After a year characterized by slowdowns, and cutbacks, the SaaS market has started 2024 on a more positive note with growth coming back.

Both B2B and B2C revenue growth was up from the decline seen in December, but it’s not the end of the tough times just yet, with sales still low and churn remaining an issue.

This is the latest in our ongoing market reports, which track the movement of the ProfitWell B2B SaaS Index, and its underlying growth and retention trends. This month, we examine January 2024 performance.

Subscribe to the SaaS Market Report newsletter to get these updates in your inbox.

KP and Ben discuss this month's data. Scroll down to read the full report.

B2B growth bounces back

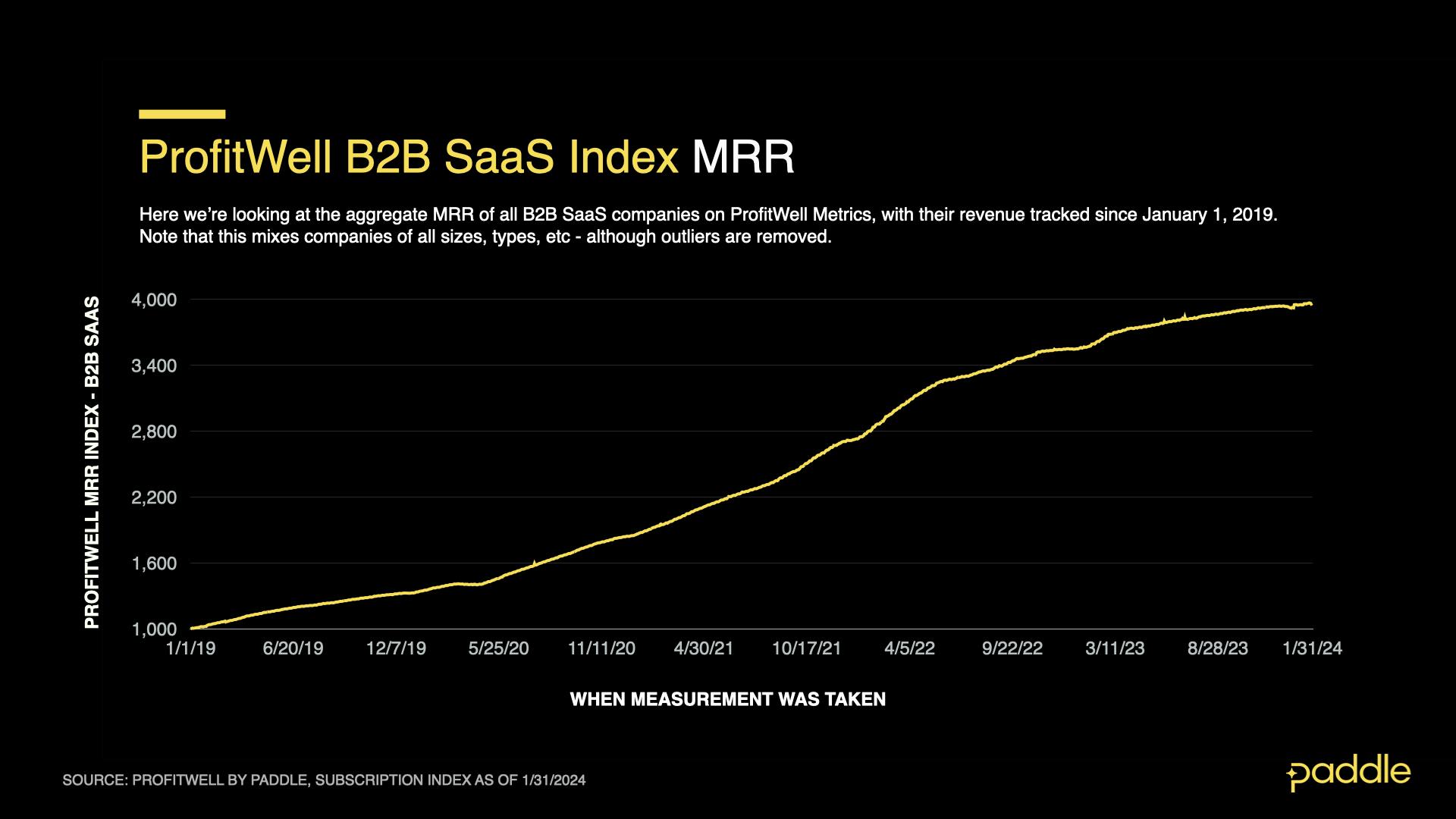

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation.

Explore the free demo of ProfitWell Metrics here.

