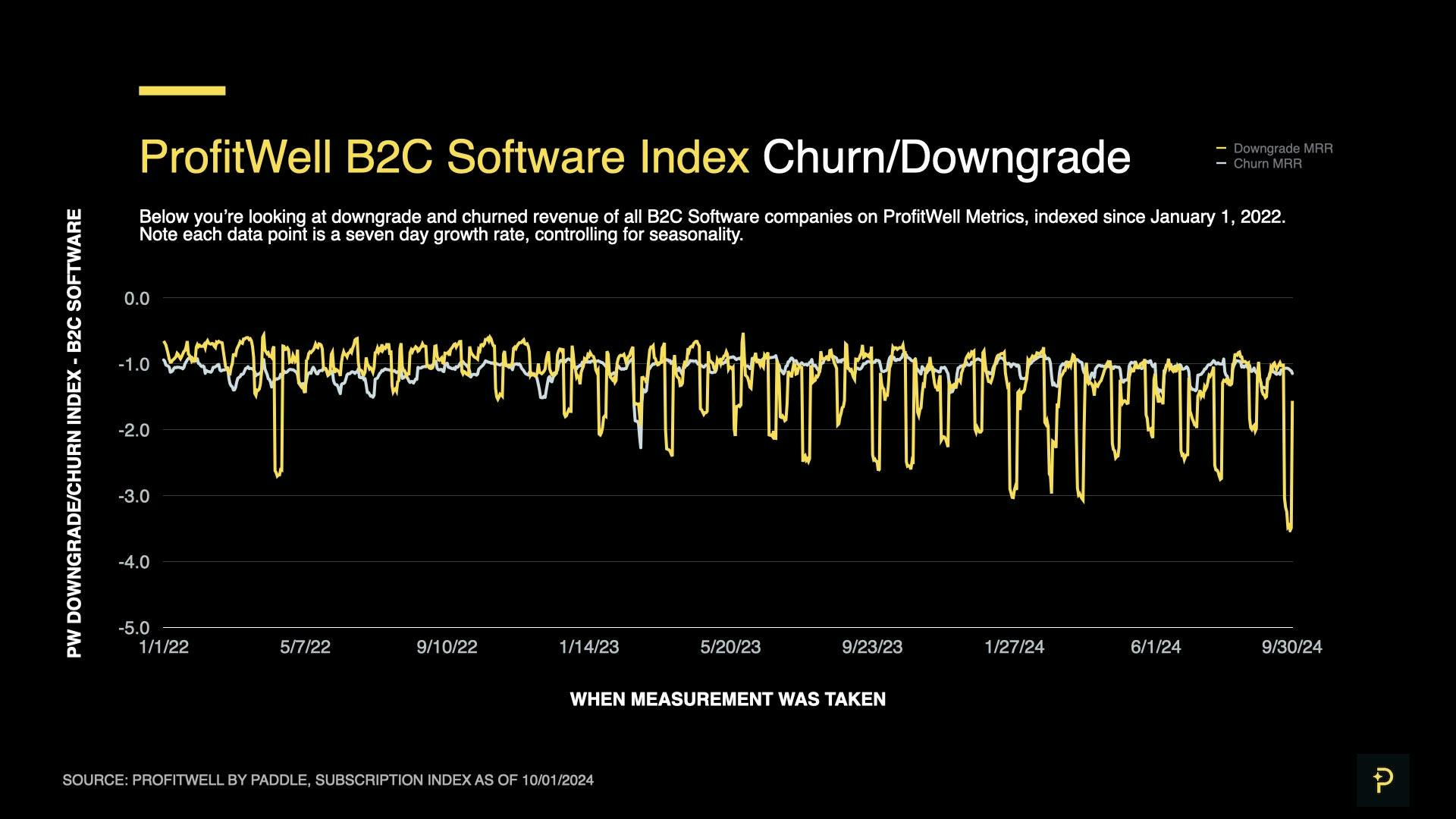

The churn index grew by 7.8% in September, to an average value of -1.167, its highest since Feb 2023. Downgrades on the other hand, grew significantly, reaching an average index value of -1.672, after growing by a whopping 34% in September.