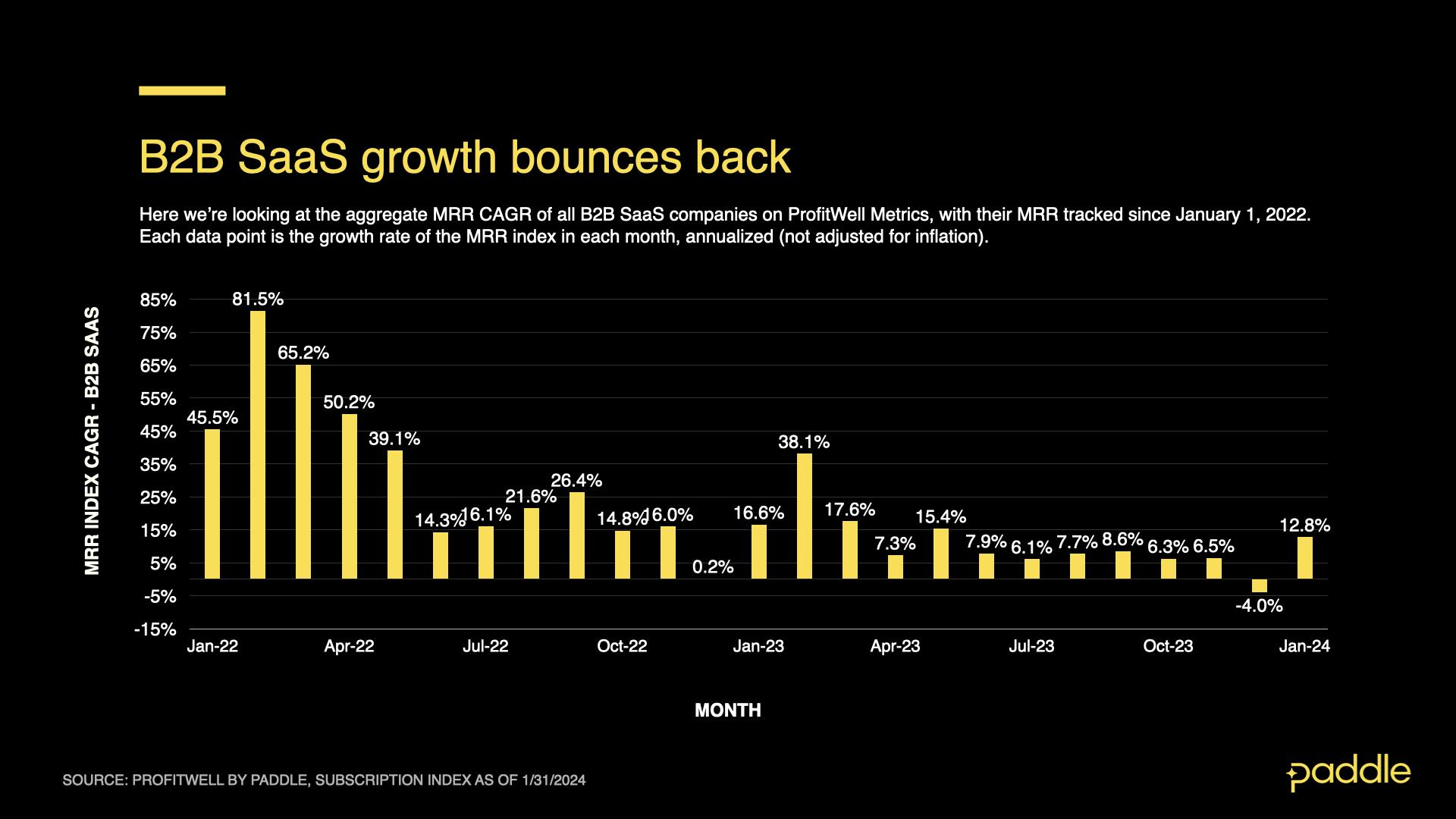

Following its first-ever decline in the MRR compound annual growth rate (CAGR) in December, the ProfitWell B2B SaaS Index bounced back in January, growing 12.8%.

In that report, we asked “Is the worst behind us?” and, for now at least, it looks to be the case. This 16.8% upswing mirrors January 2023 where growth came in at 16.6% following a flat December.

As we’ll go into further below, the major driver of this recovery was neither new sales nor reduced churn but reactivation MRR; the sum of MRR from customers that previously churned but came back.