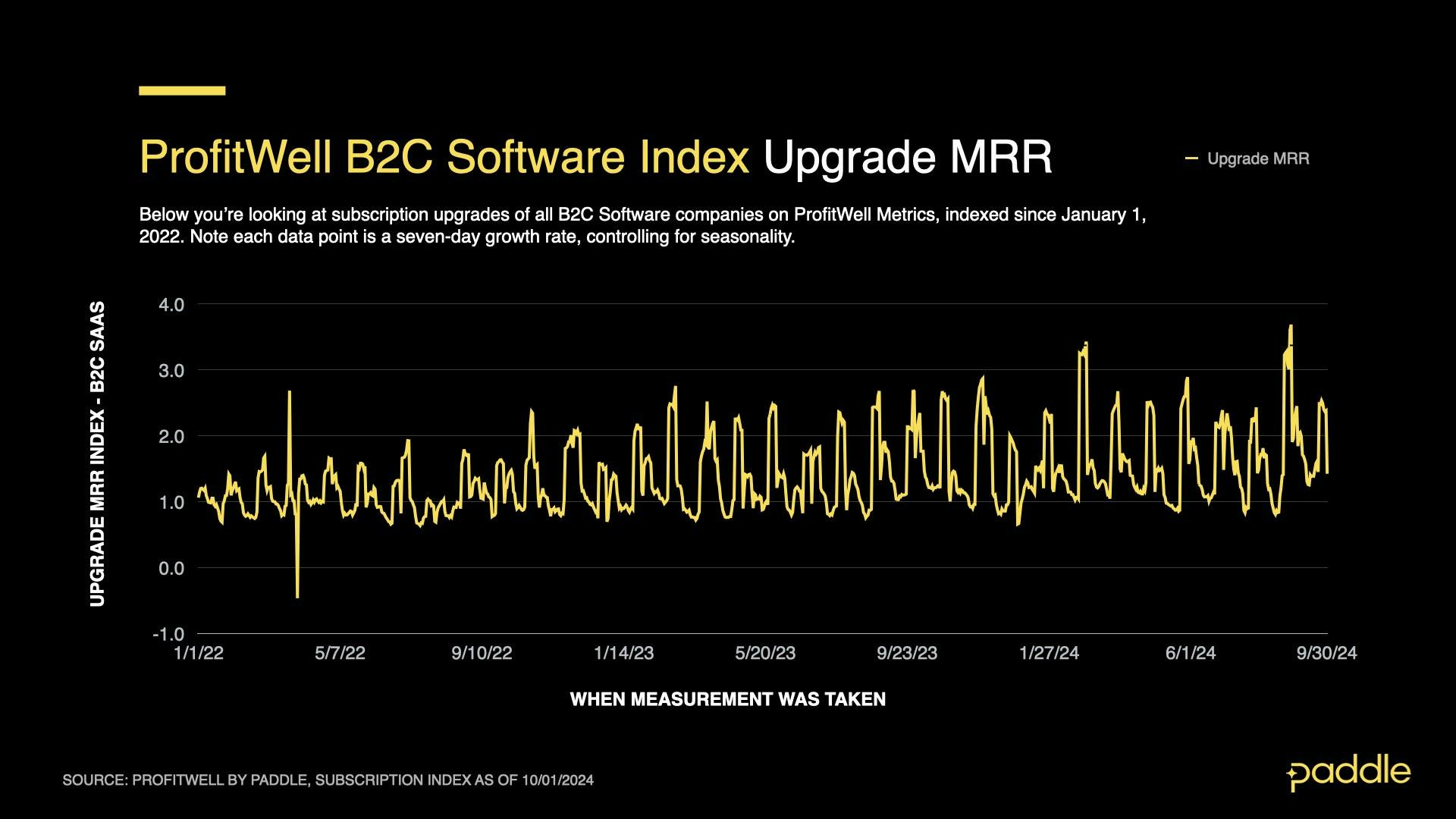

The increase in upgrades however, was comparatively minor, growing only 5.6% in September, and reaching an average index value of 1.860.