B2B sales remain slow

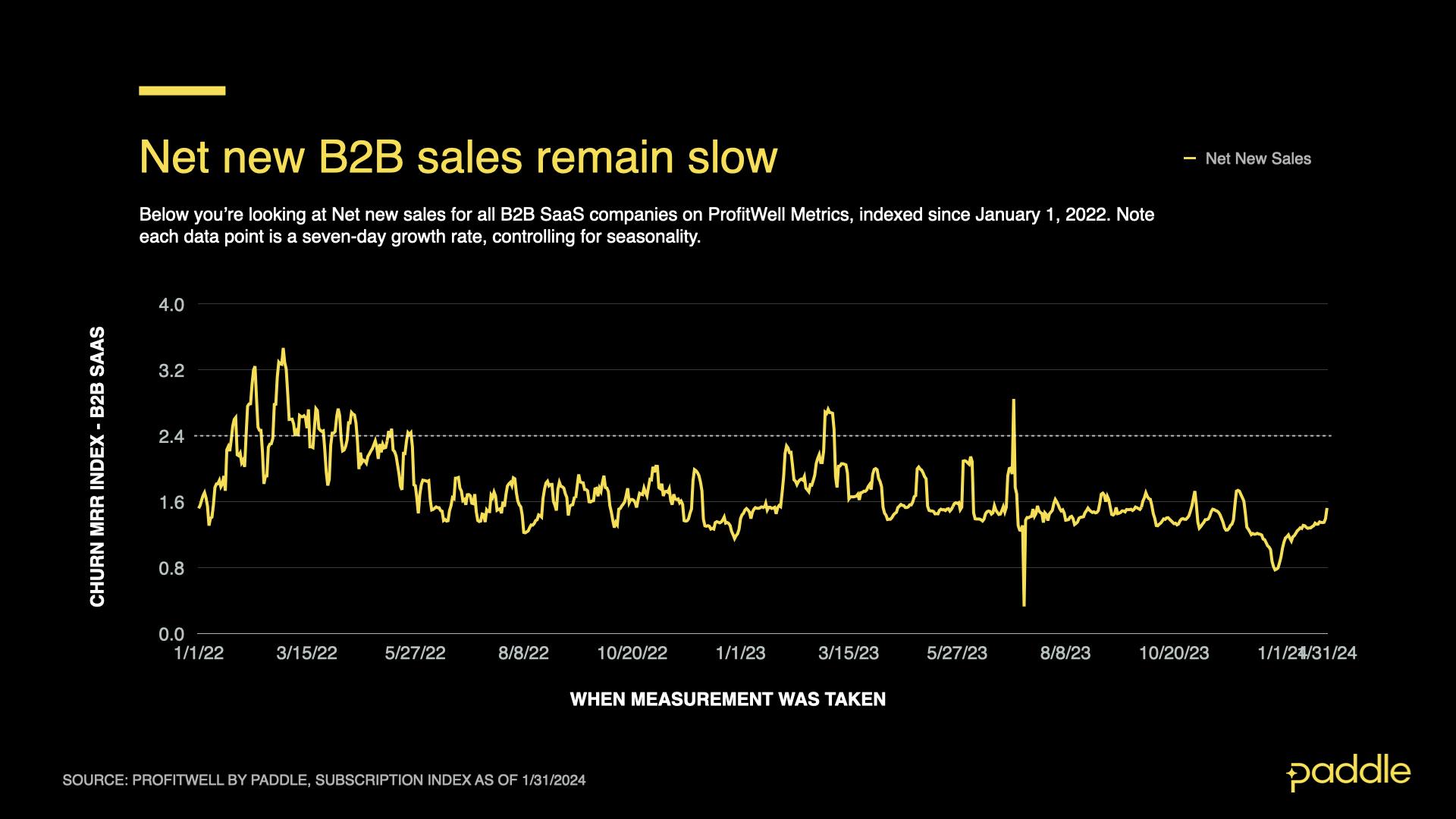

The ProfitWell B2B SaaS Sales Index is a seven-day rolling average of MRR from net new sales, expressed as a multiple of typical daily sales in 2019. A 1.00 index reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales (the ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators and not direct inputs into the main SaaS index.

The ProfitWell B2B SaaS Sales Index ended January at an average of 1.26, a small 3% lift from December’s three-year low. Compared to January 2023, however, new sales were down 18%.

It’s important to note that sales cycles have gotten longer which is impacting new sales. According to research from Tomasz Tunguz, Venture Capitalist at Theory, the average startup sales cycle has increased from 60 to 75 days, or 24% longer. As for those selling to enterprises, sales cycles are 36% longer.

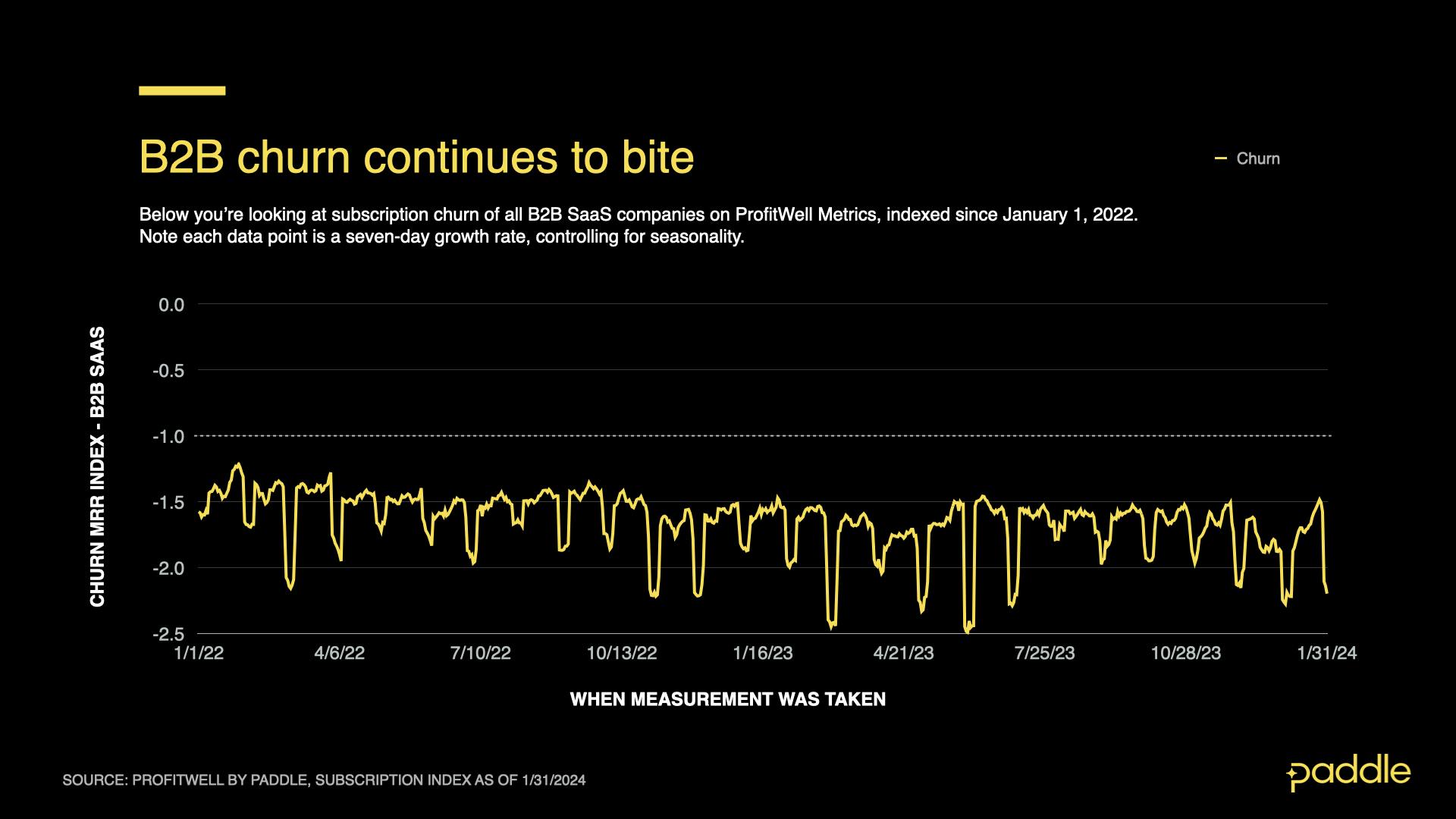

Churn continues to bite

Churn reached an all-time high in December and there was almost no change in January. MRR churn ended the month at an average of -1.84 (only slightly better than -1.85 in December) but was up 13% from January 2023.

So what's driving this rebound?

As we noted in last June’s market report, when it comes to stripping back SaaS spend, companies were more likely to cancel outright rather than move to lower-priced plans.

What we’re seeing in January is reactivation MRR driving much of the surge in revenue. Reactivations coming from customers who previously churned can be attributed to several factors, such as returning to a sticky product, new product updates or releases, a renewed need for the solution or better financial circumstances.

Considering the climate of the past 18-24 months, where operational efficiency was the name of the game, it’s likely that some customers have improved their finances to a point where they can reinstate tools that will help them going forward.

And while it’s not an uptick in new sales yet, software spending is set to go up this year.