Similar to what we observed in B2B, after this burst of activity across all four B2C growth drivers subsides, we can expect these indices to return to their nominal values (from before the summer slowdown).

This means the new sales index will likely fall by ~12%, churn will drop by ~9%, while upgrades and downgrades fall by ~15% and ~11% respectively. This will likely have a cooling effect on B2C growth, however, this will be working in opposition to the upwards pressure on B2C growth exerted by the Fed’s September rate cut.

Accordingly, we are likely to see B2C growth fluctuate around 12% CAGR over the next few months (potentially even dropping by a few percentage points), before slowing down for the holidays again in December.

Strategies to consider

With a few months of stable growth ahead, it’s important to make every month count before the next “holiday slowdown” in December.

Before we jump into our strategies for taking advantage of this high growth period, one thing we’d like to call attention to is Black Friday - an exceptional opportunity for consumer companies to capture new customers with deals. Check out our Ultimate Black Friday Guide for tactics and strategies for making the most of this opportunity!

Trust is the foundation for retention

Building and maintaining customer trust is one of the most important steps to creating an exceptionally sticky product.

If you run a SaaS company, the bar for proving your value to your customers is much higher than products which are one-off purchases. Your customers pay for your product monthly, and they will ask themselves whether your product is worth it, each time they see your company on their credit card bill.

This means that ensuring your product continuously solves your customers’ core problems is merely table stakes. To maintain a high retention rate, you need to proactively share your product roadmap (and make sure it’s aligned with your customers’ vision for the future), call attention to new features, and maintain channels for customer feedback.

Investing in in-product communication channels, and regular launch events are an exceptional way to stay top of mind with your customers, and show them that they’re subscribing to a product that gets better every day. We also suggest “starting small” when seeking customer feedback, and only asking for in-person customer interviews once a rapport has been established.

For more tips and tricks on building customer trust, check out our recent webinar with Beamer, as part of our Paddle Happy Hour series, where we do a deep dive on the tactics for demonstrating long-term value with your product.

Grow your margins with web monetization

The recent court rulings that forced Apple and Google to open up their app stores have created an opportunity to significantly grow your margins by re-directing customers to subscribe on the web (rather than directly in-app), thus avoiding Apple’s 30% transaction fee.

Understandably, this is a new approach to monetization, and there’s a lot of apprehension about implementing it - whether from fears of getting on Apple or Google’s bad side, needing to deal with tax remittances (instead of letting the app store automate it), or even decreasing conversion by adding another step to your payment flow.

That said, it's easier than you think, and several top app builders have used web monetization to significantly improve their margins. If this is something you’re considering, check out our Web Monetization Guide to learn the latest tactics, and map out your first steps!

Unlock revenue with value based pricing

Often, SaaS companies will use seats as a proxy for measuring product usage, thinking that as their customers scale, the number of seats they will pay for, will grow too.

However, this creates misaligned incentives - customers often try to reduce the number of seats they buy, by sharing passwords or scaling back their usage - potentially reducing your product’s overall stickiness.

So, instead of using seats as a pricing metric, try pricing your product based on total usage. This way, pricing will be more transparent, and far more of your customers’ employees will access (and share) your product.

Moreover, studies have shown that willingness to pay does not usually scale with your customers’ company size, but it does scale with their usage. So, by switching from seat-based pricing to value-based pricing, you will likely be able to significantly increase your revenue from top-line customers.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here

Subscribe below to be the first to receive the next SaaS Market Report.