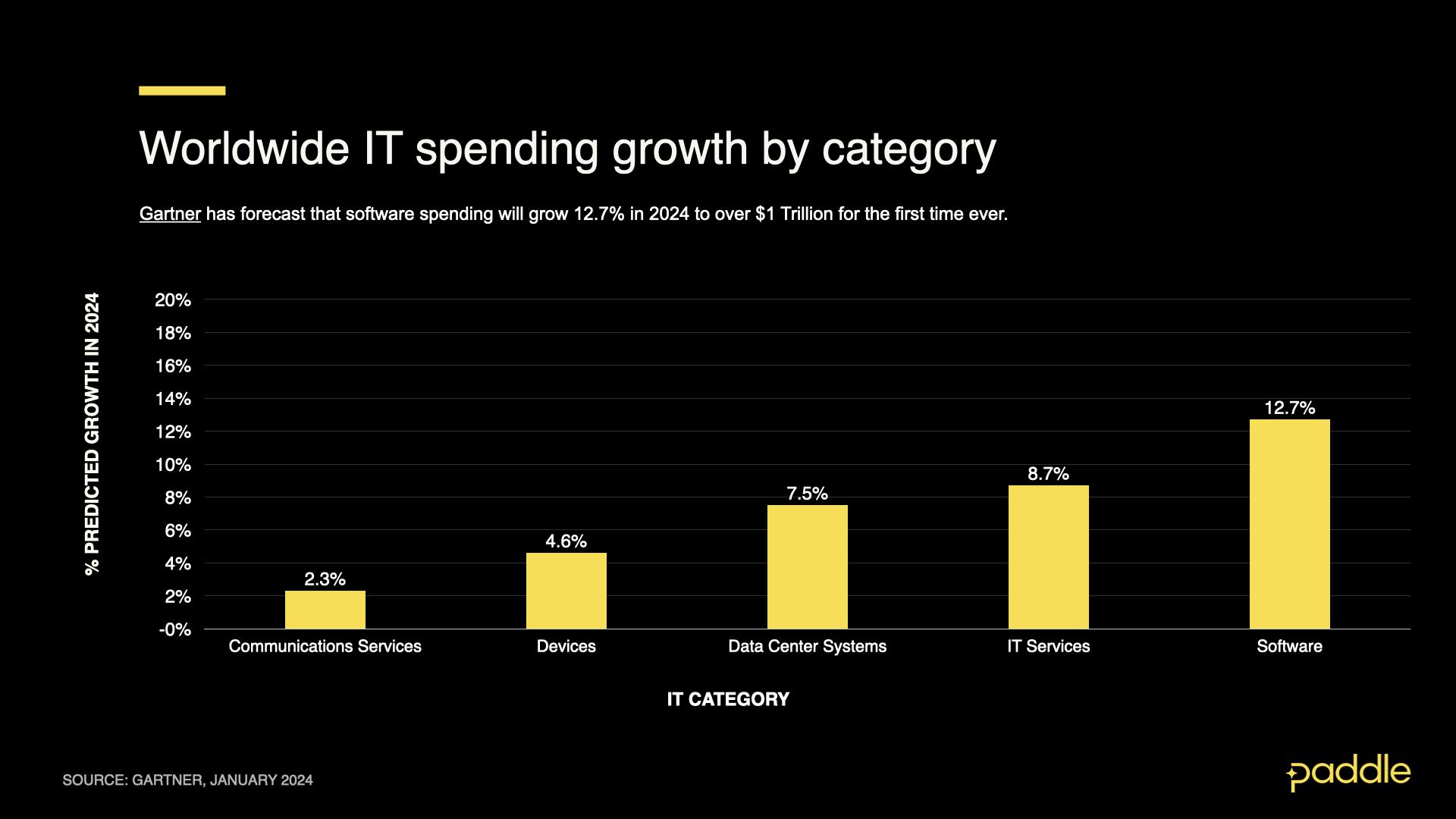

Software spending will grow past $1 trillion in 2024

Gartner has forecasted that software spending will grow 12.7% in 2024 to over $1 Trillion for the first time ever. That growth outpaces all of the other IT spending categories, although Gartner cautions that there is still some resistance to change from CIOs unless there is clear certainty of outcomes.

What does this mean for B2B SaaS? It’s a positive sign for software as a category but it doesn’t mean a blanket increase in spending across the board. Getting a slice of the pie will be dependent on the sector a company operates and the value it provides users.

It could also be a case of finding new market opportunities for your product when you may see a slowdown in your current market.

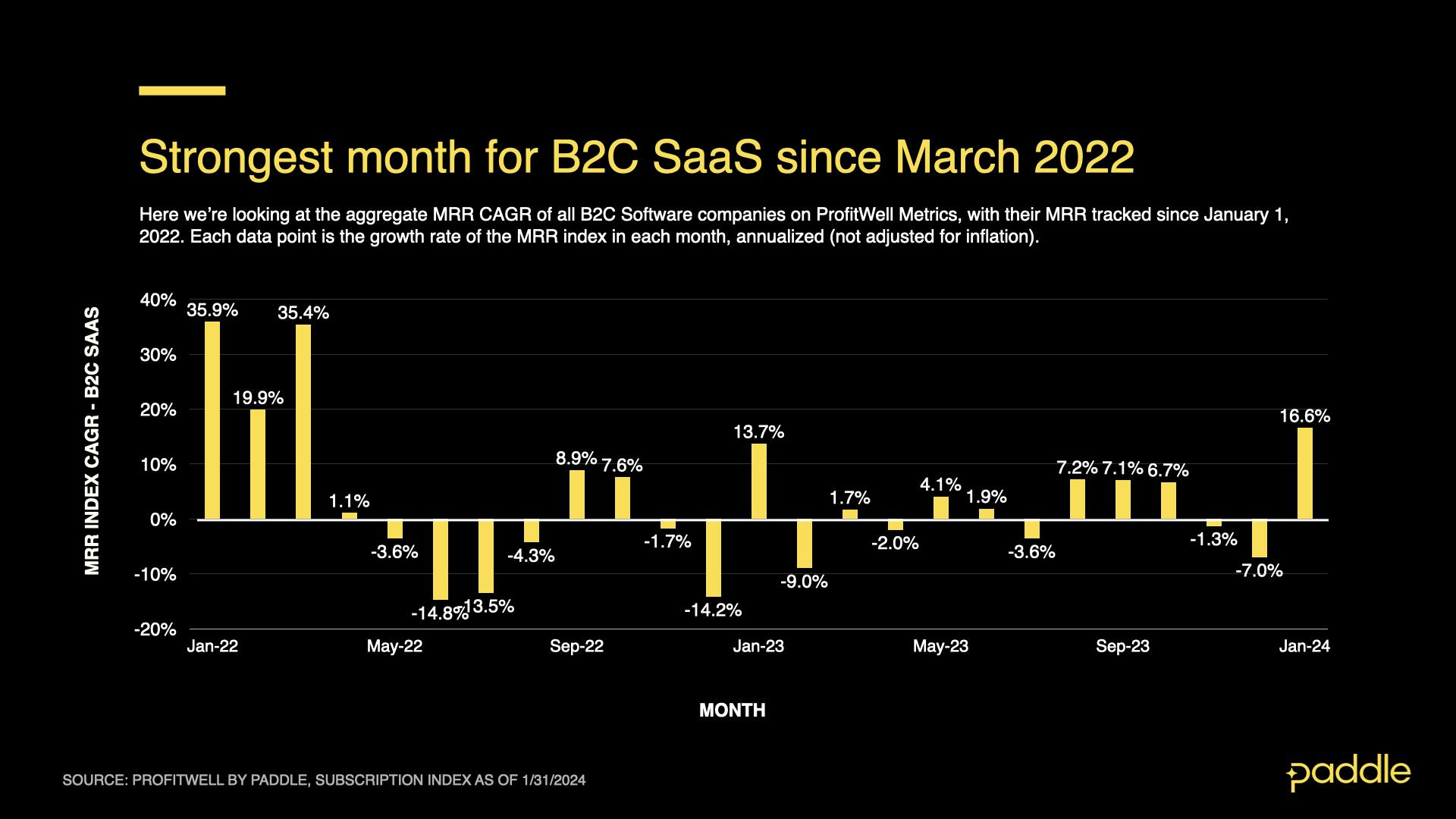

B2C growth surges to strongest month since March 2022

It was the first month since November that we’ve seen positive growth in monthly CAGR, with B2C revenue growth up 16.6%, a 23.6% jump from December 2023. It was also the strongest month since March 2022, thanks to a jump in new sales.

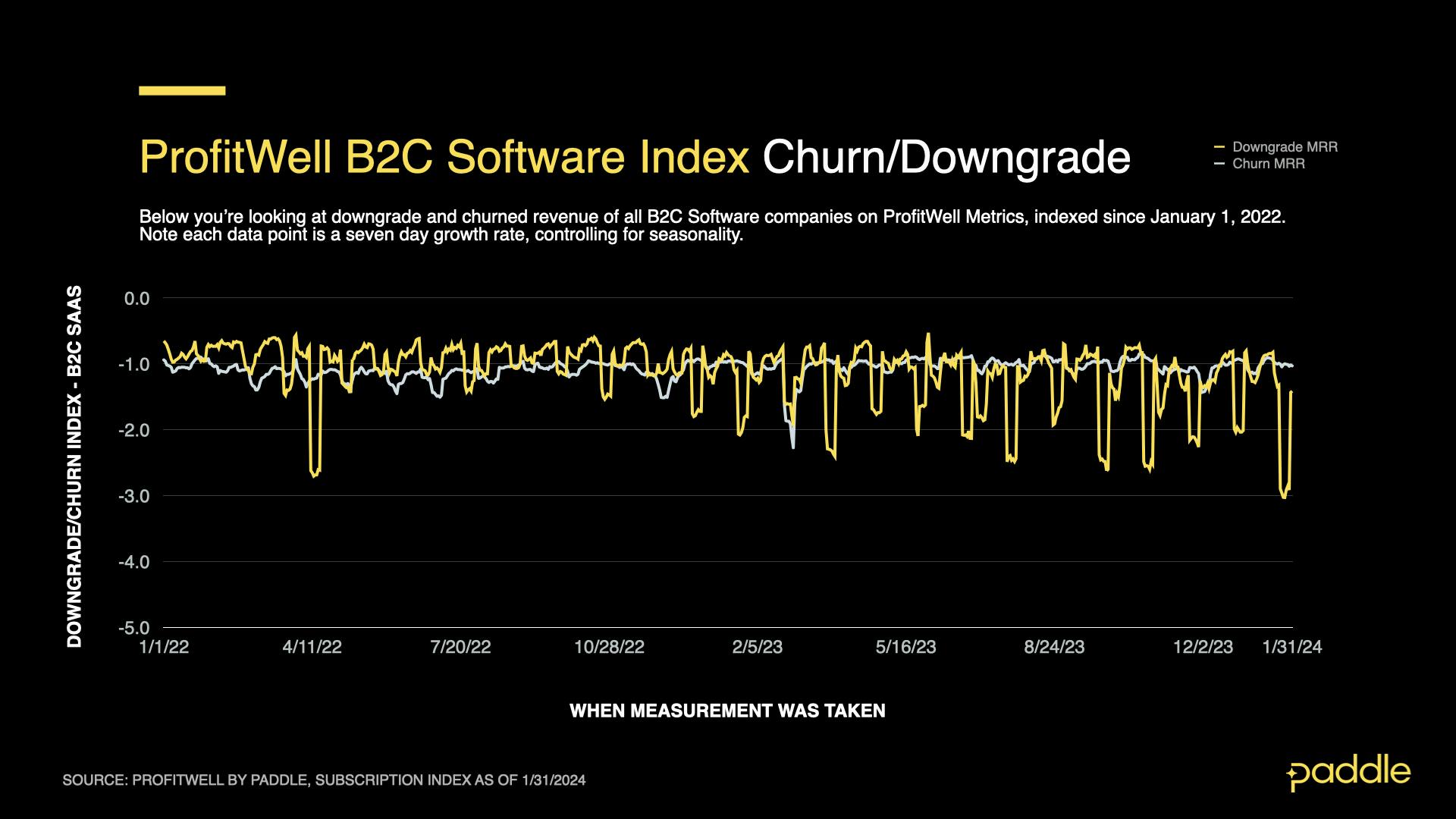

Interestingly, we noticed a spike in downgrades on January 26th, with the downgrade index hitting a new low at -3.03. Overall, downgrades for the month ended at an average of -1.49, a 15% increase from December and the highest it has been since July 2023.

The good news is that churn improved marginally in January, ending at -1.02, a 5% improvement from December 2023.

Strategies to consider moving forward

Identify and win back reactivation opportunities

One of the hardest aspects of growth is getting your target buyer to know you exist. With so much noise and saturation in SaaS now, that’s becoming more difficult and more expensive. While customers who cancel and churn are obviously painful, the silver lining is they at least know you exist, and this could be one of the factors for MRR reactivation this month.

Make sure you’re taking advantage of that silver lining by at least having basic win-back and reactivation campaigns.

Your win-back strategy starting point should be to understand your customer's needs. It's not worth trying to win back lost customers if you can't change the circumstances that led them to churn.

Here’s a breakdown of churn reasons across a spectrum of B2B and consumer products that we categorized as being in the company’s control (e.g.features, support problems, etc.) and those that weren’t (e.g. budget, timing, etc.).

On average, four out of 10 cancellations are out of your control, so how can you win back a lost customer?

If possible, start with data analysis and/or your customer's feedback. It's crucial to ensure you understand the customer's behavioral patterns, needs, and reasons for leaving.

Depending on that information you can determine the best way to reach out—pricing, retargeting campaigns, social proof to build brand credibility, new announcements, or targeted re-engagement offers.

We dive deeper into running effective win-back campaigns here

Find out how Retain by Paddle tackles churn prevention from all angles.

Continue to stay lean and efficient

Towards the end of 2023, we noted that churn was at an all-time high and it’s not surprising as companies continue to cut spend on tools, services, and even employee count in response to slower growth.

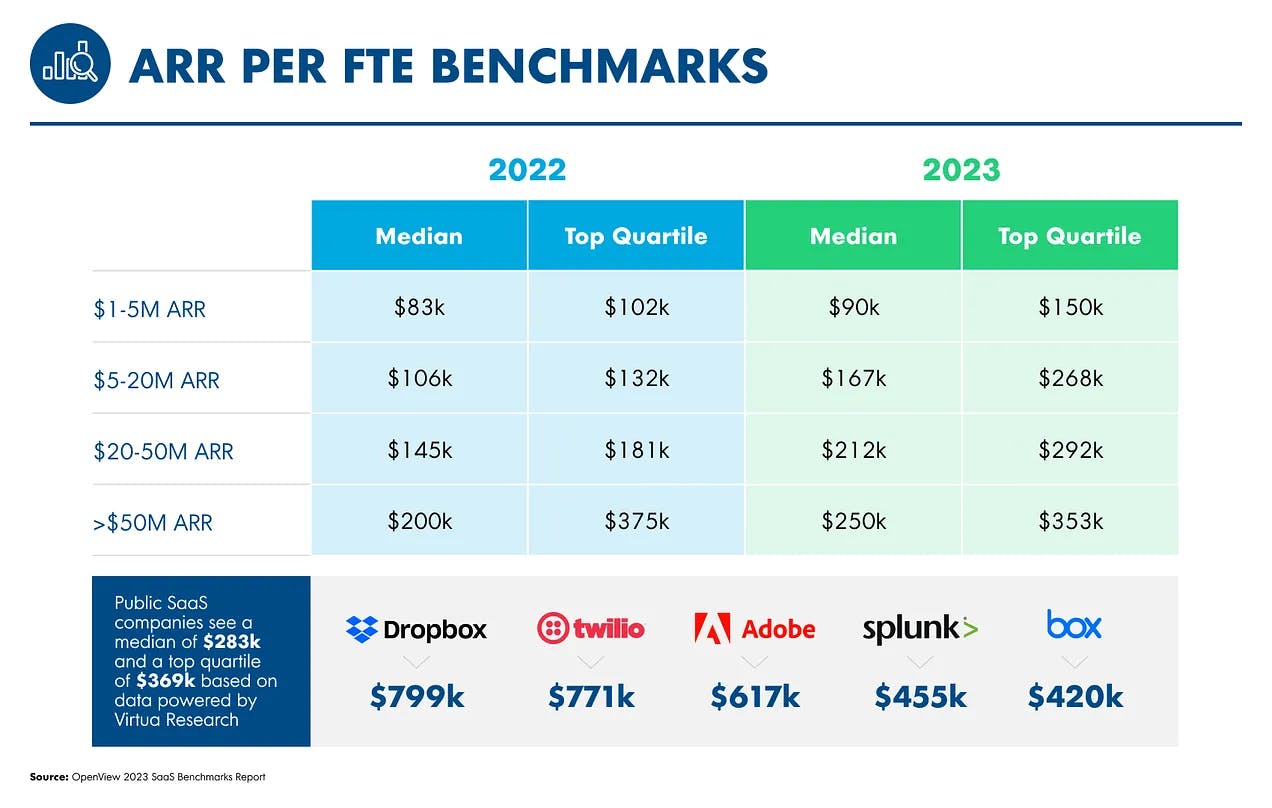

In a report we published with OpenView last year, we found that companies were paying more attention to productivity, focusing on the new north star metric: ARR per FTE (annual recurring revenue per full-time employee).

One area to drive productivity is your payments, billing, and tax stack. These tools usually incur recurring expenses that quickly add up, but their costs are often overlooked. We found that one in four companies surveyed didn’t know their billing stack costs, or didn’t track those costs at all.

This could indicate a fragmented billing stack with a lot of hidden costs, making it difficult to continue driving productivity and could make it hard to respond to growth opportunities quickly.

Use the right value metric

Whether or not you plan to launch a new feature this year, getting your monetization strategy right is crucial to driving continuous growth. The most important part of your monetization strategy is getting the right value metric, that is “the way a company measures the per unit value of their product for sale.”

In a recent webinar with our pricing experts, we explored three things each value metric needs to have so that your company continues to grow as product usage grows.

- Value alignment - How you charge for your product is in line with how customers perceive the value of your product.

- Captures growth - As someone uses your product more and therefore receives more value from your product, your “per unit value” should also capture that growth.

- Measurable - Your value metric should be easily quantifiable and measured, and it should be easily understood by customers.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here

Subscribe here, and be the first to receive the next SaaS Market Report.